BloombergNEF and battery energy storage system provider Pylontech published a report on the residential battery energy storage market at the end of 2023. The full report is publicly available here.

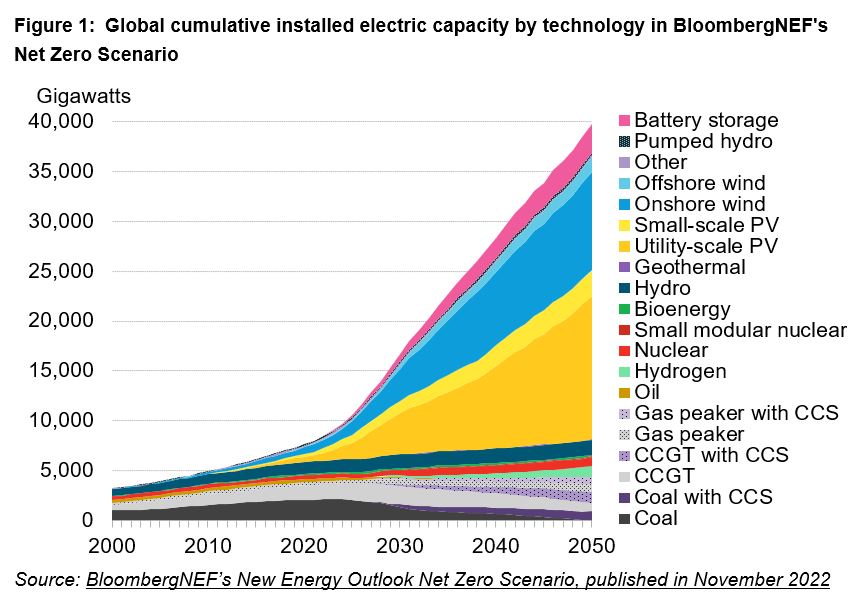

Globally, a rapid expected scale-up in renewable energy will require power storage to balance daily fluctuations in output from solar and wind generation. BNEF estimates that energy storage capacity worldwide needs to grow by a factor of 16.1 times from the end of 2022, to 720 gigawatts by 2030, to support a global target to triple renewables that is under discussion ahead of COP28. Success could help put the world on track for net zero by 2050 and to hit Paris-aligned climate goals (see Tripling Renewables Goal by 2030: Hard, Fast and Achievable).

This energy storage capacity is mainly needed to shift solar electricity from day to night but will also provide frequency regulation and other services to the grid. Residential batteries are expected to reduce the need for expensive grid upgrades. In BNEF’s Net Zero Scenario, investment in required grid upgrades reaches $777 billion by 2030, nearly three times the figure spent updating grids in 2022.

These residential batteries do not necessarily need to be centrally controlled to help the world’s power grids integrate renewables. At the household level, a battery installed with solar panels charges in the daytime when solar power is generated in excess, and discharges to supply the home later in the evening when there is typically higher demand. This can also reduce price volatility in wholesale power markets, as residential battery charge and discharge patterns flatten out net load, avoiding the so-called ‘duck curve’ which emerges at high solar penetrations.

Examples of this ‘duck curve’ already exist in Hawaii and California in the US, South Australia, and even on a sunny day in the Netherlands or Spain

Consumer uptake of batteries

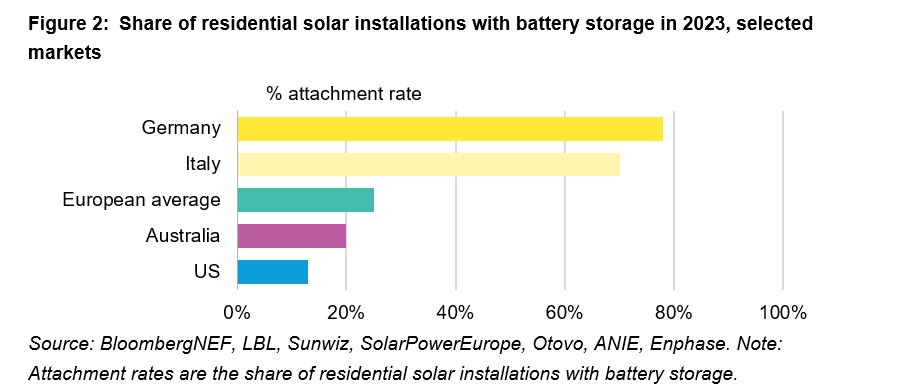

Residential battery deployment is rising quickly. In 2023, over 70% of residential solar systems in Germany and Italy, as well as 20% in Australia and 13% across the US, had batteries attached. Global cumulative residential battery capacity is expected to reach 34 gigawatt-hours by the end of 2023, of which 12 gigawatt-hours is to be installed in 2023 alone.

Most consumers buy batteries for three distinct, but sometimes overlapping, reasons:

-

Back-up power and resilience:

Homeowners often install batteries because they need or want resilience, i.e., to have back-up power and be able to operate off-grid. This is either because they are living in an area with an unreliable grid or with extreme weather events.

-

Solar self-supply:

Homeowners may also install batteries out of a desire to green their electricity consumption by increasing solar self-supply. This may not always correlate with reducing their energy bills, and such customers may be willing to pay a financial premium to go green and support the energy transition.

-

Bill savings:

Homeowners also simply install batteries for economic reasons i.e., to reduce their energy bills. However, few markets have an economically attractive market for residential batteries without tax credits or subsidies, or a structure of electricity pricing that incentivizes system-supporting battery charging and discharging behavior.

Paths to scale

BNEF and Pylontech identified four key steps for companies and policymakers to scale up the residential battery market:

Cost-reflective rate structures.

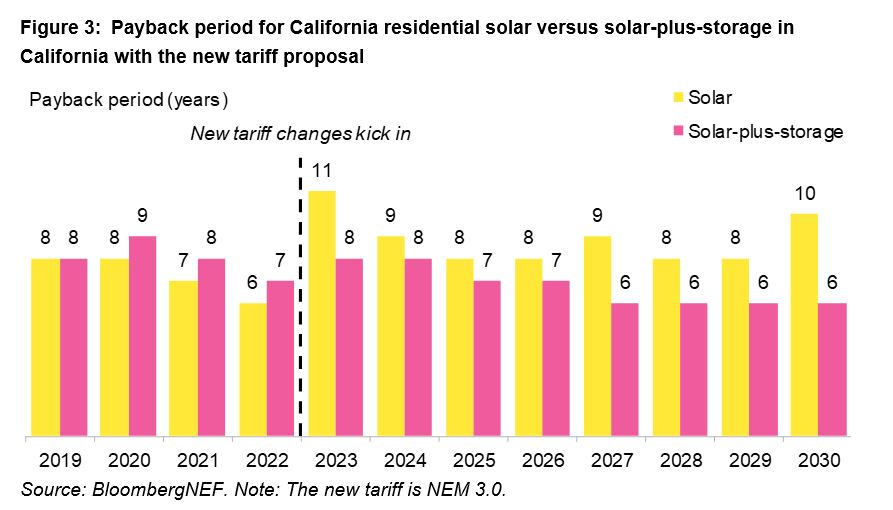

Changes to tariff schemes can shift the economics in favor of batteries. A prime case study is California, which gets about 21% of its in-state generation from solar and has a well-developed duck curve. All future solar installations will now be compensated under a new tariff structure, called the Net Energy Metering (NEM) 3.0, which became effective in 2023 despite protests from the solar industry. Under NEM 3.0, solar exports are compensated at an ‘avoided cost’ that more accurately reflects the value of solar being exported to the grid. This has brought the payback period of a home solar-plus-storage installation down, so it is shorter than for a solar-only system (Figure 3).

Consumer focus.

Storage system providers can offer more targeted products with the actual consumer need in mind. Providers today already offer much larger entry-level systems in the US and Australia, where both the energy demand of an average home and size of a typical customer-sited solar system is bigger than in Europe. Products sold in the US and Australia also have more energy capacity and back-up functionality to enable additional hours of back-up power for customers that prioritize resilience.

Better partnerships.

Global cooperation is an important feature of the residential battery market. The localized and distributed nature of residential battery demand makes it difficult for battery or other equipment manufacturers, most of which are based in Asia, to provide downstream services in new markets across the globe. Cooperation with local partners who provide aggregation and energy trading service is a strategy for success, while increasing the value of residential energy storage.

Business models to compensate homeowners.

The benefit provided by residential batteries to the overall grid system can be enhanced by ensuring battery owners are rewarded for those services. These virtual power plant business models aggregate residential batteries to participate in flexibility markets. Detailed examples of these business models, including the use of aggregated fleets of residential batteries for frequency response in the UK, Italy, and Australia, are featured in the report.

The full report is publicly available here.

Pylontech (stock code: 688063) was founded in 2009 as a dedicated battery energy storage system provider and became the first publicly listed company in China in 2020 with a primary focus on energy storage as its core business. Pylontech integrates industrial chain with its robust research and development capabilities and comprehensive manufacturing expertise, spanning from cells, battery management systems and system integration. Its products and solutions have established a presence in over 80 nations and regions, with over one million energy storage systems successfully commissioned. In 2022, Pylontech was ranked as No.1 residential battery energy storage provider by S&P Global Commodity Insights.