ARTICLE

Electric Vehicles Remain Key Driver for Grid Investment Despite Data Center Boom

By Felicia Aminoff, Senior Associate, Grids and Utilities, BloombergNEF

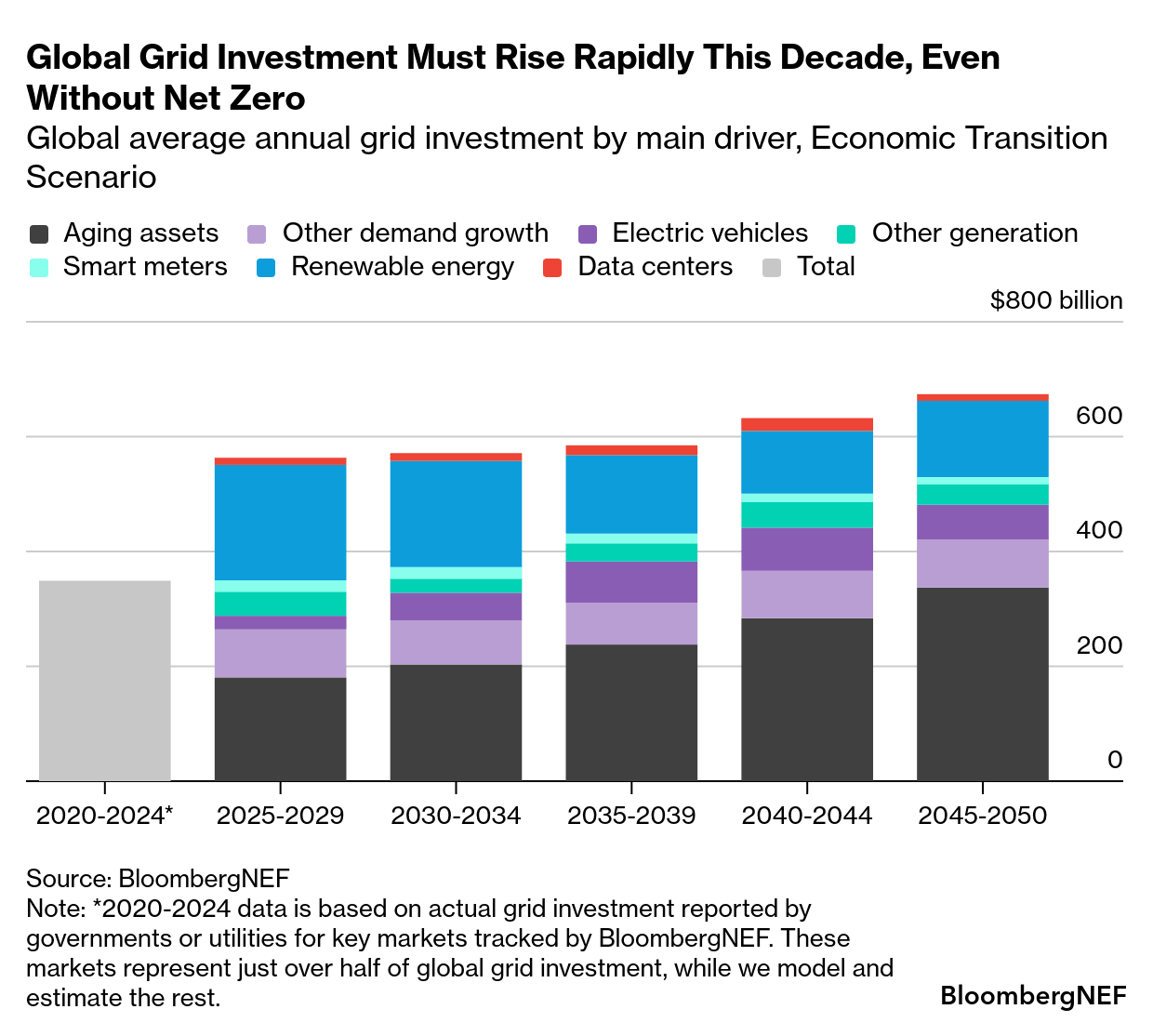

Grid investment of $15.8 trillion is needed between now and 2050 under BloombergNEF’s base-case scenario for the global energy transition, most of it for physical assets like wires, cables, towers and substations to deliver a required 29-million-kilometer (17.4-million-mile) extension. This year’s outlook included data centers as a new driver of grid investment but found that their global share of utilities’ capital expenditure on grid infrastructure remains modest.

- For this year’s New Energy Outlook, BNEF focused on updating the Economic Transition Scenario (ETS), our base case, incorporating new analysis on data center power demand, policy shifts in key geographies, and refreshed cost estimates for clean and fossil energy.

- Data centers were included as a driver of grid capital expenditure for the first time in this year’s edition of New Energy Outlook: Grids. We find that they only directly drive 3% of global grid capex for 2025-2050, but indirectly more grid spend is needed to connect generation brought online to serve new data centers.

- Replacement of aging assets and connecting renewable energy remain the key investment drivers, and distribution grid spending remains slightly higher than outlays on the transmission grid.

On the demand side, electric vehicle charging is one of the largest drivers as of grid spending as charging optimized for low prices often creates new midday demand peaks to absorb excess solar. Peak power demand is a key determinant of grid size. - There is a big gap between actual grid investment recorded for 2020-2024 and the investment our scenario tells us is needed for the rest of this decade. Annual average investment is roughly 60% higher in our scenario for 2025-2029 than it was in 2020-2024. This suggests grids suffered from underinvestment over recent years, resulting in bottlenecks for new connections and curtailment of renewable energy.

For more on grid investment and our future energy scenarios, see BNEF’s New Energy Outlook 2025: Grids and New Energy Outlook 2025.

BloombergNEF clients can access the full analysis here.