Executive Summary

Commodity markets have had a turbulent year with sanctions, wars and new administrations rewiring markets. As 2026 begins, the following numbers are a snapshot of what the BloombergNEF Commodities, Energy and Environmental Markets teams think will be the most important topics to watch.

- +0.5°C The Niño 3.4 temperature anomaly for June–August 2026

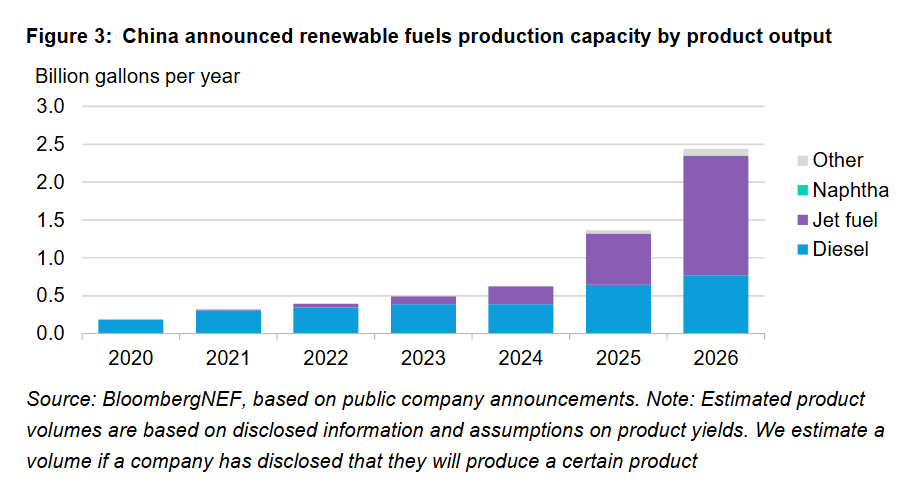

- 1.07 billion gallons Renewable fuels production capacity announced in China for 2026

- ¥11.4 per kilowatt-hour Average baseload Japan power price for 2026

- Metals – 1 million metric tons. The copper supply and demand balance swings by 1 million metric tons into a deficit, as data centers and electric vehicles drive demand.

- Japan power – ¥11.4 per kilowatt-hour. Japan’s average baseload power price in 2026 signals relief now, volatility ahead.

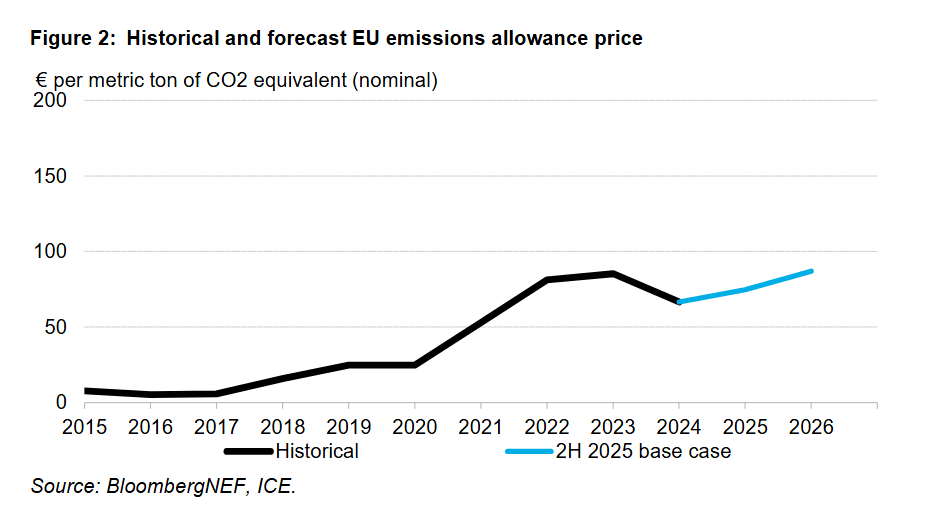

- EU carbon – €87 per ton. European Union carbon prices rise as allowance supply tightens sharply.

