By Yiwen Yin, Oil Markets Analyst, and Tai Liu, Oil Specialist, BloombergNEF

The protests in Iran have heightened the risks of political instability and potential US military intervention. Any disruption to Iranian crude production or exports — whether from conflict or trade restrictions — could push prices up.

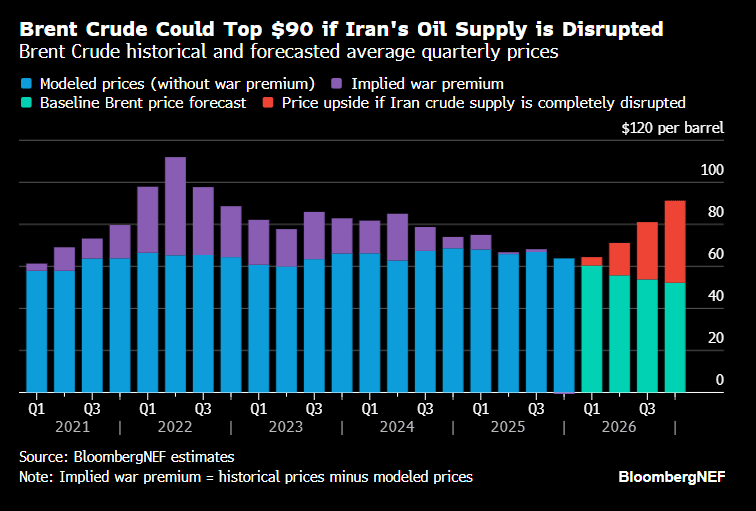

BloombergNEF estimates Brent crude to average $55 per barrel in 2026, assuming the situation in Iran does not disturb global oil markets. However, If Iran’s oil exports were completely removed from the market starting in February, an extreme scenario we currently view as unlikely, Brent could rise to an average of $71/bbl in 2Q 2026. If the disruption persisted through the rest of 2026, Brent could average $91/bbl in 4Q 2026.

Iran is the fifth largest crude oil producer in OPEC+, pumping roughly 3.3 million barrels per day. Brent crude has exceeded $66 since the protests began, trading at its highest levels since October 2025. BNEF sees only a modest war premium built into crude oil prices now, at around $4 a barrel.

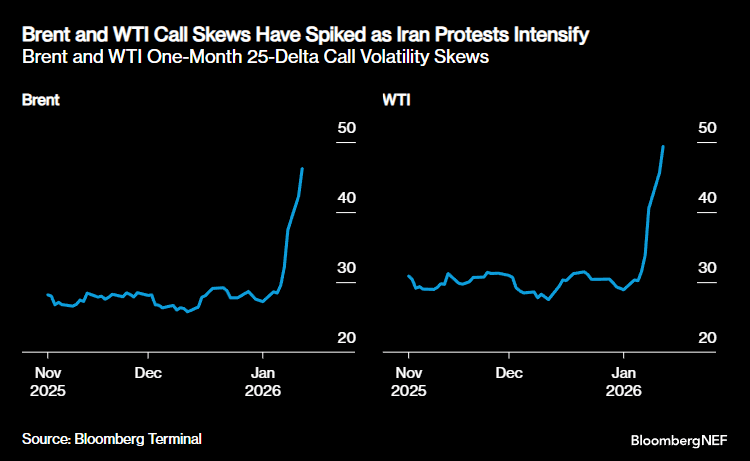

Since the protests in Iran began on December 28, 2025, price signals from the crude oil options market have indicated upside risks to prices. Brent and WTI one-month call skews spiked in early January, with Brent call skews growing by nearly 19 points and WTI call skews growing over 20 points since the start of 2026 through January 13. Market volatility intensified after US President Donald Trump announced, on January 12, a 25% tariff on goods from countries doing business with Iran, posting on social media that it would be “effective immediately”.

If the situation in Iran escalates, additional conflict or trade policies may result in disruptions to the country’s crude supplies leading to price upsides reminiscent of past war-related premiums.

Brent’s war risk premium

External shock events typically have large impacts on short-term crude prices. During the Russian-Ukraine war, we observed a “war premium” that started creeping into crude oil prices as early as 2021, when Russia began building up its military along its shared border with Ukraine. BNEF estimates Brent’s implied war premium was $31 a barrel immediately following Russia’s invasion of Ukraine on February 24, 2022. The war premium rose as high as $47 a barrel in 2Q 2022, when Europe imposed a series of sanctions and bans on Russian oil. The war premium has since tapered off, as Russian oil has managed to find its way to buyers. By year-end 2025 there was little, if any, war-premium observed in prices.

Only a modest war premium is built into crude oil prices currently. If the Iran situation deteriorates and risk of oil flow interruption increases, it would start to rise.

However, context is important. For one, Iran produces fewer barrels compared to Russia, so whatever impact it has on oil flows should be smaller compared to what was feared in Russia. Second, the crude market is amply supplied in the near-term. BNEF is forecasting supply will outpace demand by an average of 3.2 million barrels per day in 2026. The crude oil market should be able to withstand oil flow interruptions to some extent, depending on the size of the disruption.

Despite the projected supply glut, a complete removal of Iranian crude from global markets, though unlikely, could flip the outlook to a potential supply deficit in 2026, even as OPEC+ continues to hike production quotas.

The outlier event would be a blockage of the Strait of Hormuz, which borders Iran. Approximately 20 million barrels per day of oil transversed the narrow seaway in 2024, or roughly 20% of global petroleum liquids consumption. If this choke point is somehow impeded or blockaded, crude oil war premiums would surge.

Trump’s announcement of a 25% tariff on Iran’s trading partners could put China’s trade flows with Iran at risk. China is a key buyer of Iranian oil.