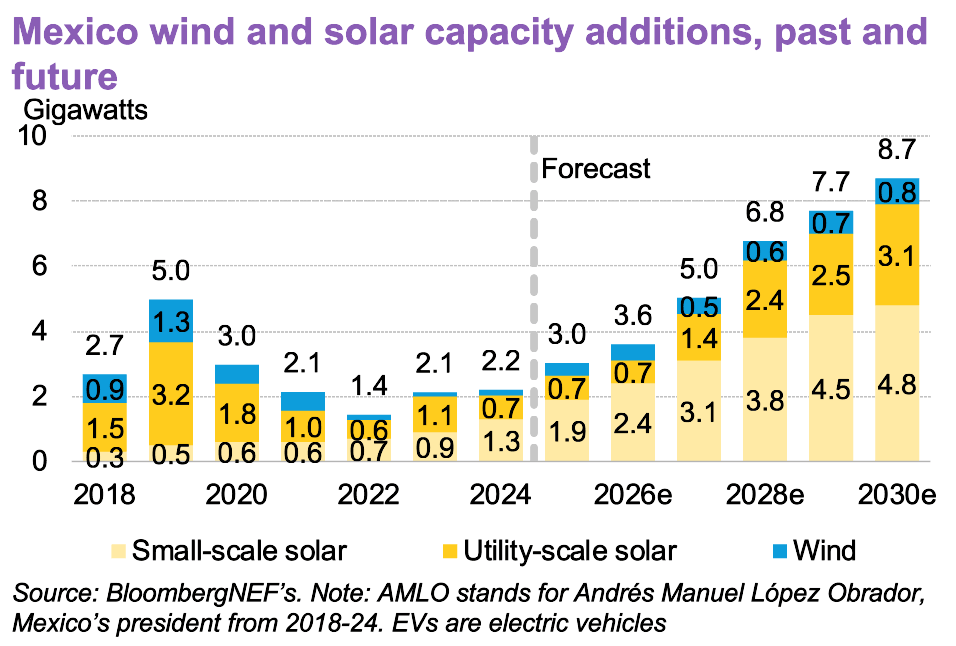

After an extended hiatus during the AMLO years, Mexico’s energy transition appears ready for renaissance now that President Claudia Sheinbaum’s administration is pushing toward more private sector involvement. Major issues remain unresolved, of course, including Mexico’s long-term heavy reliance on US natural gas and next year’s renegotiation of the US-Mexico-Canada (USMCA) trade pact. Nonetheless, an uptick in renewable capacity build, expanding electric vehicle sales and a nascent carbon credit trading market all suggest the transition is getting back on track. Here are 11 key trends BNEF is now tracking in Mexico:

- Mexico poised for $24 billion in power generation investment through 2030

- Power sector emissions likely to dip, then rebound to today’s levels by 2050

- Clean power build ready for take-off through 2030

- Mexico’s badly underinvested grid needs $57 billion through 2050

- Oil production has declined for a decade due to Pemex and underinvestment

- Mexico’s heavy reliance on US gas imports grows through 2030

- Mexico’s low-carbon policy framework lags others in the G-20

- Domestic EV demand is accelerating but exports north may stall

- The country’s clean-tech trade hinges on batteries and battery electric vehicles

- New carbon market poised to drive offset issuance to record highs

- Transition opportunities can offset physical risks facing Mexico companies

By the numbers

Projected Mexico power generation investment through 2030 under BloombergNEF’s Economic Transition Scenario

Projected share of total Mexico gas consumption US imports will account for in 2030, under BNEF’s base case scenario

Total battery electric vehicles and plug-in hybrid electric vehicles BNEF projects to be sold in Mexico in 2025

BNEF clients can access the full report here, and additional Mexico coverage below: