A new wave of early-stage data center projects is reshaping US electricity demand – and it’s doing it quickly.

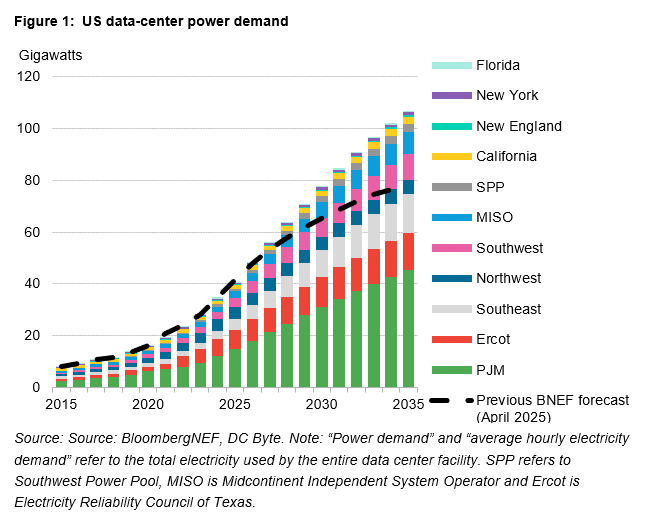

Data-center power demand hits 106 gigawatts (GW) by 2035 in BloombergNEF’s newest forecast – a 36% jump from the previous outlook, published just seven months ago.

The massive growth rate in data center power demand reflects more than a surge in the number of data centers in the pipeline; it also highlights the new centers’ size. Of the nearly 150 new data center projects BNEF added to its tracker in the last year, nearly a quarter exceed 500 megawatts. That’s more than double last year’s share.

This boom in data center demand is colliding with grid realities. In PJM, BNEF forecasts data center capacity could 31GW by 2030, nearly matching the 28.7GW of new generation the Energy Information Administration expects over the same period. In the Electric Reliability Council of Texas, reserve margins could fall into risky territory after 2028, a sign that short-term growth can be absorbed, but longer-term supply will lag.

These pressures point to an inflection moment for US grids: the desire to accommodate AI-driven load without undermining reliability or driving up power costs.

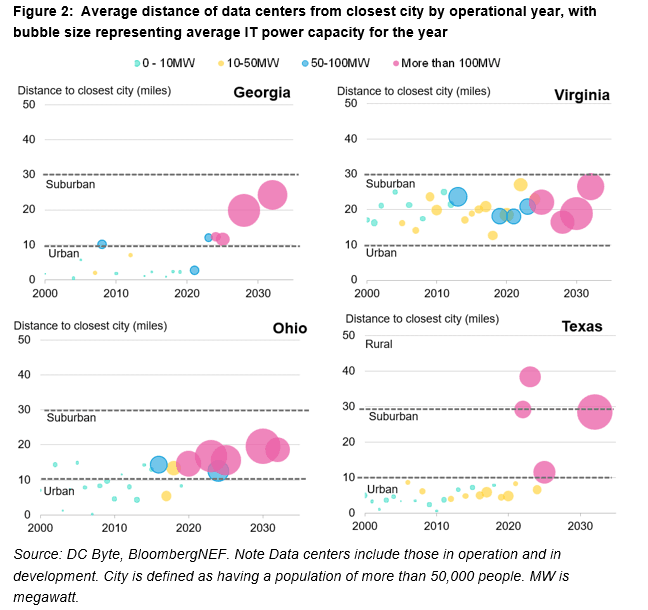

At the same time, the geography of US data centers is shifting. The once-dominant market in northern Virginia market is nearing saturation, sending new projects south and west into central and southern Virginia. Georgia is seeing expansion beyond the metropolitan Atlanta area as land and power constraints tighten. Texas is an exception: Developers there are transitioning former crypto-mining sites into AI data centers closer to population centers and fiber routes.

BloombergNEF clients can access the full report here.