By Colin McKerracher, Head of Clean Transport, BloombergNEF

Sales of electric heavy trucks are taking off. The analyst team at BloombergNEF recently published a comprehensive factbook in partnership with Smart Freight Centre that digs into details on sales, policies, truckmaker strategies, technology changes and more.

Below are five key findings from the report, which is publicly available here. BNEF clients can download all the supporting data here.

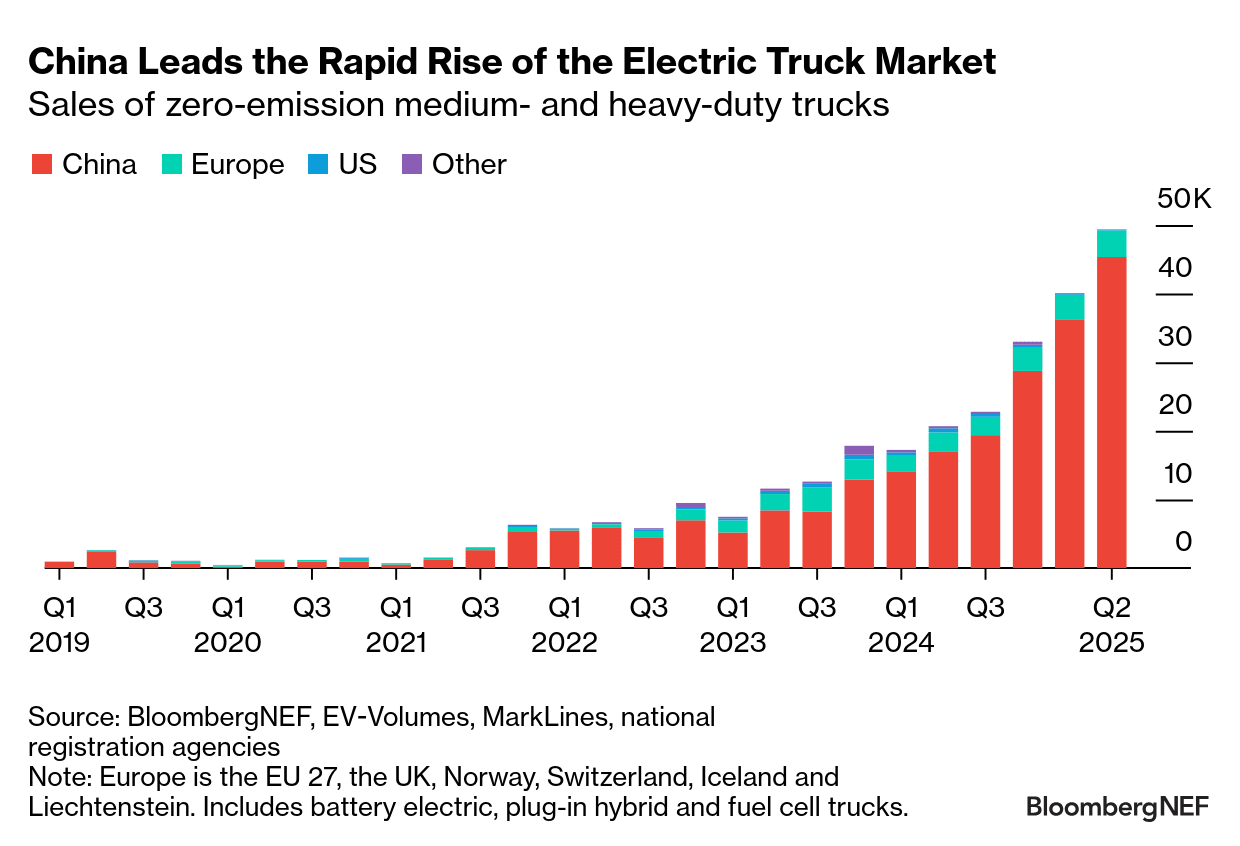

China leads, US falters

Over 89,000 electric trucks were sold in the first half of 2025, up 140% from the same period last year. China accounted for almost 80,000 of those, with sales in Europe making up most of the balance. US sales shrunk to just 200 units.

The global heavy truck market is about five years behind passenger cars in terms of EV adoption. It’s a harder market to crack for many reasons, including demanding duty cycles, thin margins and uncertainty with regard to residual values. Many of those concerns are steadily being addressed by better and cheaper batteries, more dedicated charging infrastructure and more operating experience from fleets.

