By Brenna Casey, Sustainable Materials, BloombergNEF

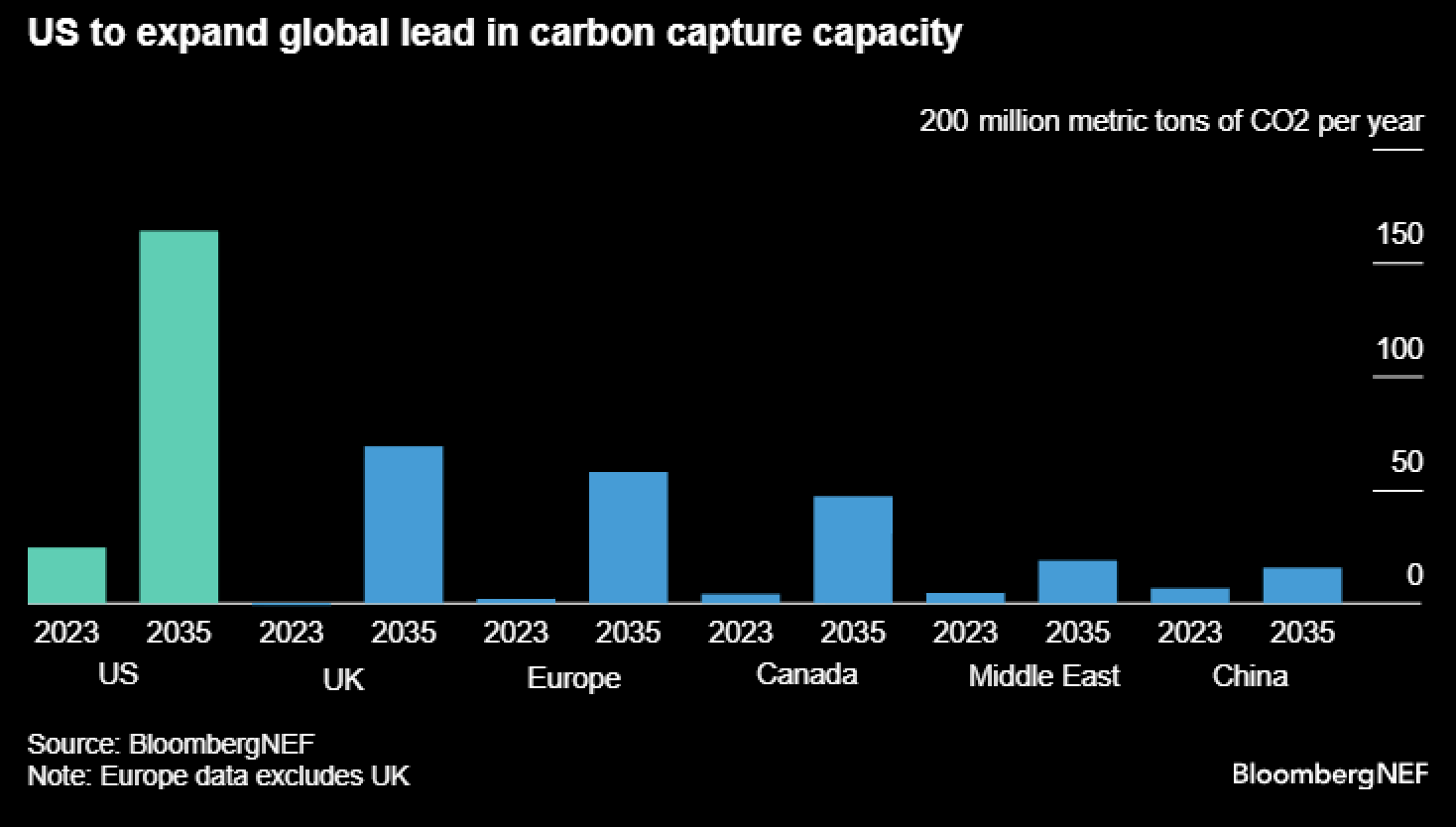

The US leads the global carbon capture industry. Its capacity is expected to jump sevenfold by 2035, aided by the incentives offered by the Biden administration.

The US will have the capacity to capture as much as 164 million tons of carbon by 2035 — almost equivalent to the next three markets combined — according to BloombergNEF.

