PRESS RELEASE

Japan’s Steel Sector Needs to Use All Low-Carbon Pathways to Reach Emissions Goal: Report

BloombergNEF: Electric arc furnaces could provide route to lowering sector emissions under Japan’s Green Steel Framework.

Tokyo, December 3, 2025 – Emissions from Japan’s coal-based steel production will need to be cut if Japan is to achieve its 2050 net zero goal. The steel sector, which is responsible for about 13% of the country’s emissions, faces structural and economic pressures from declining domestic demand and intensifying global competition. Japan will require innovation and supporting policies to take advantage of all low-emission pathways for steel production to stay on track for its climate goals while preserving cost competitiveness, according to BloombergNEF’s latest report, Decarbonization of Japan’s Steel Industry: Economics and Path Forward, commissioned by Tokyo Steel Manufacturing Co.

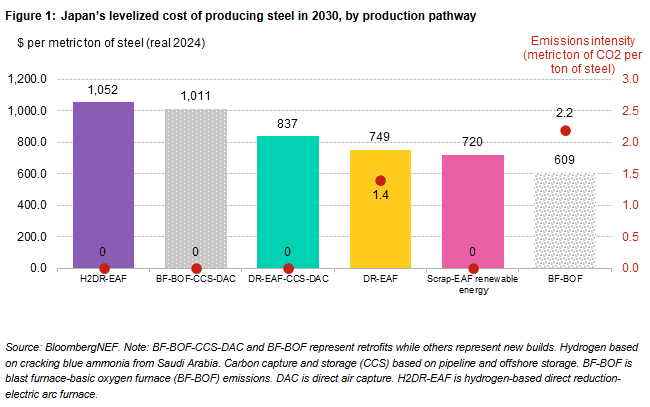

Policy measures such as incentives and carbon pricing could help accelerate the emergence of low-carbon steel technologies in Japan. Existing and fully depreciated blast furnace-basic oxygen furnace (BF-BOF) assets is Japan are the country’s cheapest steel production pathway, in the absence of a carbon price, according to BNEF’s analysis of the levelized cost of steel production. By 2030, however, scrap-based electric arc furnaces (EAFs) powered by renewable energy can produce steel at around $720 per ton (real 2024). This is only 18% costlier than BF-BOF but with none of the emissions. Pathways relying on the use of hydrogen or carbon capture and storage (CCS), by contrast, remain more expensive, at more than $1,000 per ton of steel in 2030, and do not become cost competitive before 2050, Japan’s net-zero target date.

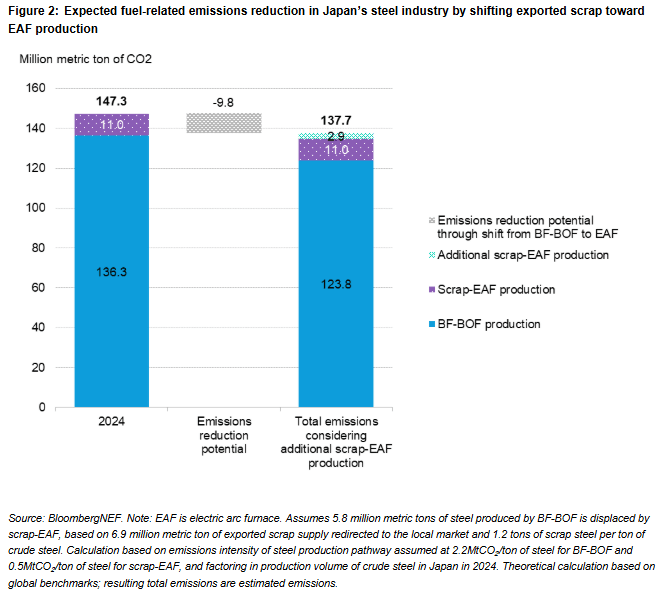

While most low-emission steel pathways are still emerging, Japan could begin to lower emissions from its steel sector by maximizing production at existing scrap-EAFs. BNEF’s analysis finds that this is currently one of the most economical pathways for low-emissions steel in Japan. The government could provide further support by introducing policies to redirect currently exported scrap volumes to the domestic steel sector. Based on BNEF analysis, the 6.9 million tons of scrap steel Japan exported in 2023 could enable production of 5.8 million tons of lower-carbon EAF-based steel, assuming 1.2 tons of scrap is used to produce each ton of steel. This would potentially help Japan avoid 9.8 million tons of direct CO₂ emissions, or about 7% of Japan’s steel sector so-called Scope 1 and 2 emissions in 2024 (Figure 2). An additional 13.9 million tons of CO₂ could be abated by powering the scrap-EAF process with clean power. This would bring total potential emissions reductions to 23.7 million tons of CO₂.

Laying out low-emissions steel standards would provide a strong signal to domestic steel manufacturers on the need for decarbonization and steps they need to take to meet those standards. Japan would benefit from an industry-wide green steel definition to unify standards across all manufacturers.

“A green steel standard based on real, measurable emissions reduction would be very beneficial to both producers and buyers. The chosen green steel standards may also evolve over time to take advantage of technological advances,” said Umer Sadiq, BNEF analyst and author of the report.

In addition, Japan’s green steel push would be well served by long-term infrastructure and supply-chain planning. Ensuring a low-cost, stable supply of low-emissions electricity, adequate steel recycling infrastructure along with the timely buildout of new supply chains, including for new low-carbon iron feedstocks, would help avoid future bottlenecks.

“Building stronger demand-signals for low-carbon steel is also imperative, which is one area where the government can lead,” said Ali Izadi, BNEF Head of Asia Pacific. “Japan’s current incentives for steel decarbonization favor incumbent BF-BOF owners. The incentive schemes can be improved to accelerate emissions reduction at lower cost to Japanese taxpayers.”

For the full report, please visit this link. Japanese translation of the report is available here.

Media Contact(s)

For further information, please contact our media team.

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.