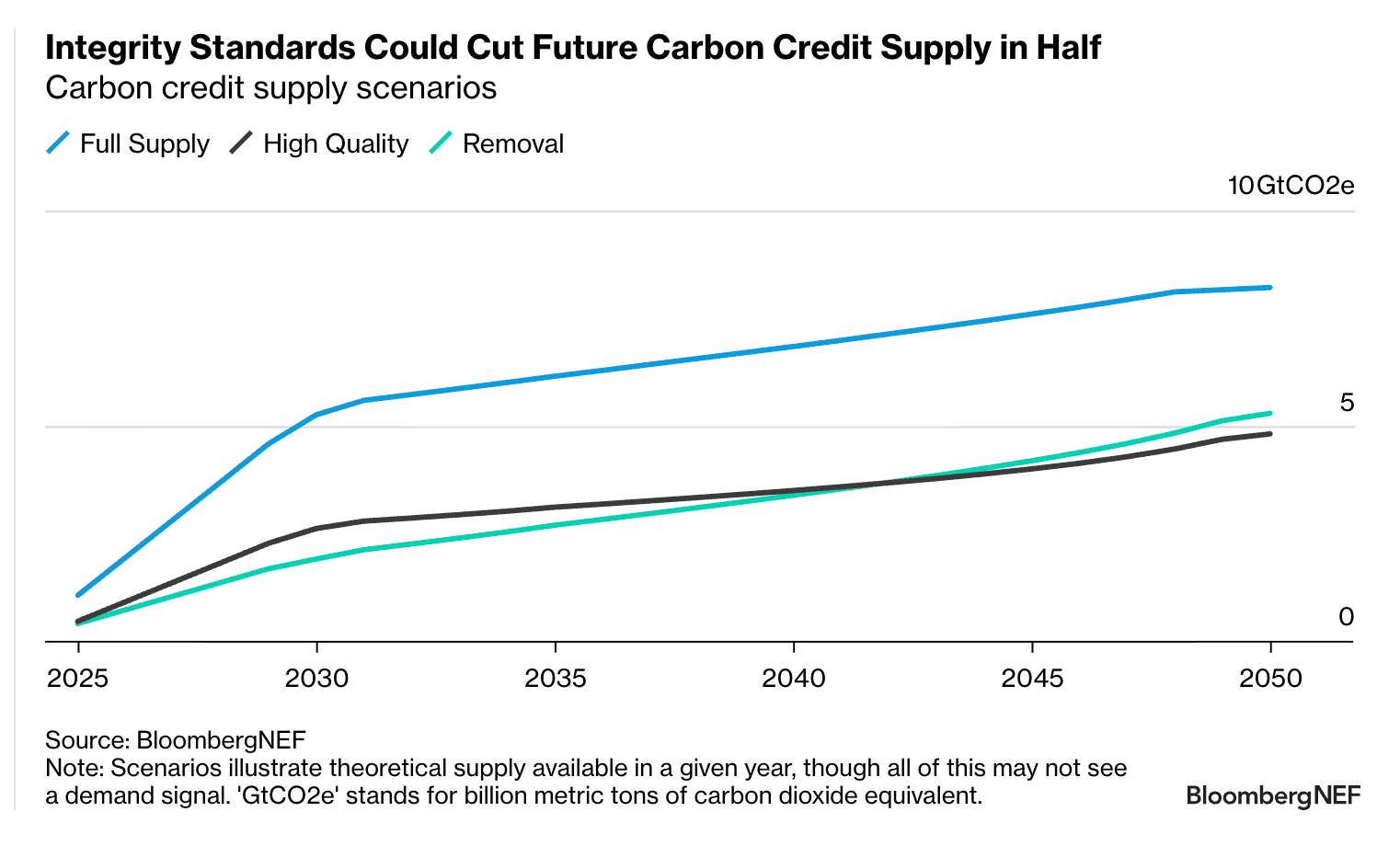

Global carbon credit supply could grow 20- to 35-fold by 2050 from today’s levels, catalyzed by a market reset already underway that focuses on integrity and impact. While this long-term growth is likely, as carbon credits will allow compliance with a range of regulated and unregulated markets, the winners from the reset could range from nature-based solutions to technology-based carbon removal. Average costs might rise as high as $60 per ton of CO2 equivalent in 2030 and $104/ton in 2050, based on which sectors dominate.

- BloombergNEF’s base case High Quality scenario sees theoretical carbon credit supply rising from 243 million tons in 2024 to 2.6 billion tons in 2030 and 4.8 billion tons in 2050, reflecting renewed confidence in the market following its reset underway since 2022. This would lead to a boutique market focused on a smaller pool of high-impact projects, relative to initial predictions. Direct air capture is the biggest winner, making up 21% of available supply in 2050 and driving up weighted average costs across the market to $104/ton in 2050.

- An alternative Full Supply scenario assumes the current market reset fails to shift investor sentiment, leading to more supply but less quality governance, resembling the carbon credit market seen between 2019 and 2022. Theoretical supply rises to 5.3 billion tons in 2030 and 8.2 billion tons in 2050. Avoided deforestation (REDD+) and reforestation make up two thirds of supply in 2050, with markets like Brazil and Indonesia seeing a flood of investment. Due to a surplus of low-quality credits still in circulation in this scenario, weighted average costs reach just $69/ton in 2050 and the role of technology-based carbon removal is minimized.

- An over-the-counter carbon removal market has emerged alongside the broader carbon credit market reset, with bespoke bilateral transactions growing 27-fold since 2022. Groups like the Science Based Targets initiative have pushed for this to be the main form of carbon credit supply eligible for corporate net-zero claims. Should this be the case, BNEF forecasts supply growing to 2 billion tons in 2030 and 5.3 billion in 2050. Bioenergy carbon capture and storage would be the biggest winner and weighted average costs reach $98/ton in 2050.

- BNEF modeled carbon credit supply and cost for eight sectors, which make up an estimated 86% of the market since 2016. Sectoral prevalence, countries impacted and average costs change depending on future market structure, informed by ongoing work seen today.

BloombergNEF clients can access the full analysis here.