By Colin McKerracher, Head of Clean Transport, BloombergNEF

Last week, my BloombergNEF colleague Siong-Hu Wong published a comparison of EV adoption outlooks from major groups including the International Energy Agency, US Energy Information Administration, Organization of the Petroleum Exporting Countries and others.

Unsurprisingly, OPEC still has the most bullish view on the future of the internal combustion engine. It sees the global passenger vehicle fleet rising from 1.4 billion today to 2.3 billion by 2050, with the majority of these still powered by gasoline.

For a decade, BNEF has pushed back against these oil-led narratives in our annual Electric Vehicle Outlook, which looks at how declining battery costs will impact EV prices and adoption around the world. This approach has proved helpful, as rapid EV uptake wrong-footed many analysts and outlooks.

For example, OPEC’s 2015 World Oil Outlook expected a total of 4.7 million battery-electric vehicles on the road globally in 2040 and 41 million plug-in hybrids. That figure for full electrics was hit at the beginning of 2020, a remarkable 20 years earlier than OPEC anticipated. By the end of this year, BNEF estimates there will be 78 million plug-in passenger vehicles on the road globally, about 6% of the total.

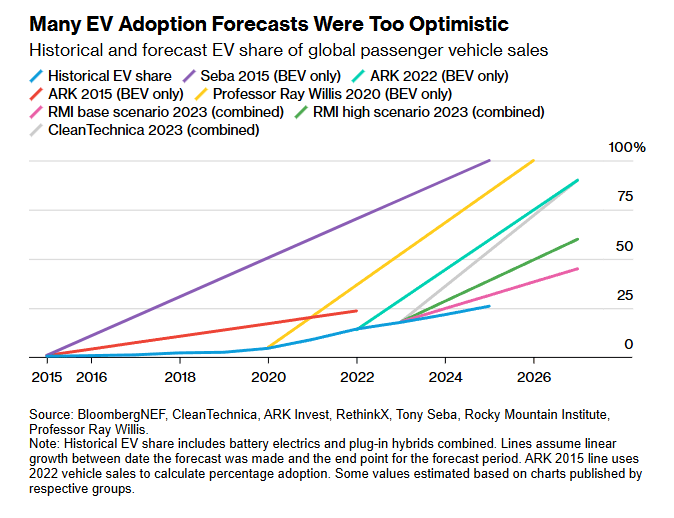

So those forecasts were wrong. But as we get into the second half of 2025, it’s worth recognizing that the optimistic EV adoption forecasts were also off the mark. Over the last decade, a steady stream of forecasters offered rosy views on EV adoption that simply haven’t come to pass. Worse, many of them were never revisited, leaving lessons unlearned.

In 2015, Cathie Wood’s Ark Invest forecast that sales of battery-electric vehicles would hit 17 million by 2022. The actual number was under 8 million. Ark updated their outlook in 2022 to state that sales of battery-electrics would hit 40 million by 2026, and that by 2027, 90% of vehicle sales could be electric. That’s now just two years away, and the 2025 number is likely to come in around 25% for both battery-electrics and plug-in hybrids combined.

Clean-energy publication CleanTechnica put out a number of similar forecasts. One, under the headline “2027 The Year It is Over For ICE Vehicles,” predicted that EV sales would hit 40 million by 2025, followed by 60 million in 2026, before dominating global car sales in 2027. Another forecast from CleanTechnica had a conservative scenario of around 34 million EVs sold in 2025 and an optimistic one of 46 million. Actual sales this year will be around 22 million, including both battery-electrics and plug-in hybrids.

On X, formerly Twitter, even more extreme forecasts have proliferated, with groups and individuals stating that combustion engine vehicle sales would be fully eliminated by 2026. Tony Seba, an author with think tank RethinkX, proclaimed that by 2025, all new vehicles sold will be electric.

There are lessons in all this.

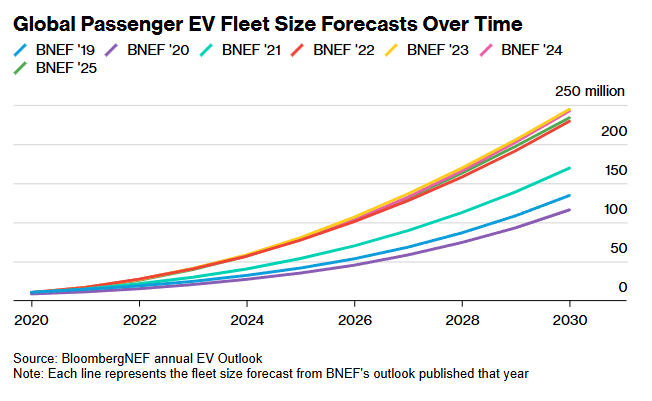

Firstly, forecasts need to be revisited to be useful. BNEF has changed its forecast over the years, first increasing it, then most recently decreasing it primarily due to policy changes in the US. Each year, we include a section in our outlook on what has changed from the previous year, and every year we publish a comparison showing how our outlook has changed over time.

In the US, for example, we’ve noticed that while battery prices have fallen faster than expected, adoption outside of California has generally been slower than we thought it would be. Consumers want more range and power than we originally thought, with 300 miles (483 kilometers) and up quickly becoming the new benchmark. Getting that kind of range for a full-size pickup means very big battery packs, pushing out price parity and, critically, profitability for models in that segment.

Cutting the other way, BNEF’s early outlooks projected that China’s EV demand would remain policy-led until 2025. Instead, organic consumer demand took over around 2022.

Secondly, be careful with short term extrapolation from early growth rates. Many of the optimistic forecasts came during the Covid-19 pandemic, when EV sales soared in some countries due to a combination of policy support, new models, stimulus spending, low interest rates and increased disposable income for white-collar workers.

Annual growth rates tend to slow as industries mature, and the EV market has been no different. When there’s an exponential growth curve forming, asking how much longer it can last is usually a more helpful response than jumping directly to the assumed disruption that comes if it continues. Most exponential growth stories don’t hold for long.

Thirdly, understanding how policy impacts both supply and demand factors is critical. European countries saw a spike in EV sales in 2020 and 2021 as vehicle CO2 regulations tightened. Observers who were less familiar with the five-year cycle of these regulations assumed that growth would continue and ended up with wildly optimistic numbers as a result. In practice, sales growth slowed from the period of 2022 through 2024, and is now rising as emissions-reduction targets are made tougher again. For the EV market, policy still really matters.

Finally, when forecasts vary widely, it’s often safe to discard the extremes — they’re usually self-serving in some way.

That’s certainly true for the EV sector. Auto sales represent a $2.5 trillion market, and we’re now in the messy middle of the transition. That means steps forward and back, even if the end destination is clear.