ARTICLE

The US Transition Ahead: Booming Energy Demand, Shifting Mobility

By Sunny Park, Deputy Director, Summits, BloombergNEF

After decades of relatively flat electricity demand, the US is entering an era of rapidly rising consumption. The rise of AI-driven data centers, electric vehicles and distributed generation and storage is reshaping the nation’s load profile at an unprecedented speed. Hotter summers are driving higher air conditioning use, while the early stages of industrial electrification are placing additional strain on an already stressed grid system.

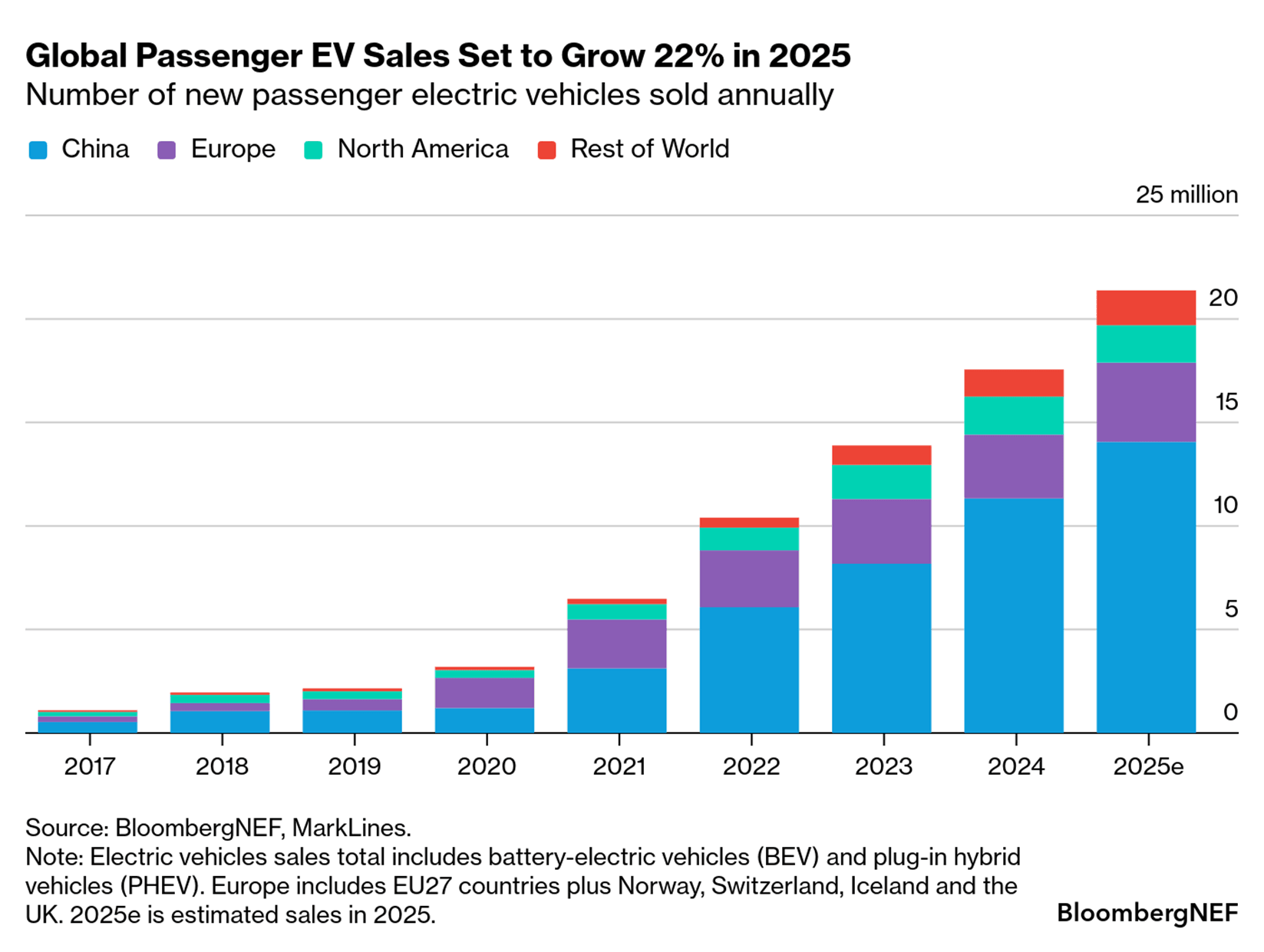

The world of transport continues to evolve rapidly with electric vehicle sales reaching new heights globally in 2025 and two- and three-wheeled electric vehicles also gaining traction, particularly in developing nations. In the US, EV sales growth has been more tepid as the industry faces major, new policy challenges from Washington.