- LNG – 29 million metric tons. New supply capacity to come online in 2026.

- Renewable fuels – 1.07 billion gallons. China adds a record amount of new renewable fuel production capacity, reordering global markets.

- Petrochemicals – 15.6 million metric tons. A new ethylene capacity buildout deepens oversupply and pressures European assets.

- Weather – +0.5°C. A Niño forecast poses questions over La Niña winter expectations and natural gas demand.

- US power – 48.3 gigawatts. Power demand from data centers to reach this figure, pushing electricity grids toward reliability limits.

- US gas – $3.90 per million British thermal unit. The marginal supply cost for Haynesville, Texas, dry gas – a key driver of US natural gas supply growth given its proximity to LNG terminals.

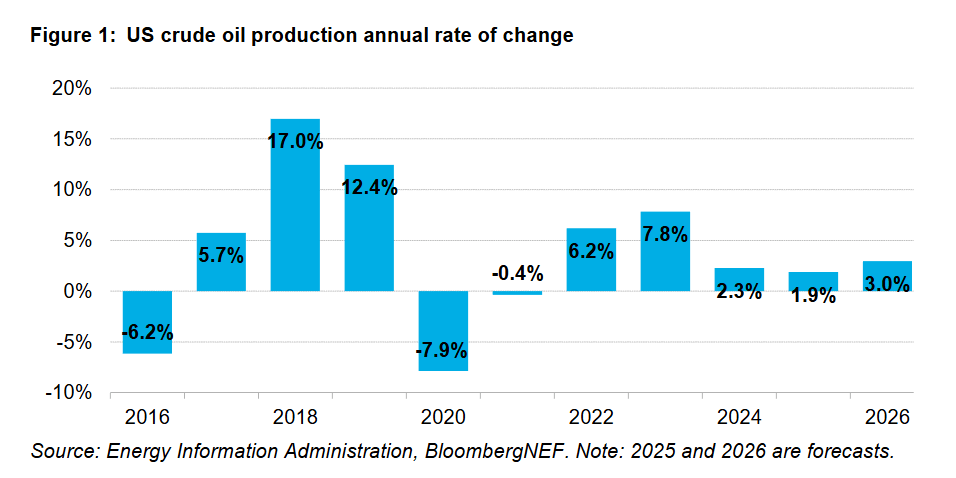

- Oil – 13.8 million barrels per day. US oil production growth slows to 3% year-on-year as a 2026 global oil supply glut pressures prices.

Metals – The copper balance swings by 1 million tons into deficit

Copper demand continued to grow in 2025, driven by energy-transition requirements originating in the transportation sector, as well as emerging demand from data centers. The market enters into a deficit in 2026. Copper supply faces acute long-term pressure, as a boom in copper-intensive data centers coincides with mine disruptions and slow permitting.

A tight copper market in 2026 signals higher price risk and potential supply-chain constraints for electrification projects. The proliferation of EVs, the expansion of grids and the manufacturing of batteries could face cost inflation or delays.

Japan power – Average baseload power price for 2026 will fall to ¥11.4 per kilowatt-hour

Japan’s power prices are set to trend downward over the next five years as flat demand meets supply growth. BNEF expects Japan’s power prices to average ¥11.4 per kilowatt-hour in the coming year, a 5.1% drop from 2025. Japan’s declining average power prices may relieve industrial cost pressures but will challenge merchant generators.

However, structural shifts – such as aging fossil fuel generators being displaced by nuclear and renewable generation, along with hotter, prolonged summers – could still create sharp peaks and stress the power system.

EU carbon – Carbon price hits €87 per ton

Prices in the European Union’s Emissions Trading System will rise 16% in 2026 to €87 per ton. This is primarily due to a 21% drop in allowance supply – the result of a downward revision on free allocation benchmarks, the phase-in of the levy for the Carbon Border Adjustment Mechanism and shipping allowance cancellations. A tighter allowance market will raise compliance costs for heavy industry and power producers, increasing the incentive for fuel switching, efficiency measures and early decarbonization.

