The global transition to lower-carbon, more secure sources of energy is reshaping trade flows. Clean energy represented just 2.2% of total cross-border trade of goods in 2024, but that share is set to grow as the transition gathers momentum. Last year, investments into low-carbon assets reached a record $2.3 trillion, up 8% from 2024.

What further shifts lie ahead as the transition continues? The geoeconomic implications are profound as governments jostle to promote energy security and economic development.

To answer these and other questions, BloombergNEF has for the first time produced trade-flow projections through 2050 encompassing 28 geographies and 28 transition-influenced product categories, including electric vehicles (EVs), solar modules, batteries, and battery metals. Also on the list: fossil fuels, internal-combustion engine (ICE) vehicles, and other goods. To make its projections, BNEF employed multiple scenarios from its proprietary New Energy Outlook and those produced by the Network for Greening the Financial System.

Some key findings from BloombergNEF’s Trade Transition Scenarios:

EV, battery trade more than triples as that of ICE vehicles plummets

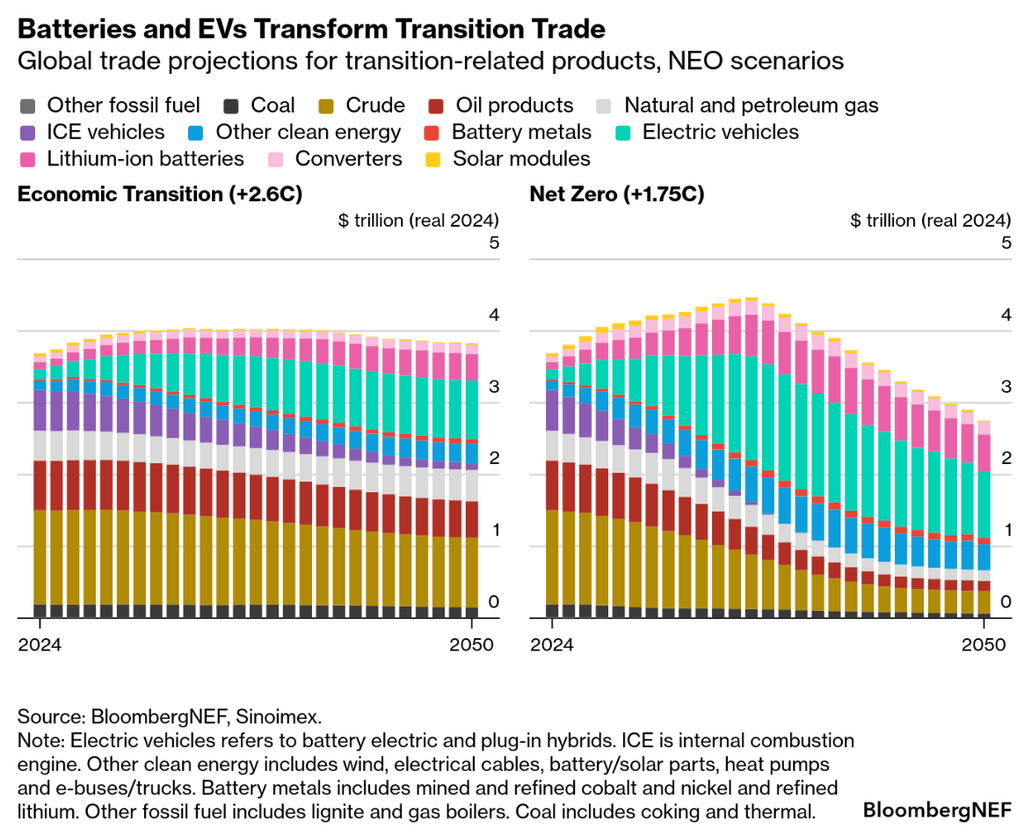

The value of EV and battery trade surges to $880 billion by 2035 up from $234 billion in 2024 under BNEF’s core Economic Transition Scenario, which assumes that clean-technology cost declines continue advancing at the pace they have in recent years and that no new major climate-related policies are adopted by governments. Rising EV adoption shrinks ICE vehicle trade to $340 billion by 2035, down 39% from 2024 levels.