About 4% of global heavy and medium segment truck sales will be electric this year, but in China that figure will be around 14%. Some European markets are heading even higher. Gasoline demand has already peaked in quite a few countries, but many considered diesel to be a safe growth area for years to come. If electric truck sales stay on their steady upward trajectory, that assumption won’t hold for long.

Cities step up

Policy support for electric trucking is strengthening in some markets and faltering in others. China has increasingly stringent truck-efficiency standards in place, along with a host of incentives for purchases and charging infrastructure, plus scrappage schemes for older trucks.

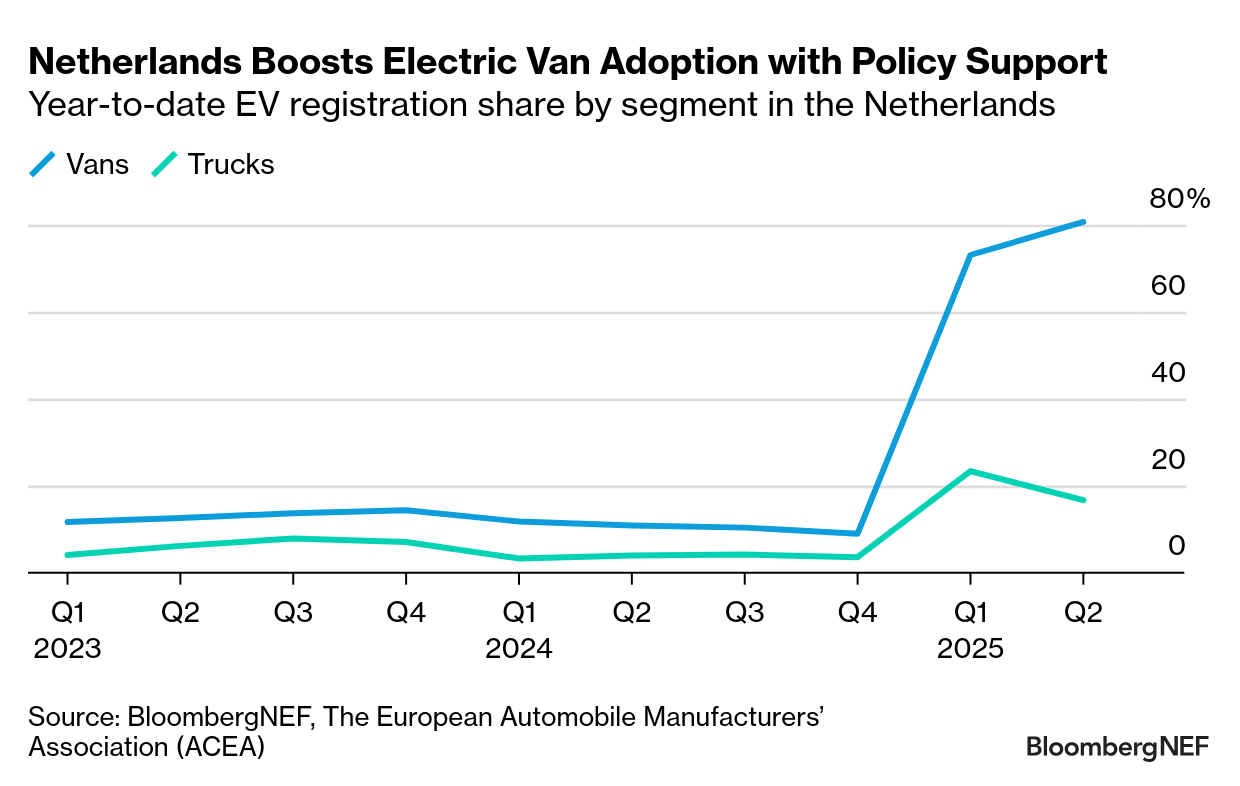

In Europe, truck CO2 emissions targets came into effect in 2025 and are set to drive much higher levels of EV adoption. While these standards remain in place, the European Commission has relaxed compliance requirements of similar targets for cars and vans, so something similar could happen in the trucking market. In the US, regulatory changes are already slowing down the market.

