PRESS RELEASE

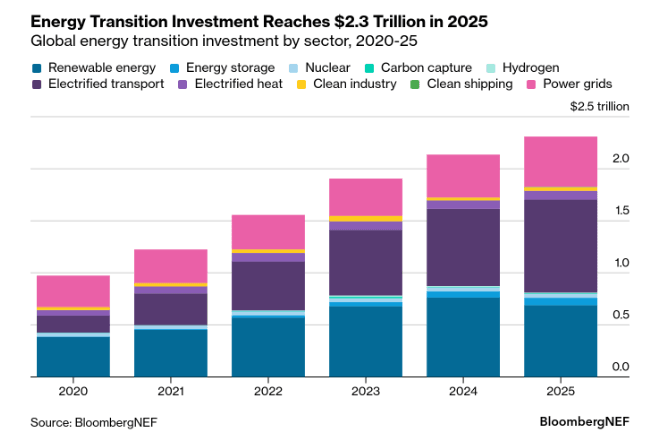

BloombergNEF Finds Global Energy Transition Investment Reached Record $2.3 Trillion in 2025, Up 8% from 2024

- BloombergNEF’s Energy Transition Investment Trends reviews annual investment figures in the global energy transition, including spending to deploy clean technologies, investment in the clean energy supply chain, equity investment in climate-tech companies, and debt issuance for energy transition purposes.

- All four of these indicators moved upward in a year marked by trade disruptions and geopolitical tension, showcasing the energy transition’s resilience.

- Electrified transport makes up the largest share of investment under study, with $893 billion spent on electric vehicles and the development of charging infrastructure, up 21% from 2024.

- US investment also moved up 3.5% to $378 billion, despite policy headwinds.

- Under BloombergNEF’s base-case Economic Transition Scenario, average annual investment in the global energy transition reaches $2.9 trillion in the next five years.

London and New York, January 26, 2026 – BloombergNEF’s (BNEF) annual Energy Transition Investment Trends (ETIT) finds that global investment into the energy transition hit a record $2.3 trillion in 2025, up 8% from the prior year. The largest investment drivers were electrified transport ($893 billion), renewable energy ($690 billion), and grid investment ($483 billion). Renewable energy investment fell 9.5% year-on-year however as changing power market regulations in China, the world’s largest market, introduced new uncertainty. All other sectors tracked by BNEF saw a rise in their investment levels, with the exception of hydrogen ($7.3 billion) and nuclear ($36 billion).

The report finds that clean energy supply investment also outpaced fossil fuel supply for a second consecutive year in 2025, with the gap widening to $102 billion from $85 billion in 2024. While clean energy investment (which includes renewables, nuclear, carbon capture, hydrogen, energy storage and power grids) continued to grow, fossil fuel supply investment fell for the first time since 2020, declining by $9 billion year-on-year. This drop was driven mainly by reduced spending on upstream oil and gas (-$9 billion) and fossil power generation (-$14 billion), although these were partly offset by higher investment in gas and coal. However, despite energy transition investment being at an all-time high, growth has slowed steadily, from 27% in 2021 to 8% in 2025.

Asia Pacific remained the largest region for investment, accounting for 47% of the global total in 2025. China, the largest market, is still the leader in overall investment ($800 billion in 2025), but posted its first decline in funding renewables since 2013. India’s investment climbed 15% to $68 billion. The EU shrugged off headwinds to grow 18% to $455 billion, contributing the most to the global uptick. US investment also recorded a 3.5% increase to $378 billion, despite the Trump administration’s moves to slow the energy transition.

Albert Cheung, Deputy CEO at BloombergNEF, said, “This past year has showcased that despite policy and trade headwinds, the global energy transition is resilient and provides a number of opportunities for investors. As many economies look to strengthen energy security and build domestic supply chains, clean energy investment will continue to rise, especially as it relates to global data center buildouts.”

Clean energy supply chain investment, which includes spending toward new clean-tech product factories along with battery metal production assets, grew 6% to $127 billion in 2025. This figure reflects the value of factories commissioned in 2025 for solar, battery, electrolyzer and wind equipment, as well as mines and processing facilities for battery metals. Growth in 2025 was largely driven by increasing battery manufacturing and battery materials investment. Overcapacity continues to weigh on all clean energy supply chain sectors, so while overall investment is still rising, downward pressure on clean-tech product prices is expected to persist. China continues to account for a clear majority of global supply chain investment, and BNEF expects this situation to continue for at least the next three years.

Climate-tech companies raised $77.3 billion in private and public equity throughout 2025, up 53% year-on-year and marking the first year of growth after three consecutive years of decline. This rise in funding was led by companies working in clean power, energy storage and low-carbon transport. Activity with public equity recovered and led to this growth, mostly due to multibillion dollar deals from Asia, while venture funding for startups fell for the third consecutive year. Additionally, M&A activity remained strong, ending 2025 with $99.1 billion closed, reaching a 37% increase from the prior year. This increase can be attributed to acquisitions from companies in the clean power and buildings sectors gaining traction for global data center buildouts.

The report also found that energy transition debt issuance totaled $1.2 trillion in 2025, up 17% from 2024. This rise can be credited to the growth in corporate and project finance flows, each up 20% respectively, and offsetting a dip in government debt sales as labeled issuances were scaled back for mature transition sectors like renewables.

Other key findings from the 2026 Energy Transition Investment Trends include:

- BNEF estimates that data center investment was around half a trillion dollars in 2025, putting it ahead of overall investment in solar, but behind electrified transport in scale. This will be a continued area to note for global investment.

- Despite the drop in renewables funding, the most established areas of the energy transition continue to dominate investment. Renewables, storage, EVs and grids are relatively mainstream technologies with little risk and increasingly well-established business models.

- While China’s dominance in clean-tech manufacturing investment is not likely to be challenged any time soon, its share of annual investment is gradually declining, due to investments in the US, EU and India as they onshore clean-tech supply chains.

- Across all sectors, supply chain investment is expected to continue growing at a pace far beyond the spending required by BNEF’s Economic Transition Scenario, though wind is at risk of lagging behind. Maintaining alignment with net-zero pathways will require a major uptick in wind manufacturing spending, while battery metals could face long-term misalignment if the pace of future additions slows as currently projected.

BloombergNEF clients can find the full report – as well as an accompanying data viewer, country-level insights and a semi-annual deep dive on renewables investment specifically – on bnef.com and the Bloomberg Terminal.

A public summary version is available at this link.

Media Contact(s)

For further information, please contact our media team.

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.