By Rafael Rabioglio, Head of Latin America Research, BloombergNEF

Brazil is a biofuel powerhouse. Decades of supportive policies and a booming agricultural industry have fostered large-scale adoption of low-carbon fuels in Brazil’s transport sector. The country is the second-largest ethanol and third-largest biodiesel producer in the world.

The industry is likely to face both headwinds and tailwinds in the coming decades, including a potential increase in domestic blending mandates and a reduction in ethanol demand for road transport due to rising electrification. The potential to be a global supplier of advanced low-carbon fuels – such as sustainable aviation fuel (SAF) – could represent an important economic opportunity for Brazil but will not come without challenges.

- A significant increase in SAF demand will depend heavily on policy and economic incentives, as SAF comes with considerably higher costs than its fossil-based counterpart. Even the United Nations’ regulating body for aviation (Corsia) is unlikely to spur significant SAF demand, as the low price of carbon credits makes these a far more cost-effective alternative to adopting SAF at scale

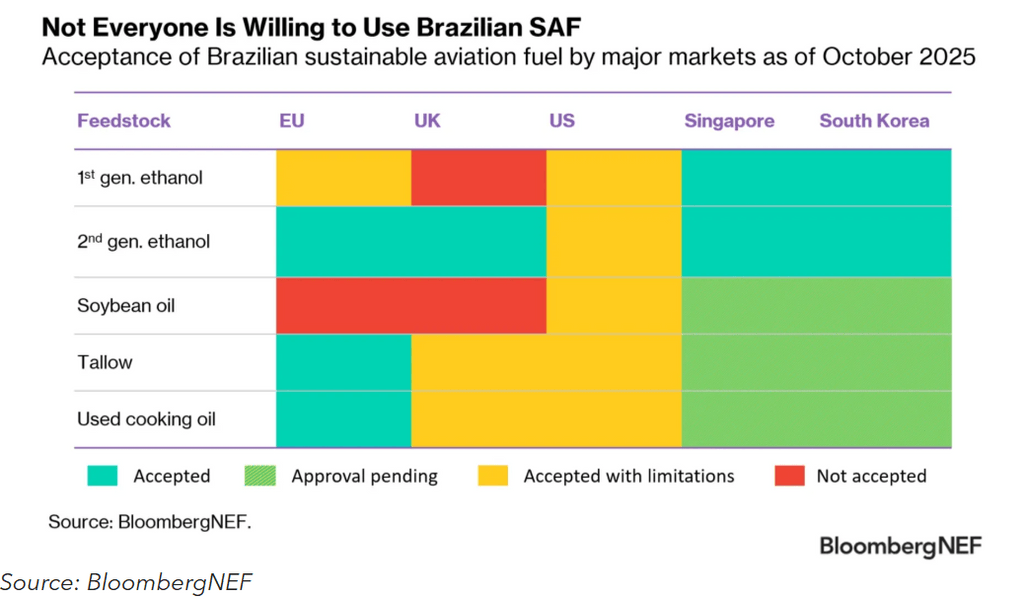

- Brazilian SAF production could face export challenges. Food-crop feedstocks, such as sugarcane and soy, face policy exclusions or reduced economic incentives in major SAF markets such as the EU and the US

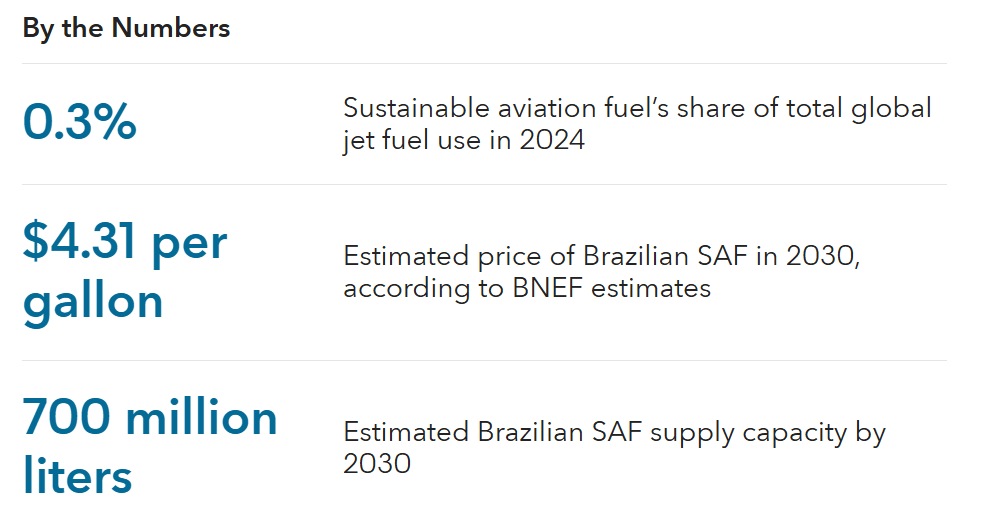

- The combined capacity of announced projects in Brazil is likely to represent a small share of global supply. The 10 announced plants – projected to produce about 700 million liters per year by 2030 – would represent just 2% of global SAF supply, or 9% of total domestic jet fuel demand.

- Despite the challenges, the sheer scale of Brazil’s agricultural sector and its agronomic advantages represent opportunities. A 48% decline in deforestation since 2021, an increase in double-cropping practices (eg, between soy and corn), and initiatives to restore degraded areas could all help Brazil become more competitive than other biofuel-producing nations. These attributes could, for example, reduce emissions related to land use and land-use change in Corsia’s carbon intensity calculations for most crops, while also alleviating pressures on global land requirements for food and fiber versus biofuel crops.

- An advanced low-carbon fuel industry could strengthen Brazil’s exports and protect it from global trade disputes. Agricultural commodities are often used as leverage, as seen in the recent shift in Chinese soy purchases from the US in response to new import tariffs. By moving further down in the value chain, Brazil would add value to exports and be less exposed to commodities price fluctuations and geopolitical shifts.

BloombergNEF clients can access the full report here.