City policies are playing a growing role. Electric commercial van purchases skyrocketed in the Netherlands to reach more than 80% of sales in the first half of this year, the highest globally, after the government allowed municipalities to designate urban zero-emissions zones. So far, 18 cities, including Amsterdam, The Hague and Eindhoven, have introduced such zones, with 11 more in planning.

Long-haul electric trucking is here

Most electric heavy trucks are still running in urban and shorter regional duty cycles, but that is starting to shift. New long-haul truck models are hitting the market from Volvo, MAN, Mercedes-Benz and others.

Alongside the Tesla Semi, these are the first models outside of China entering series-production that are technically capable for operation in heavy-duty, long-haul duty cycles. While that was previously a very hard use case to address, these vehicle are now making their way onto roads with buyers including logistics and consumer product companies.

The energy efficiency of these vehicles can be 2-3 times better than that of diesel equivalents as the economics can already be attractive in areas with high fuel prices or low electricity costs. Most long-haul models come equipped with mega-watt scale charging capability, and more dedicated truck charging stations are starting to come online.

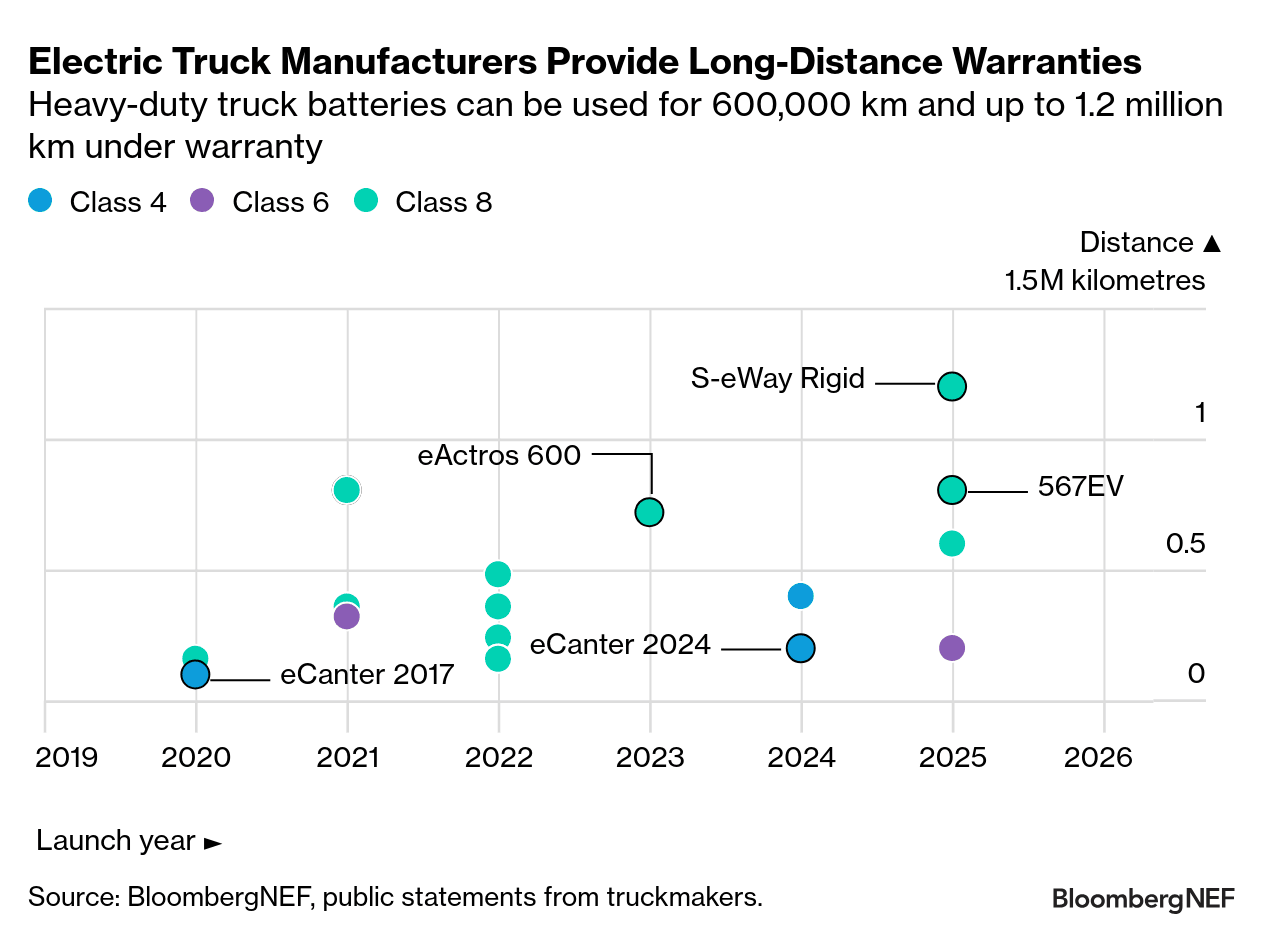

Battery warranties are getting longer

Uncertainty about the longevity of batteries has been a challenge for electric trucks, leading to concern about residual values and higher financing costs. As truckmakers get more confident in the technology, battery warranty periods are steadily rising.

Long-haul models like the Mercedes-Benz eActros 600 now offer a battery warranty of more than 700,000 kilometers, while Iveco offers one at 1.2 million kilometers (750,000 miles). Some warranties have doubled with the latest iteration truck models. Longer battery warranties will help reduce depreciation rates for electric trucks, which have been high for some early offerings.