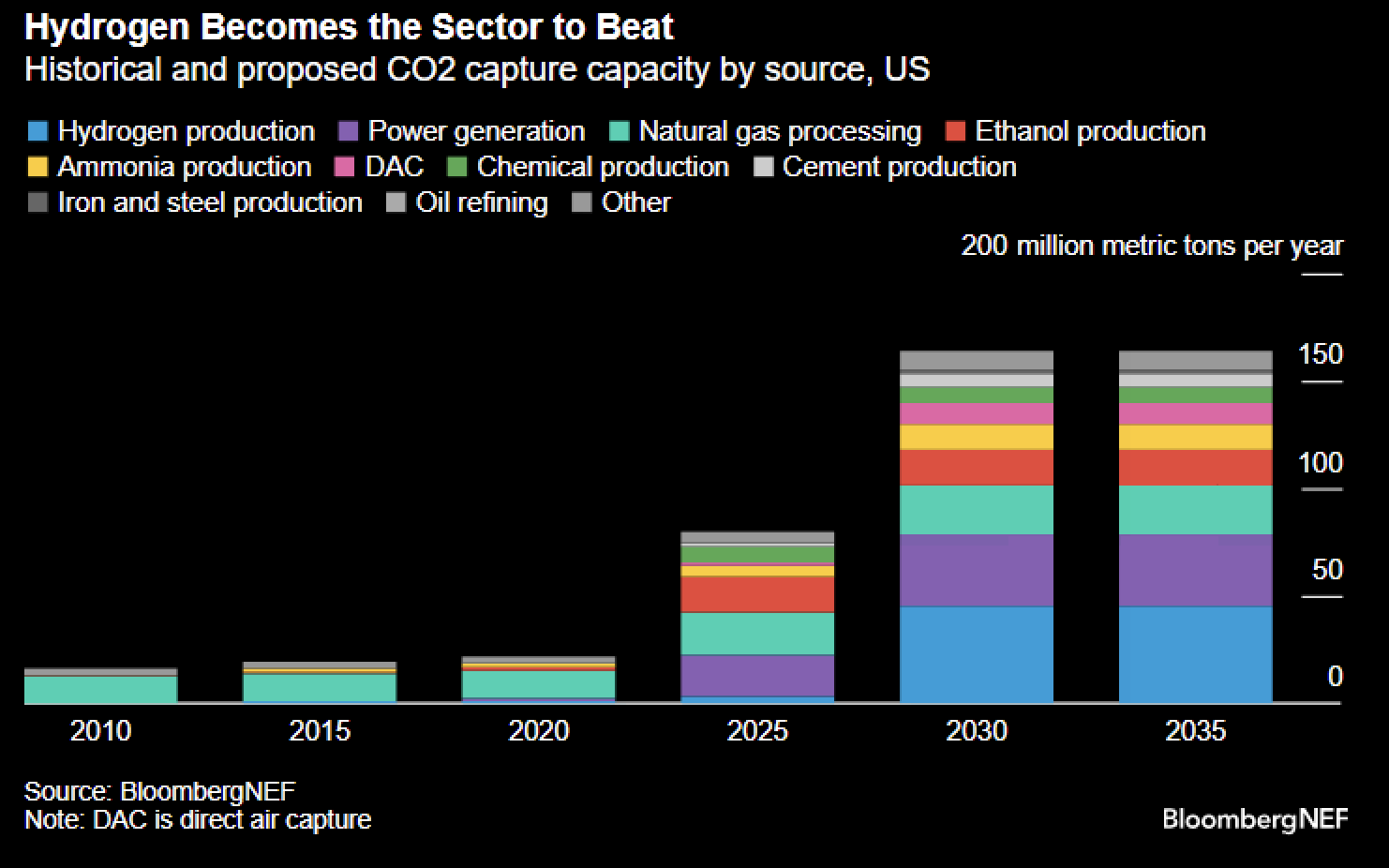

Carbon is captured mainly from natural gas processing and utilized for enhanced oil recovery currently.