On January 26 and 27, the BNEF Summit San Francisco will explore the drivers behind the US power demand surge, the tech race to meet growing electricity demand and the evolving transport sector. We will examine the implications for utilities, regulators and investors, and discuss how the grid can keep pace in a decade defined by electrification, digitalization and intensifying climate risk.

1. The technology race to meet growing power needs

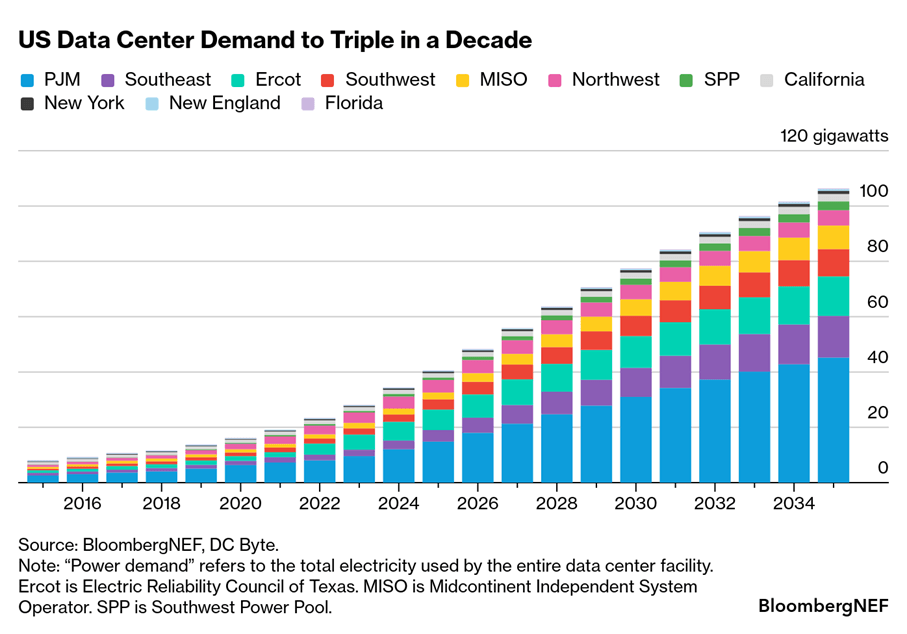

US data-center power demand is set to surge—from 34.7 gigawatts in 2024 to 106 gigawatts by 2035—putting growing strain on existing power systems. To meet this load, a wide range of technologies are now competing for relevance, including geothermal, virtual power plants, small modular reactors (SMRs), next-generation renewables and advanced battery systems.

Nuclear energy, in particular, has returned to the headlines. Despite strong political momentum—including President Donald Trump’s May 2025 orders supporting nuclear development in the US and abroad—the sector faces long development timelines. Only two new reactors were connected to the grid in 2025, in China and India, while share prices of major nuclear companies have remained volatile as commercial returns are years away. Enthusiasm for “new nuclear” is high, but investors still face familiar questions: Which technologies can secure political and social acceptance, scale efficiently, compete on cost and reach the market in time? These questions extend even beyond nuclear and apply across the emerging power technology landscape.

Throughout 2026, the Summit series—including San Francisco—will examine which of these technology pathways is most likely to succeed and serve as a critical stepping-stone in meeting growing power demand.

2. Who pays for the AI data center buildout?

Data centers have become the largest capital-investment story of the decade, with hundreds of billions poised to flow into the infrastructure that powers cloud computing, artificial intelligence and the broader digital economy. While major tech firms still fund a significant portion of their expansion through operating cash flow, the scale and speed required for hyperscale build-outs are pushing them more deeply into capital markets. Debt and equity issuances are playing a growing role in financing multi-billion-dollar campuses, complemented by rising participation from infrastructure investors, private equity firms and sovereign wealth funds seeking stable long-term returns.