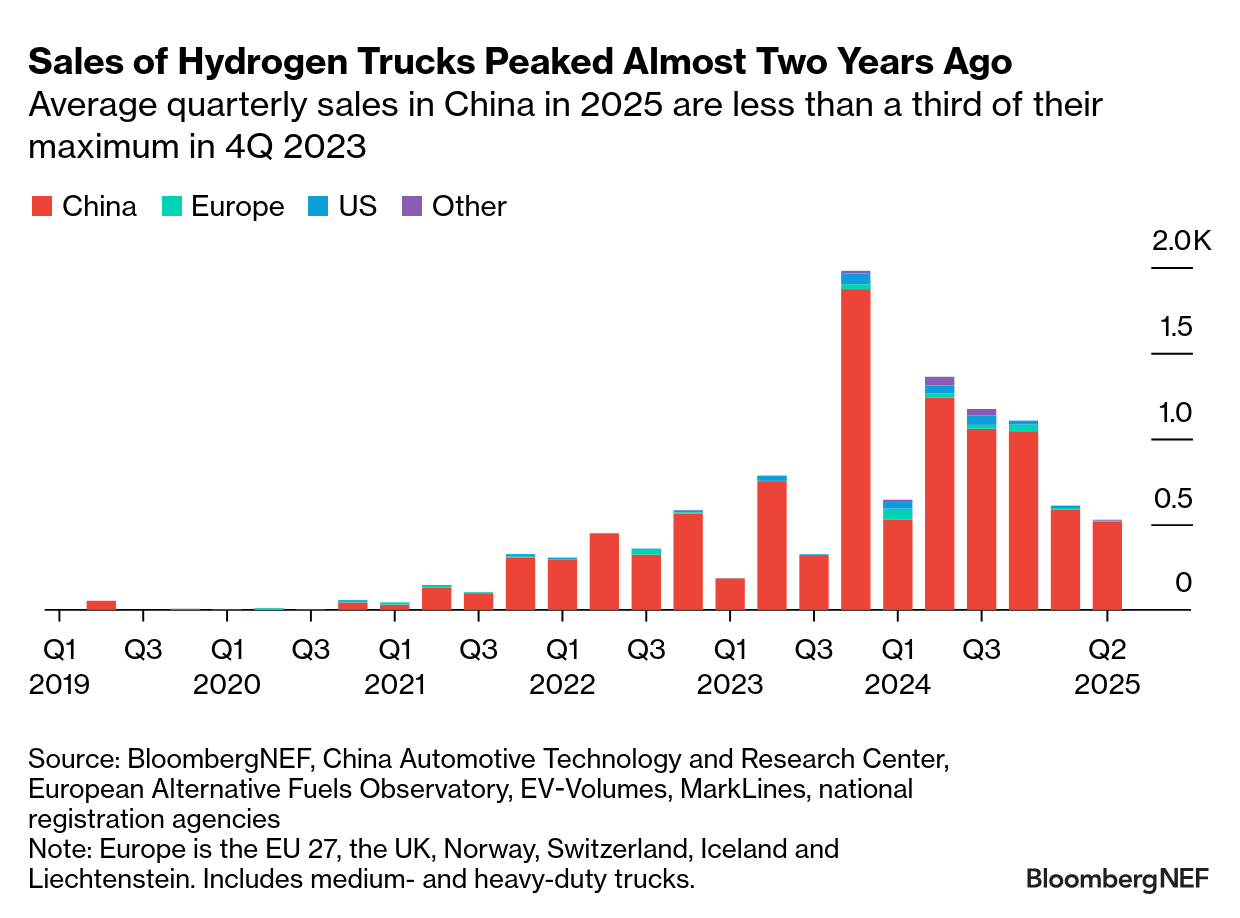

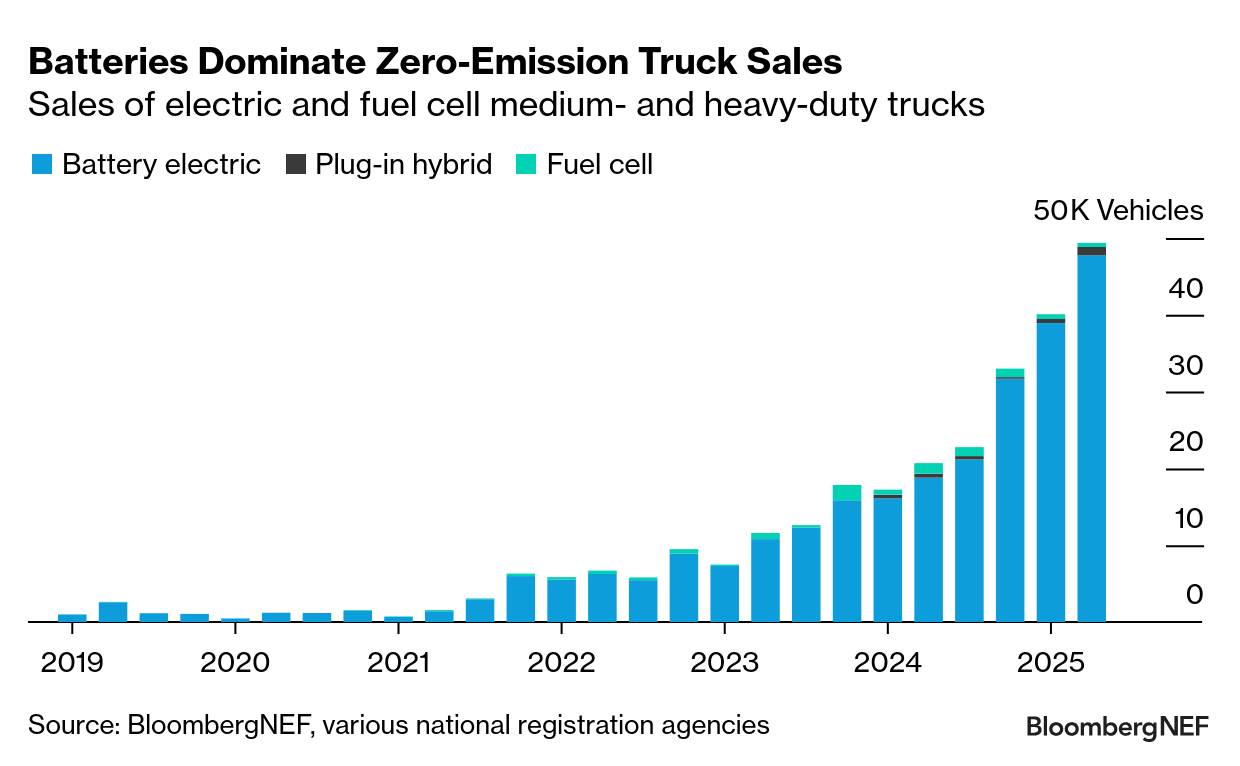

Fuel cell truck sales are in freefall

After losing the car market, many proponents of fuel cell vehicles pinned their hopes on heavy trucks as the application where hydrogen would shine. That storyline has lost its luster, with fuel cell truck sales plummeting and a wave of bankruptcies sweeping the sector, from Nikola to Hyzon Motors and others. Electric medium and heavy trucks now outsell their fuel cell counterparts by nearly 100 to 1.

The prospects for hydrogen in road transport look dim. Cost for both vehicles and fuel remain high, infrastructure is challenging, buyers seem uninterested and generous government subsidies won’t last forever. Technology neutrality is good policy, but at some point, the market decides what is going to work. Once that happens, it’s best to get out of the way.