LNG supply – 29 million metric tons of new capacity to come online in 2026

The global LNG market is headed for a glut in supply, with new production capacity slated to commission from the US, Qatar, Australia, Mexico and Africa in 2026. About 8 million tons of export capacity is expected online from the major Qatari North Field Expansion project, and the Golden Pass LNG project in Texas adds two out of three production trains in 2026 – at 5.2 million tons capacity each.

The level of supply entering the market will depend on the commissioning timelines and ramp-up schedules set by the operators. Much of this new capacity is not directly tied to long-term LNG contracts and could find its way into the spot market, putting downward pressure on prices –already reflected in the forward curves for the European gas benchmark price and the Asian spot LNG price marker in coming years.

Renewable fuels – 1.07 billion gallons per year of new renewable fuels production capacity announced for China

China’s 15th five-year plan, to be announced in March, is widely expected to introduce a sustainable aviation fuel (SAF) blending target. As the market evolves from pilot programs to mandated consumption levels, the volume of announced production capacity targeted to come online in 2026 has hit a high over 1 billion gallons per year, almost half of all global additions announced in the year ahead.

China’s move toward a national SAF mandate positions it to dominate global renewable-fuel manufacturing capacity. This could shift supply chains, lower SAF costs globally, and intensify competitive pressure on Western producers.

Petrochemicals – 15.6 million metric tons per year of new ethylene production nameplate capacity

China’s rapid capacity expansion has cut into its imports, redirecting them to Europe and squeezing the region’s older and smaller assets that were already struggling with high costs and thin margins. The strain has triggered a wave of closures, the latest being Exxon Mobil Corp.’s 800,000 metric tons per year ethylene plant in Fife, Scotland. A massive wave of new Chinese-led ethylene supply will deepen global oversupply, pressure margins and accelerate closures in Europe. Petrochemical producers outside China face heightened competitiveness challenges.

Weather – +0.5°C temperature anomaly in summer

The US National Center for Environmental Prediction’s Climate Forecast System Version 2 (CSFv2) forecast puts the Niño 3.4 temperature anomaly at +0.5°C for June–August 2026. That suggests that La Niña may linger into early next year before easing toward neutral or even El Niño territory.

If this shift happens earlier than forecast, expectations for a cold La Niña winter could fade. That would reduce US heating degree days and leave natural gas supplies more comfortable by the end of winter.

US power – Power demand from data centers to reach 48.3GW

The rapid expansion of the US data center fleet will lead to a 7.7GW jump in average power demand from the sector in 2026.

Analysis of key power market regions like PJM Interconnection and the Electric Reliability Council of Texas (Ercot) indicates that grid tipping points are already emerging, as planned power supply fails to keep pace with accelerating data-center growth.

Data centers are now a system-wide driver of grid stress. Major markets may face capacity shortfalls unless generation and transmission expansions accelerate, increasing reliability and pricing risk.

US gas – $3.90/MMBtu marginal supply cost for Haynesville, Texas, dry gas

The US needs to unlock more gas supply to feed a growing number of LNG export terminals along the Gulf Coast and support data centers’ rising power demand. The Haynesville shale basin is expected to be a key driver of US natural gas supply growth in the medium term, given its proximity to LNG terminals and pipeline constraints limiting growth in other regions. BNEF’s latest breakeven cost estimates place the Texas-side of Haynesville as the marginal gas producing region. US Henry Hub gas price futures for 2026, as of Dec. 15, were trading at an average of $3.86/MMBtu – just below BNEF’s marginal gas production cost estimate. Maintaining supply growth to meet rising demand may require higher US gas prices or further improvements in well productivity, drilling and completion costs.

Oil – 13.8 million barrels per day of US oil output

The rapid increase in US oil production is coming to an end as investors prefer capital discipline over output growth, and a crude glut looms in 2026. Global crude oil supply is set to comfortably outpace demand in 2026, sending balances into surplus and weighing on prices. Those lower prices will discourage US oil producers from raising output.