By Musfika Mishi, Technology & Innovation, BloombergNEF

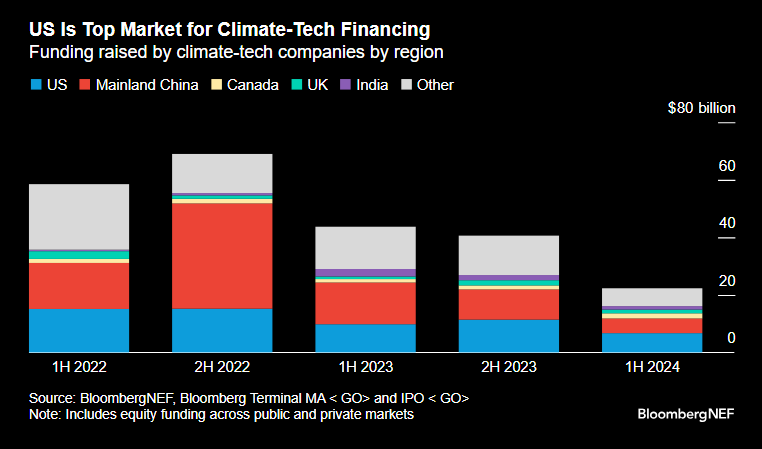

The US emerged as the top climate-tech financing market in 2024, with $6.7 billion mobilized in the first half of the year. Most of this financing was for clean power companies — renewable energy equipment makers and project developers — as well as startups along the energy storage value chain. Climate-tech companies from mainland China raised $5.1 billion in the same period. Canada placed third with $1.8 billion.

There has been a marked slowdown in overall climate-tech equity funding across both public and private markets this year. While almost $44 billion were raised in the first two quarters of 2023, the comparable funding this year was down to half of that.

The number of deals completed suffered simultaneously, dropping by a sixth year-on-year. Roughly 600 deals were tracked in BNEF’S Climate-Tech Investment Radar for 2024 to date.

The number of deals completed suffered simultaneously, dropping by a sixth year-on-year. Roughly 600 deals were tracked in BNEF’S Climate-Tech Investment Radar for 2024 to date.

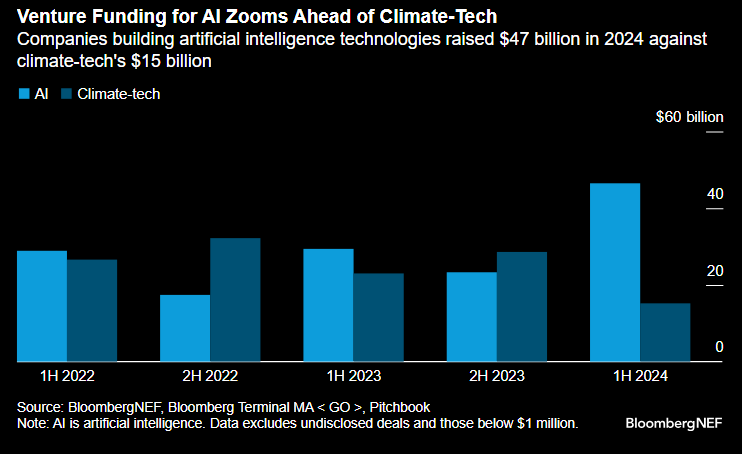

AI fascination

Zooming in on venture capital, equity raised by climate-tech firms only made up 12% of the total global venture financing in the first half of the year, down from 16% in the same period a year before. One of the reasons for this drop could be the surge in investor fascination with artificial intelligence or AI technologies. According to Pitchbook data, almost $47 billion was funneled toward AI startups across nearly 1,200 deals in the first half of 2024. This was a 60% increase over the funding volumes tracked during the same time in 2023, and triple the amount raised by climate-tech companies.

Almost 60% of the climate-tech venture deals completed in the US in the first half of 2024 were cross-border, wherein companies attracted investors from outside the region. This is up from the 54% and 39% tracked during the same period in 2023 and 2022, respectively. The US is increasingly seen as a lucrative market for climate technologies globally, largely due to the incentives provided by the Inflation Reduction Act.

Some of the largest deals tracked this year were from US-headquartered companies, and included clean energy developers Pine Gate Renewables and Nexamp, in addition to small modular reactor developer Oklo Technologies, each raising deals north of $500 million. Denver-based geological hydrogen startup Koloma made headlines with its $246 million investment from Breakthrough Energy Ventures. Notably, Chinese EV maker Zeekr Intelligent Technology’s $441 million listing on the New York Stock Exchange marked the largest US listing of a Chinese company since 2021. Alphabet’s direct air capture spin off — 280 Earth — raised $50 million from Builders VC, which was followed by 61,000 tons of offsets being contracted.

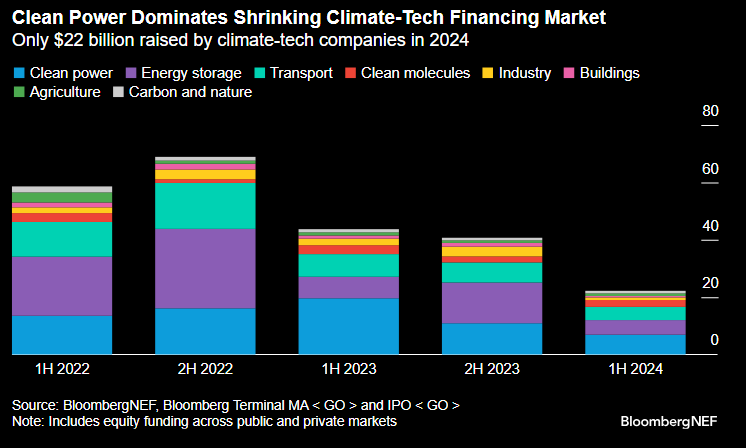

Globally, three sectors have consistently drawn the most financing: clean power, energy storage and transportation.

Looking ahead, equity funding for climate-tech companies appears to be stabilizing somewhat, dropping only 3% from the first quarter of 2024 to the second. If this trend continues, total climate-tech financing for the year could reach almost $45 billion — which is still only half of what was raised in 2023.