PRESS RELEASE

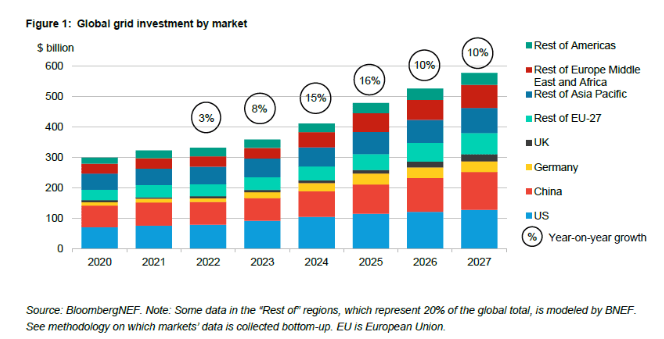

Global Grid Investment Could Top $470 Billion for the First Time in 2025: BloombergNEF

- Grid spending is set to rise by 16% this year, following 15% growth last year, showcasing how rising spending is becoming an established feature of the global energy transition

- A portion of this increase can be attributed to years of rising grid equipment costs and high inflation, leaving bottlenecks in physical grid infrastructure growth

December 1, 2025, New York: Global grid capital spending is set for double-digit growth for the second year in a row, reaching over $470 billion for the first time, new analysis from BloombergNEF finds. The grid continues to be the key enabler for delivering renewable energy connections, reaching electrification targets and connecting data centers to power, driving a 16% increase in grid spending this year, according to the Grid Investment Outlook 2025.

While new grid projects contribute to this steady growth in spending, rising equipment costs compounded by high inflation are also beginning to have an effect on overall spending figures. These factors suggest that increased spending will not fully eliminate ongoing grid-infrastructure bottlenecks, meaning delays to new generation and demand connections are likely to continue in the coming years.

The US has the highest levels of grid investment in 2025, with $115 billion, or a quarter of the worldwide total. China and the EU/UK follow as other major contributors, each with around 20% of the global sum.

Despite an array of generation queue reform efforts globally, the queues to connect new generation remain oversized across most markets. Now, demand queues are also rising rapidly as transmission grids receive a major increase in connection requests from companies in need of power, mainly large data centers and industries with high levels of electricity consumption.

Investment in transmission is projected to grow at almost twice the rate of distribution, with a compound annual growth rate of 16% between 2024 and 2027 for transmission versus 9% for distribution. While current investment in distribution is higher, this will likely shift before the end of the decade if the rate of change is sustained. The growth in transmission grid investment is heavily driven by specific projects, including long-distance connections, new substations and high-voltage direct-current projects.

Peter Wall, Head of Grids Research at BloombergNEF, said: “Grid expansion is a complex issue that will be the key to a successful global energy transition. We’ve seen that even with increased investment, there are significant barriers to meeting the needs of new generation and power demand on time. With data centers and industrial electrification driving sharp increases in power demand, investors need to factor in how essential timely grid expansion is for not only connecting new demand but also connecting all of the generation we will need to ensure a secure and reliable supply to this demand after over a decade of stagnation.”

Additional grid investment is hampered by supply chain and labor constraints, with some transmission and distribution companies struggling to meet their business goals due to project delays. As these companies look to complete projects and improve grid conditions, permitting and licensing delays along with a shortage of specialized talent are barriers to grid expansion.

Other key findings of the report include:

- Debt capital is still the main vehicle for financing grid investment, but in certain markets borrowing is reaching levels where injections of new equity capital are necessary to keep finances balanced.

- In most markets, operating expenses for the grid are passed down to consumer bills with no additional profit for the grid company, often disincentivizing investment in grid-enhancing technologies that unlock capacity. Regulatory changes to address this remain slow across markets.

- Investment in innovative grid technologies, like dynamic line ratings, advanced power flow control and AI-optimized smart-grid software solutions, continues to grow despite ongoing challenges around utilities benefiting more from traditional investments.

Media Contact(s)

For further information, please contact our media team.

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.