Fossil fuel trade is stunted

Crude oil and its derived products drive most fossil-fuel trade flows, which hold steady at around $3 trillion until 2030, before entering a long period of decline through 2050 under the Economic Transition Scenario. While natural-gas trade expands over the period, it does not offset oil demand destruction on a dollar basis.

Yet fossil-fuels continue to represent more than half global energy-related flows over the period. Under BNEF’s Net Zero Scenario, which assumes nations put in place policies that result in the world achieving net-zero emissions by 2050, fossil-fuel trade drops below $1 trillion by 2040.

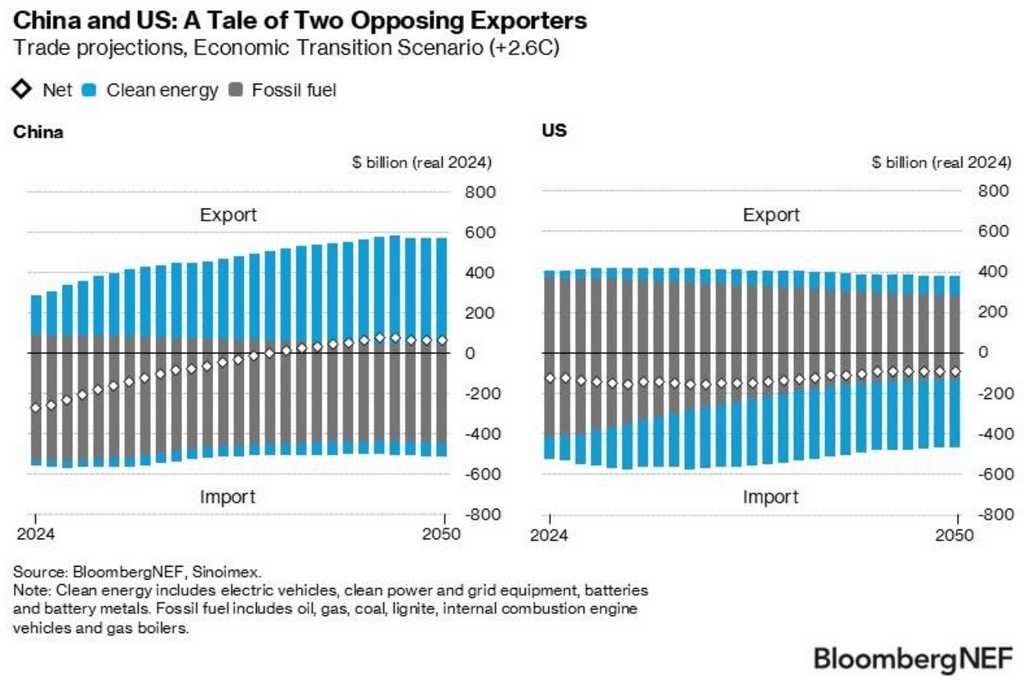

Diverging paths for the US and China

Both the US and China are today net importers of the 28 energy goods studied in the report but the two progress along very different pathways through 2050. China, already today the largest exporter of clean-tech goods, accounts for at least a third of global clean-energy exports through 2050 under the Economic Transition Scenario. The rapid expansion of EV and battery exports as well as domestic electrification turn China’s $266 billion energy-related trade deficit in 2024 into a surplus by the late 2030s.

The US today is also a net importer of the goods studied in the report but to a much lesser extent due to substantial oil and gas exports. As the energy system transitions, however, US fossil fuel exports plateau then gradually contract as clean–energy product imports rise. This leaves the US energy trade balance in negative territory, hovering around $130 billion through 2050.

For its part, the EU’s energy-related trade deficit shrinks 29% by 2035, mainly owing lower crude oil imports and higher EV exports, though competition with China for global vehicle markets will be fierce.

To derive these projections, BNEF assumed that imports grow in line with the domestic demand for energy products or commodities. Similarly, exports grow in line with global demand.

BNEF and Bloomberg Terminal clients can access the report here. The full results of BNEF’s Trade Transition Scenarios are available through a data visualization tool, including full methodology, here.