By Nayel Brihi, Corporate Energy Analyst, BloombergNEF

Corporate power purchase agreements have typically been assessed through additionality or the new renewable energy plants they enable. BloombergNEF broadened that view to include the carbon impact of each PPA, or emissionality. Amazon leads global peers in carbon emissions avoided through its renewable energy purchases, followed closely by other major tech firms. Companies like Rio Tinto are making an impact from large purchases in high-emitting regions.

By the numbers

Megatons of CO2 emissions avoided by corporate PPAs from projects commissioned between 2015 and 2030

Renewable energy projects commissioned and supported by corporate PPAs between 2015 and 2030

Kilotons of CO2 emissions displaced per megawatt of renewable PPA capacity in Australia – four times more than in the US

- Carbon impact of corporate PPAs varies significantly between regions. BNEF analyzed the carbon impact of 2,916 corporate PPAs signed between 2015 and 2024, contributing to the development of 301 gigawatts (GW) of renewable energy projects. Each megawatt of capacity avoided 1.9 kilotons of CO2 in the Asia-Pacific (APAC) region, 1 kiloton in the Americas (AMER) and 0.7 kilotons in Europe, Middle East and Africa (EMEA). In the US alone, we expect corporate PPAs to displace the equivalent of 10% of the market’s power sector emissions in 2024, at 1.5 gigatons of CO2 (GtCO2).

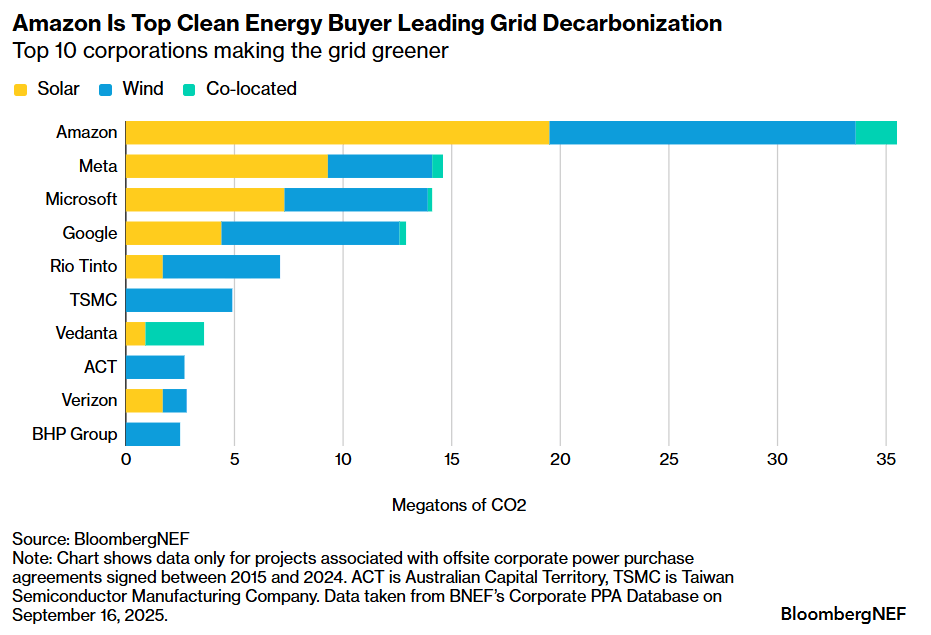

- Amazon is the leading corporate clean energy buyer for its grid impact (Figure 1). The technology giant has displaced 35.5 megatons of CO2 (MtCO2) by buying over 45GW of renewable energy capacity, which is more than the power generation fleet of the United Arab Emirates. Other big tech companies – Meta, Microsoft and Google – follow, removing a combined 41.7MtCO2 by their corporate PPA activity.

- Two strategies emerge for company decarbonization: buy renewable power in bulk or be more selective to maximize impact. Technology giants dominate in both corporate PPA volumes signed and emissions avoided. However, mining giant Rio Tinto managed to feature in the top five with a much smaller portfolio of 2.7GW by sealing bigger deals in dirtier grids.

BloombergNEF clients can access the full report here.