PRESS RELEASE

Global Renewable Energy Investment Still Reaches New Record as Investors Reassess Risks

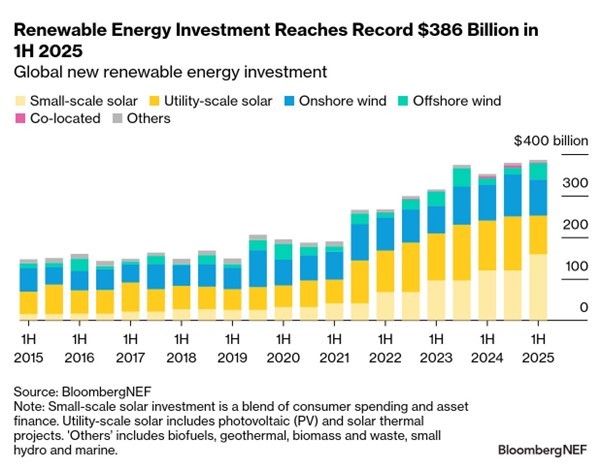

- Global investment for new renewable energy development reached a record $386 billion during the first half of 2025, according to BloombergNEF’s 2H 2025 Renewable Energy Investment Tracker

- Global offshore wind and small-scale solar spurred growth in the first half of 2025

- Asset finance for utility-scale solar and onshore wind was down 13% compared to 1H 2024

- Investment in the US fell 36% from the second half of 2024 as investors recalibrate to the region’s changing policy landscape

London, August 26, 2025 – Global investment in new renewable energy projects hit a record $386 billion in the first half of 2025, up 10% from the previous year. However, asset finance for utility-scale solar and onshore wind shrank by 13% compared to 1H 2024, reaching the lowest share of total investment since 2006, according to the latest investment data collected by BloombergNEF (BNEF) and published in the 2H 2025 Renewable Energy Investment Tracker.

BNEF finds that utility-scale solar photovoltaic investment was particularly hit, falling 19% compared to the first half of 2024. The markets that saw the largest year-on-year declines in investment – including mainland China, Spain, Greece and Brazil – have seen rising curtailment and greater exposure to negative power prices, signaling that concerns over revenue were paramount for investors. Utility-scale solar investor activity was stronger in markets with supportive government auctions or strong corporate energy demand.

Spending on small-scale solar made up for the drop in financing toward larger projects as these projects are quick to deploy and can be brought online ahead of significant policy shifts that impact revenues or returns. For instance, in mainland China small-scale solar investment nearly doubled year-on-year while utility-scale solar installations fell 28% ahead of a regulatory change that now exposes renewables to volatile power prices.

Offshore wind also contributed to the record investment volume, attracting $39 billion in 1H 2025, exceeding 2024’s total of $31 billion investment. Asset financing for the sector is driven by large projects and the schedule of government auctions, meaning sizeable swings in investment over time is quite natural. Elevated project costs outside mainland China also contributed to the rise.

“Renewable energy investors and developers are rethinking capital allocation and putting their money where project returns are strongest” said Meredith Annex, Head of Clean Power at BloombergNEF. “The decline in utility-scale solar and onshore wind financing during the first half of 2025 is taking a toll on project pipelines and likely will continue to do so.”

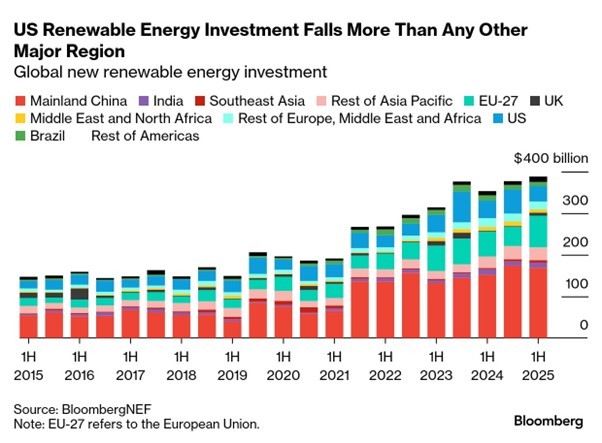

Of all major regions, the US saw the greatest drop in new renewable energy investment in 1H 2025, with committed spending down $20.5 billion (36%) from the second half of 2024. This reflects the industry’s response to the 2024 US federal elections, as developers rushed to begin construction toward the end of last year, to lock in access to tax credits, and then slowed activity in the first half of this year due to deteriorating policy conditions, particularly for wind, and growing tariff uncertainty.

“Markets with supportive revenue mechanisms have maintained momentum on renewable energy investment,” said Annex. “Whereas projects in markets where revenue certainty is shifting, particularly when it’s down to large swings in policy as in the US or mainland China, are seeing a boom-bust cycle ahead of those changes.”

In contrast, the EU-27 saw investment in the first half of 2025 rise by nearly $30 billion, or 63%, compared to the second half of 2024. These numbers support the idea that companies are reallocating capital out of the US and into Europe – particularly in offshore wind, where several developers refocused to North Sea sites over US projects.

Newer and emerging markets for renewables – which saw significant growth in 2024 – mostly held at their new investment levels rather than gaining further shares of the global total. Exceptions included Southeast Asia, where investment was up 7% from the second half of 2024, and Latin America, where smaller markets gained their largest share of regional investment to date.

Mainland China remained the largest market, with a 44% share of global new investment in 1H 2025.

BloombergNEF clients can find the full report and full data viewer on bnef.com and the Bloomberg Terminal.

Media Contact(s)

For further information, please contact our media team.

Alaina Hay

BloombergNEF

ahay38@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.