PRESS RELEASE

Corporate Clean Energy Buying Fell in 2025 After Nearly a Decade of Growth

- BloombergNEF analysis shows offsite corporate clean energy deal volumes dropped in all regions except the Americas

- Big Tech buyers accounted for 49% of global activity, led by Meta and Amazon

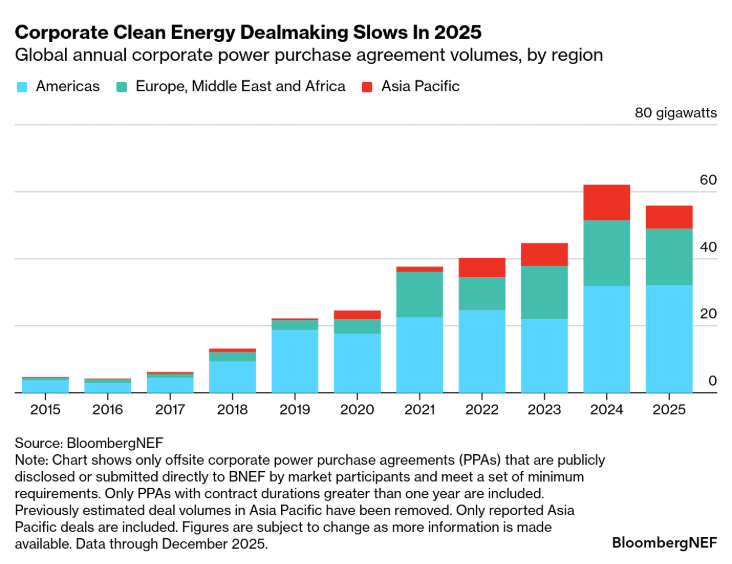

London, February 19, 2026 – Global clean power purchase agreement (PPA) volumes fell for the first time last year in nearly a decade, as power prices and policy risks redefined market activity. Corporations announced deals for 55.9 gigawatts of clean power in 2025, 10% down from the record set the prior year, according to BloombergNEF in its 1H 2026 Corporate Energy Market Outlook.

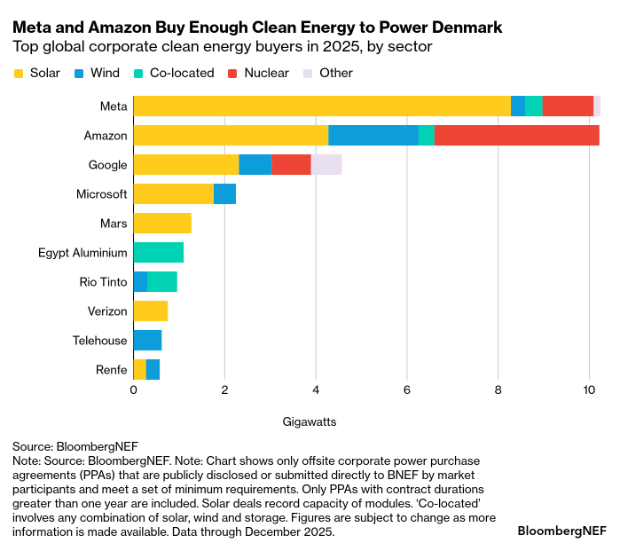

The market is increasingly defined by a divergence between hyperscalers and the broader universe of corporate buyers. Technology giants Meta, Amazon, Google and Microsoft were responsible for 49% of all global activity last year. Meta and Amazon led global clean energy buying activity in 2025, contracting a combined 20.4 gigawatts (GW), including 4.7GW of nuclear power. While Meta’s activity was concentrated in the US, Amazon was the most active buyer in Europe and Asia Pacific.

The US is still the largest market, hosting a record 29.5GW of deals, driven by Big Tech’s pivot to nuclear, hydro and geothermal. However, the largest technology firms signed most of the deals, with smaller players becoming less active, as project costs and policy uncertainty rose. The number of unique corporate buyers in the US dropped 51% year-on-year to just 33.

Meanwhile, in the Europe, Middle East and Africa region, corporate PPA volumes slid 13% year-on-year in 2025, to 17GW, with capacity notably falling back to 2023 levels in Europe. Rapidly increasing hours of negative power prices are eroding the value of standalone solar and wind deals, pushing buyers toward hybrid portfolios.

In the Asia Pacific region, volumes dropped to 6.9GW, from 10.7 gigawatts the year prior, primarily due to slowdowns in India and South Korea. Corporate clean energy procurement in the region is increasingly bifurcating between countries where corporate PPA adoption becomes more sophisticated like Japan, and markets like Malaysia where growth remains dependent on regulatory support.

Nayel Brihi, BNEF corporate energy analyst and lead author of the report, said: “Corporate clean energy buyers are operating at two different speeds. Large tech buyers are venturing into bigger deals and frontier technologies, while smaller companies are grappling with power market realities. Some buyers in newer markets are just familiarizing themselves with the concept of offtake agreements altogether. For the market to return to growth, we will need to see clean, firm power supply options such as co-located solar and storage delivering at scale, and at competitive prices.”

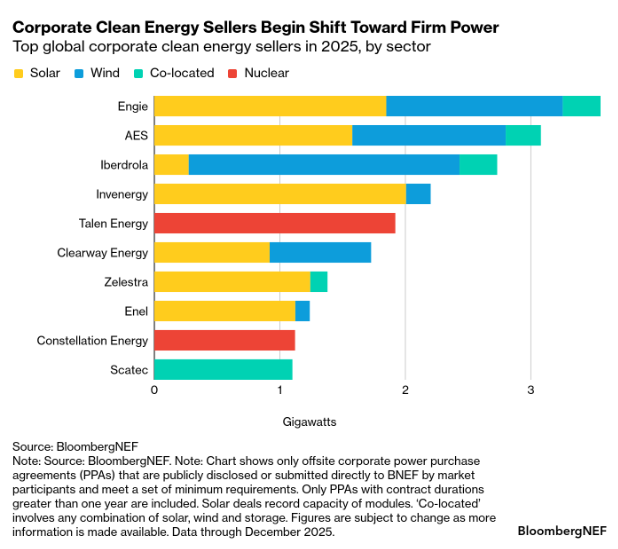

On the supply side, Engie emerged as the top developer, contracting 3.6GW globally. Developers offering clean, firm power solutions are increasingly present in the league tables. Seven of the top 10 sellers engaged in such power contracts – including co-located solar and storage, hybrid solar and wind, or nuclear PPAs. These “baseload-like” products accounted for 5.2GW of activity.

The push for more sophisticated corporate clean energy deals is also being driven by regulatory shifts. The Greenhouse Gas (GHG) Protocol – the global standard for corporate carbon accounting – is updating its Scope 2 emissions standards, with proposed amendments potentially requiring hourly tracking and stricter geographical boundaries for indirect electricity, heat, steam and cooling purchases. Under an hourly tracking regime, 100% renewable claims will become harder to justify for most buyers.

Corporate clean energy buyers are already preparing for this change, with 5.8GW of co-located and hybrid deals tracked in 2025. As battery costs continue to decline, these deal structures are expected to become the new standard for corporate procurement.

BNEF’s 1H 2026 Corporate Energy Market Outlook is the latest in a series of reports focusing on the current trends in corporate energy strategy. Our PPA database monitors offsite corporate clean energy deals that are publicly disclosed or submitted directly to us by market participants and meet a set of minimum requirements.

Media Contact

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.