By Adithya Bhashyam, Associate, Hydrogen, BloombergNEF

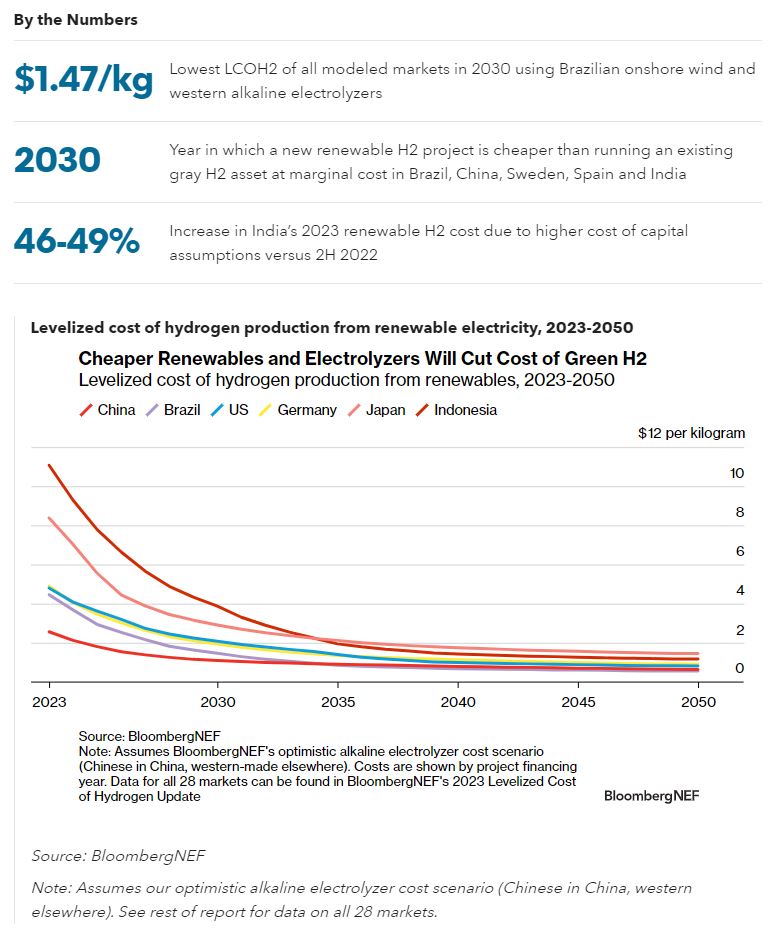

The levelized cost of hydrogen (LCOH2) has risen slightly in 2023 due to inflation and higher financing costs. Still, green hydrogen (H2) will become competitive with existing gray H2 plants running at marginal cost in five markets by 2030.

- The LCOH2 forecast increased slightly in 2023 compared to 2H 2022. Inflation, higher financing costs for some markets and longer construction times drive this change.

- Declines in natural gas prices mean blue H2 remains the most competitive low-carbon option today. The average levelized cost of blue hydrogen is 59% cheaper than green for projects financed in 2023 due to a drop in forward gas prices since our 2H 2022 update.

- Still, green H2 now undercuts blue H2 1-3 years earlier in all modeled markets. Green is cheaper than new blue H2 by 2028 using Chinese alkaline electrolyzers, and by 2033 using western alkaline electrolyzers.

- Green H2 undercuts new gray H2 in over 90% of markets by 2035. By 2030, building a new green H2 plant is already cheaper than continuing to run an existing gray hydrogen plant in Brazil, China, Sweden, Spain and India. By 2050, the levelized cost of newly-built green H2 undercuts the marginal cost of gray H2 from existing plants in all modeled markets.

- Improvements since 2H 2022: Cost of capital estimates were differentiated by market to account for differences in financing costs between regions. Renewables construction timelines were aligned to H2 projects to account for a longer construction time for some renewables. The hydrogen project construction time was extended to two years in all markets except China to better reflect current lead times for equipment.

BNEF clients can view the full report here.