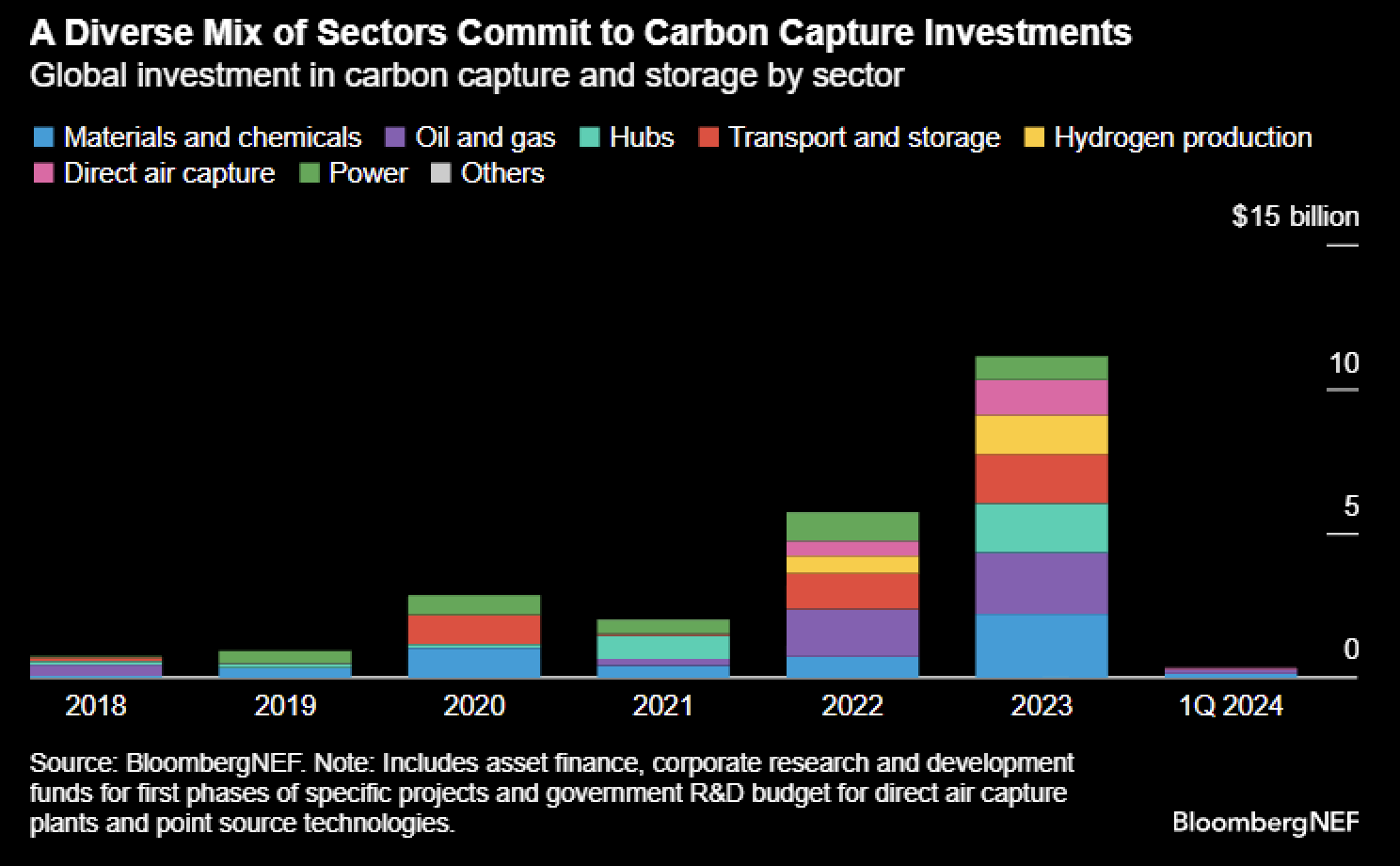

The global carbon capture sector attracted more than $11 billion in investments last year – nearly doubling from the 2022 level. The US share was 25%.

Capturing carbon is a capital intensive process. When such a unit is added to a coal or gas plant, it could raise the levelized cost of electricity for these facilities by up to 56% in the US.

The US also remains the global leader in cumulative CCUS investments. It raked in $2.8 billion just last year, thanks to subsidies from the Department of Energy and new projects like Linde’s hydrogen complex in Texas reaching final investment decision.

There has been limited activity over the last six months, however. The Industrial Demonstration Program, announced in April, is making most of the noise in 2024. This program will potentially distribute up to $867 million in further funding to carbon capture, utilization and storage or CCUS projects in the US. The Indiana plant of Heidelberg Materials recently received an approval for up to $500 million in grants, while a project proposed by National Cement Company of California, and another one by a consortium of Technip Energies, Webster Process Technology and LanzaTech are both in queue.

As capacity expands, carbon will mostly be captured from the hydrogen industry, with the power sector being the second largest segment.

A lot of activity is tied to the hydrogen hubs coming up in the US. Around 80% of the announced hydrogen capacity is in hub-affiliated states, where the captured carbon will be used for blue hydrogen production. An important nuance is that only 2.6% of all US hydrogen capacity has secured binding offtake agreements, meaning final investment decisions for many of these projects are pending.

Slowdown

Only 6 million tons of new CO2 capturing capacity was proposed in the US over the last six months. This is quite the rude awakening, and a stark contrast from the flurry of announcements through last year, likely attributable to the political ambiguity plaguing the US.

The Internal Revenue Service is also yet to address the uncertainty around the associated tax credit (45Q). The guidelines will likely be delayed further in the face of presidential elections in November. This is discouraging investors from announcing new projects or taking final investment decisions for already announced ones. Funding awarded under the Industrial Demonstration Program is also at risk of revocation unless final contracts are agreed upon. BNEF believes that a complete policy U-turn for the tax credit or the demonstration program is unlikely since a large share of the proposed capacity is located in Republican-leaning states.

There are also issues to resolve with permitting for CO2 transport pipelines and storage locations. The next two to three years will, therefore, be critical in pushing forward some of the first proof-of-concept projects to make way for the larger projects proposed in the US and globally.