By Victoria Cuming, Head of Policy, BloombergNEF

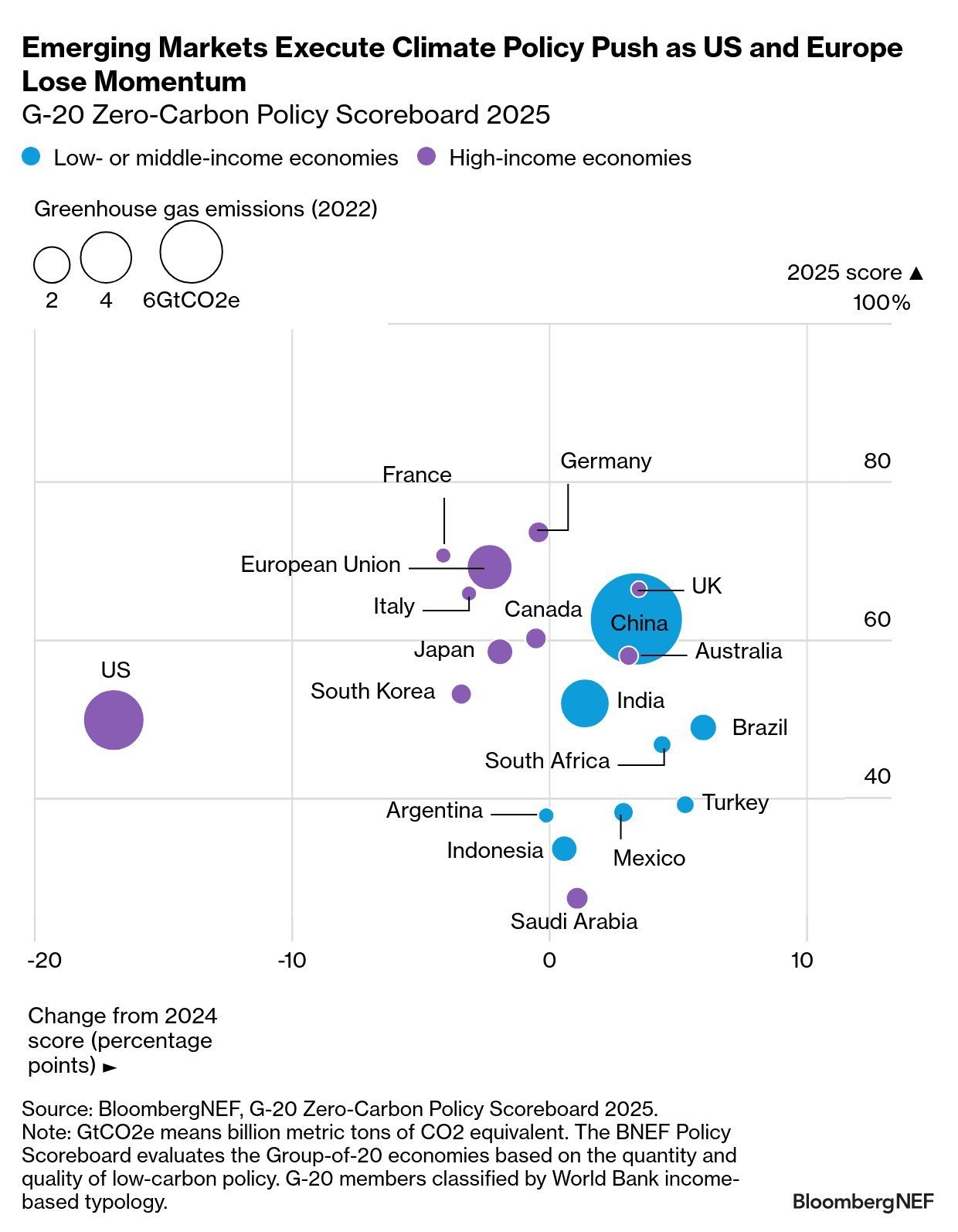

All emerging markets in the Group of 20 have bolstered low-carbon policy in the last year, according to BloombergNEF’s latest Policy Scoreboard, which tracks green government support across the G-20. This progress counterbalances backsliding by some high-income economies – in particular the US and, to a lesser extent, the European Union. Together, the G-20 accounts for roughly 75% of global emissions, meaning its action, or inaction, will largely determine the pace of the energy transition.