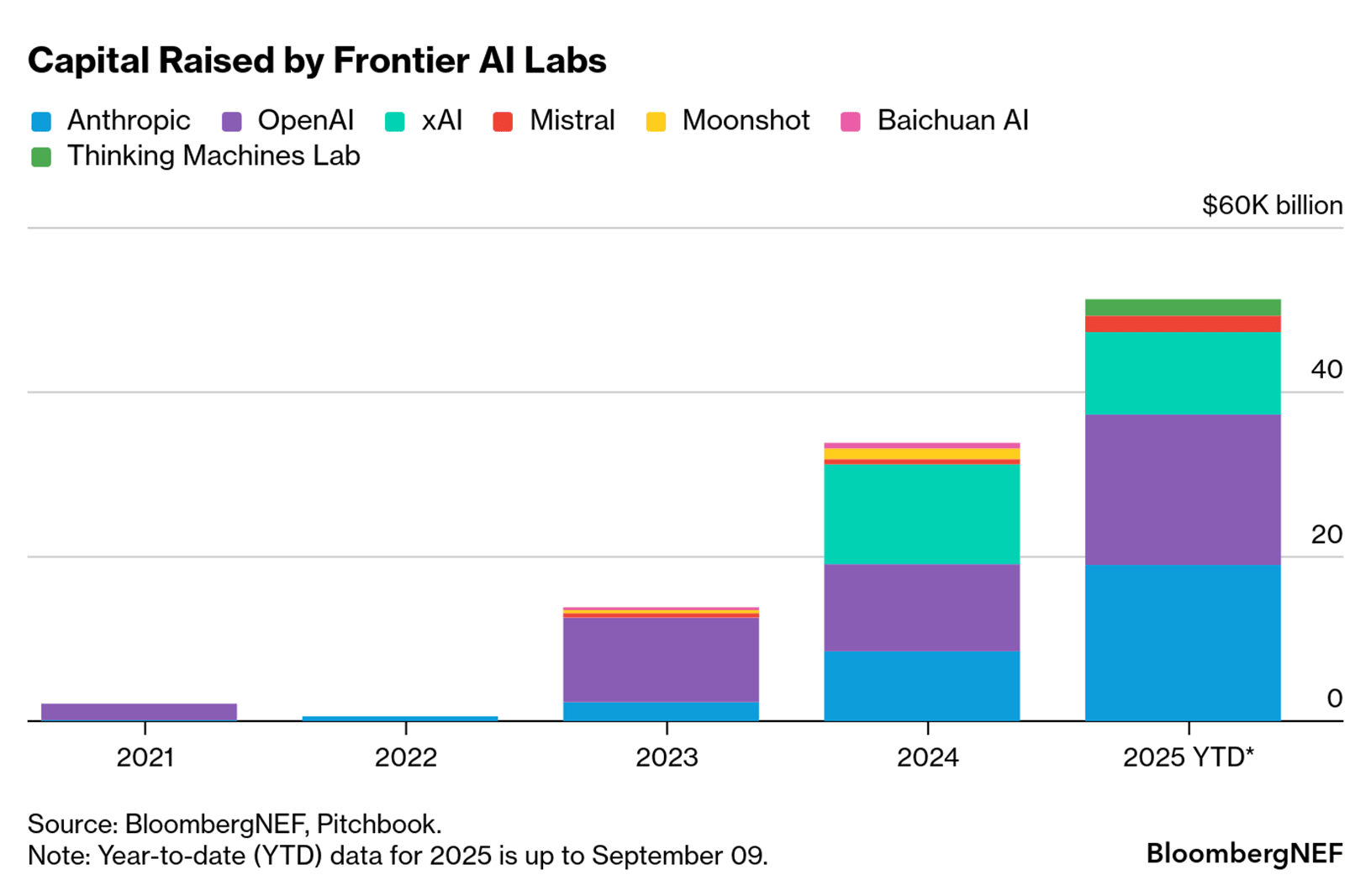

The investment appetite is enormous. BNEF’s tracking of the four cloud giants—Google, Microsoft, Amazon and Meta—shows they have tripled their capital spend on data centers to $217 billion in 2024 from $69.4 billion in 2019. As much as $82 billion in funding has been directed to just seven ‘frontier’ AI labs over the past five years. Capital-market access is critical for the next wave of AI and hyperscale data centers.

3. A turning point for the auto sector: Global strength, US uncertainty

The global EV market continues to expand, with sales estimated to have risen 22% in 2025. Innovation remains strong across the industry: automakers are launching a wide range of EV technologies—including plug-in hybrids, range-extender vehicles and battery-electric models—while battery prices fell another 8% last year. New chemistries such as solid-state and sodium-ion batteries are now moving into commercialization, creating further opportunities for growth in 2026.

Against this global momentum, the US presents a contrasting picture with federal policy shifts slowing progress and substantially increasing market uncertainty. Infrastructure gaps and divergent state-level approaches are reinforcing an uneven and fragmented transition, clouding the sector’s long-term outlook in the US.

One key blow to was the removal of the $7,500 per-vehicle EV tax credits at the end of September 2025, which triggered a last-minute surge in purchases followed by a hangover in the final months of 2025. Where EV demand will ultimately settle once the tax credit will likely become apparent later this year. Even so, the US remains an important market to watch as it enters this new phase. In the absence of strong policy support, automakers will need to offer compelling models and attractive price points to bring consumers on board.

BNEF Subscribers can access additional analysis on the topics covered in this article:

Electric Vehicle Market Outlook 4Q 2025: Ups and Downs

Data Center Market Indicators 2H 2025: Bullish Sentiment Across the Board

Nuclear 2H 2025 Market Outlook

US Data Center Outlook 2H 2025