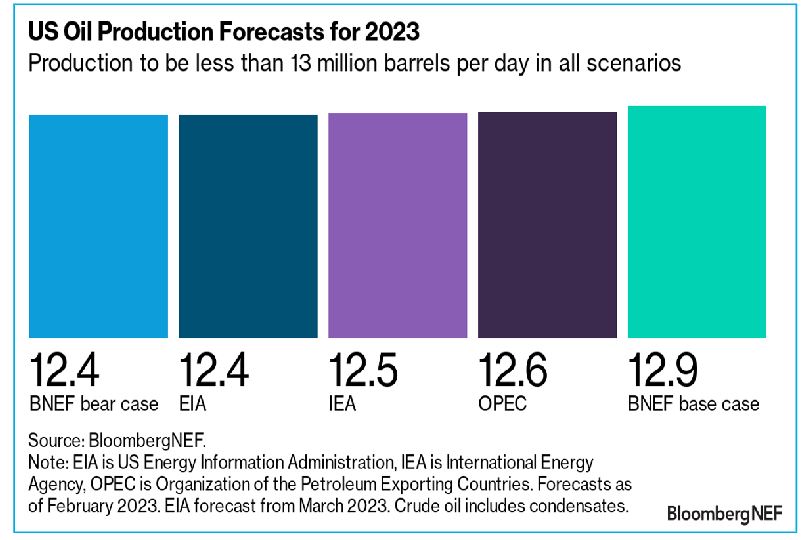

Oil production growth in the US is expected to remain muted this year, with output forecast to settle somewhere between 12.4 million to 12.9 million barrels per day, according to the latest update from BloombergNEF. Production reached 11.9 million barrels a day in 2022.

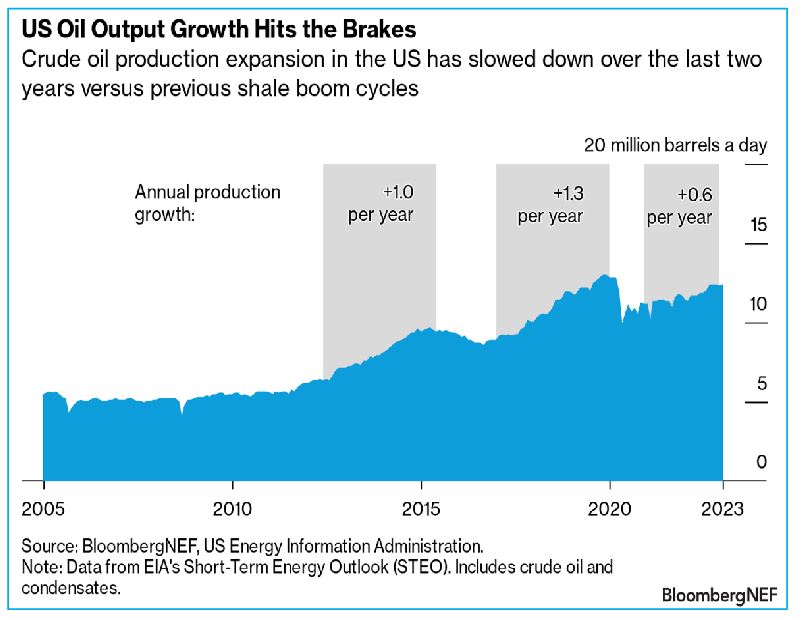

While this would continue the recovery from the Covid nadir, it would still be short of pre-pandemic highs. The shale boom looks to be coming to an end.

“This slowdown in growth can be reversed, but we don’t see any indications of that happening in the near term,” said Claudio Lubis, a BNEF oil analyst.

There are three reasons for the decelerating production: declining productivity of wells, the conservative investment strategy of producers amid a shift in focus to capital discipline, and the rising cost of oilfield services.

Since none of these factors will change quickly, “the likelihood of the production slowdown reversing skews to the downside,” said Lubis.

Oil production in US jumped by 1.3 million barrels per day per year over 2017-2020 and this growth halved to 0.6 million barrels per day in 2021 and 2022.

BNEF’s bear case sees output growth slowing even more to just 0.5 million barrels per day in 2023, and the extended forecast from the US Energy Information Administration’s Short-Term Energy Outlook points to a further deceleration to just 190,000 barrels per day in 2024.

“Structural underinvestment remains a key impediment to higher production,” BNEF said in a note looking at the fizzling out of the shale revolution.

Of the three largest US shale plays — the Permian, Bakken and Eagle Ford — only the Permian looks somewhat promising when it comes to output growth. The slowdown could thus persist over the coming years. The leading producers in these basins include Pioneer Natural Resources, Occidental Petroleum, EOG Resources and ConocoPhillips, Chevron, Devon Energy, Chesapeake Energy and XTO Energy.

The sputtering momentum means the US is unlikely to play a major role in the reshuffling of global crude oil and products trade as Europe looks for alternatives to Russian supplies.

Exports of oil products to OECD countries in Europe have barely moved from 0.6 million barrels per day in January 2022 — before Russia’s invasion of Ukraine — to 0.7 million barrels per day in December. Crude oil exports have fared better, increasing from 1.2 million barrels per day at the beginning of last year to 1.9 million barrels per day by the end. But these export levels are expected to remain more or less flat in 2023.

BNEF estimates the US will likely export around 1.7 million to 1.8 million barrels per day of crude oil to Europe and approximately 0.7 million to 0.8 million barrels per day of oil products this year as demand from neighbors and the need to replenish the country’s Strategic Petroleum Reserve take priority.