Diverging paths

High-income economies collectively saw their average rating decline by three percentage points to 59% of the climate policy support needed to stay on track to net zero, based on BNEF analysis. This was led by a 17-point collapse in the US, the steepest reversal among any member.

Conversely, all low- and middle-income economies – many of which account for a growing share of global greenhouse gas emissions – improved, increasing by an average of three percentage points. The host of this year’s United Nations climate summit, Brazil, had the biggest rise of six points, followed by Turkey and South Africa.

As a result, the G-20’s average policy score holds almost flat at 53%, just 0.1 percentage points below last year. While this may be more optimistic than some recent media headlines around weakening climate ambition, it highlights the considerable need for more credible support if the world is to achieve the goals of the Paris Agreement.

In terms of the G-20 ranking, the EU and its member states have weakened low-carbon support in some areas like transport and agriculture. But they still perform best, thanks to a comprehensive set of impactful policies and regulations. The UK is not far behind, having been one of the three high-income economies in the G-20 to improve its performance this year.

Sectoral shifts

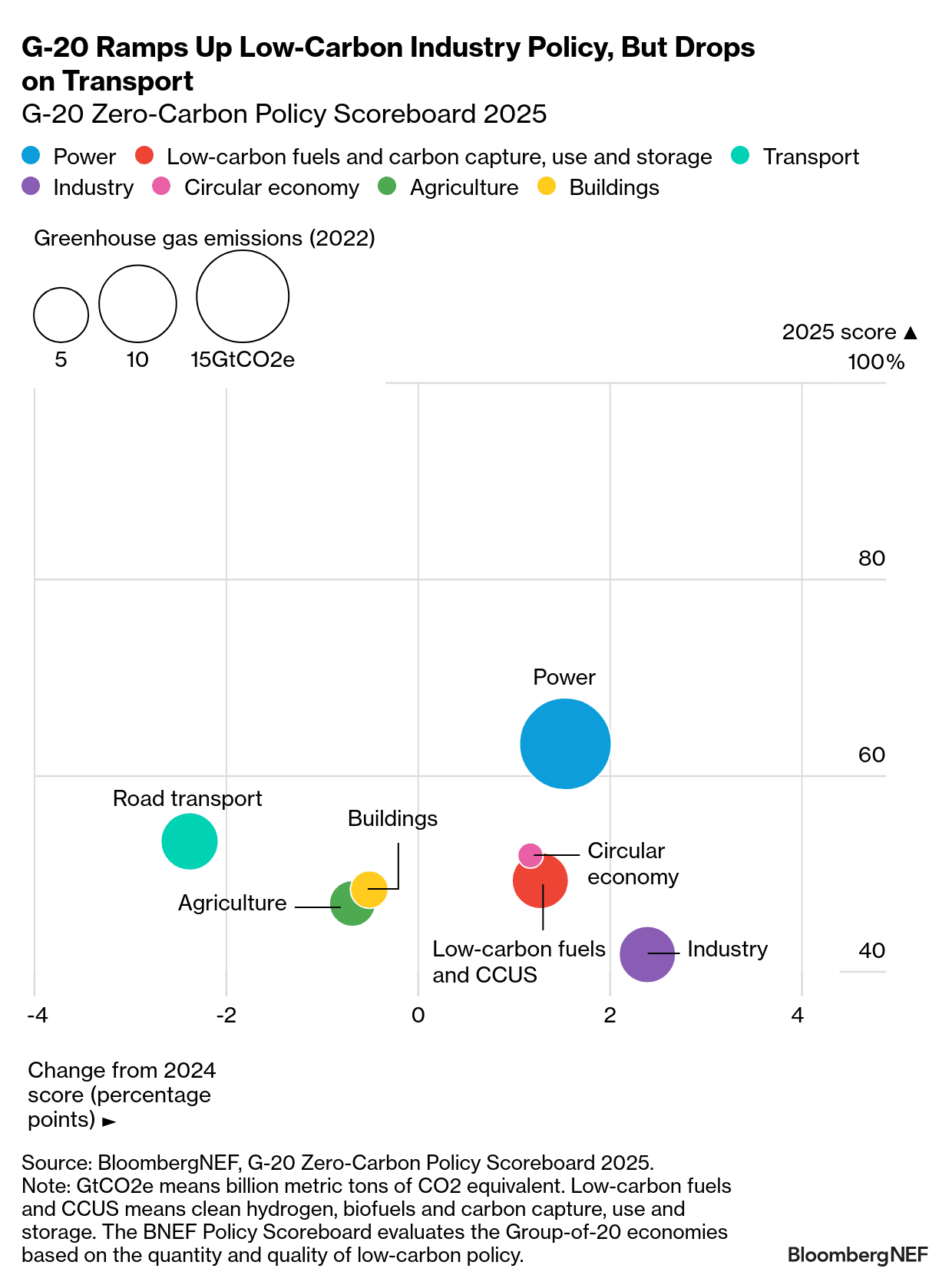

Governments are tightening regulations, such as carbon pricing, and they continue to introduce mandatory climate-risk disclosure. But the G-20 still channels hundreds of billions of dollars in fossil-fuel support each year and some have watered down sustainable finance policy. Power remains the strongest performer out of the sectors, buoyed by renewable auctions and storage incentives, though grid upgrades and permitting reforms are slow to deploy.

The two sectors most dependent on consumer uptake – road transport and buildings – had the sharpest drop in support, as policymakers seek to mitigate public and industry backlash. This decline especially hit high-income economies, some of which reduced electric vehicle and heat pump subsidies, and weakened low-carbon regulations. Yet these challenges have been partially offset by momentum in emerging economies introducing new mandates, vehicle incentives and air-conditioning efficiency standards.

By contrast, industrial decarbonization policy is gathering momentum, as policy shifts from aspirational to actionable buoyed by project funding and carbon pricing. More markets have begun to look toward creating demand signals, which will be needed for clean hydrogen, biofuels and carbon capture, use and storage to gain traction. While support for low-carbon fuels and CCUS is growing, most has targeted the supply side.

The leaders on circular economy support offer robust incentives and regulations, and are starting to integrate green practices into their industrial strategies, while agriculture is a weak link in climate policy efforts. Many governments still provide farmers’ subsidies that could have environmental harmful impacts while offering limited support for sustainable practices. Some more ambitious markets have diluted environmental conditions on subsidies and rolled back funding.

Leaders and laggards

The European Union retains the highest overall score at 69%, despite some minor slippage. The bloc’s Emissions Trading System continues to drive abatement, the new Clean Industrial Deal should promote decarbonization and competitiveness, and new mandates under the Renewable Energy Directive are poised to stimulate demand for hydrogen and biofuels. Political resistance, however, is slowing national-level implementation. The EU also lost points for reduced support for EVs and low-carbon heating.

The US has reversed course sharply under the Trump administration. Tax credits and mandates have been rolled back and billions of dollars in low-carbon funding has been scrapped. While some policies remain intact at the state level (and are included in the Scoreboard), federal retrenchment has dragged the US score to 50%, now the lowest among the high-income economies except Saudi Arabia.

Among emerging markets, Brazil stands out as the year’s biggest improver, rising six points to 49%. The new Fuel of the Future law included stricter biofuel blending mandates and incentives for low-carbon fuels and CCUS. The government has introduced a package of policies targeted at industry, including the forthcoming carbon market and new green taxonomy. Initiatives like the New Industry Brazil program and Industry Decarbonization Hub aim to mobilize public and private-sector capital for projects. Agriculture remains Brazil’s weakest link, with new environmental licensing rules threatening to loosen deforestation controls.

Pivotal to the global energy transition, China increased its total score by three percentage points to 63% this year, making it the top-ranking emerging market in the G-20. It leads the world in renewables auctions, while new programs will help it remain a frontrunner for EVs and heat pumps. China had its biggest scoring increase for industry. Its carbon market has been expanded, and reforms should make it more impactful. China has also piloted carbon footprint labeling, adopted a standard assessment method for low-carbon steel, and introduced a renewables mandate for some industrial sectors. Still, coal-power expansion and uneven performance in agriculture and circular-economy policy temper its overall performance.

Outlook

With global decarbonization momentum increasingly dependent on emerging economies, the Scoreboard reveals a world divided not by ambition but by execution. Progress in Brazil, China and others shows what’s possible with sustained policy direction. Yet without renewed leadership from high-income economies, the collective path to net zero risks slipping further out of reach.