This article first appeared on the BNEF mobile app and the Bloomberg Terminal.

- Tianqi’s Kwinana lithium refinery has been delayed to 2022

- Ganfeng to commission 50,000 tons hydroxide plant in 2020

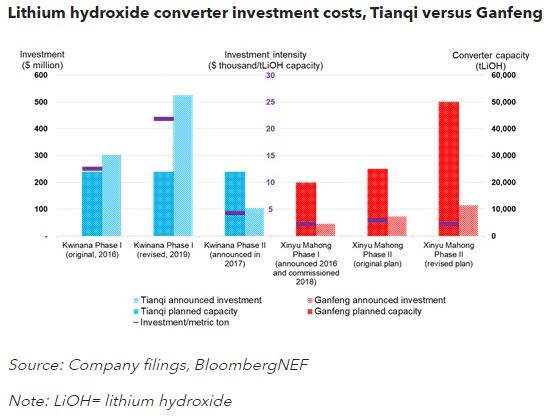

China’s Tianqi Lithium is facing cost overruns and delays at its Kwinana refinery in Australia besides struggling to repay debt. Tianqi’s investment per ton of lithium hydroxide ($/tLiOH) for Kwinana is 10 times higher than a similar converter Ganfeng developed in China.

On December 8, Tianqi announced a $1.4 billion deal with IGO Ltd. The deal will provide $200 million to finish Kwinana Phase I by 2022, four years behind schedule. Originally announced in 2016, Phase I (24,000t LiOH) was to cost $299 million and commission by 2018. In 2019, Tianqi increased investment to $525 million and postponed it to 2020. By August 2020, Tianqi had to put Phase I on hold.

For comparison, Ganfeng’s lithium hydroxide converters in China were much cheaper. Phase I of Mahong (20,000t LiOH) was announced in 2016 at $45 million (302 million yuan) and was commissioned on schedule in 2018. Ganfeng then invested $72 million (500 million yuan) for Phase II (25,000t LiOH), which was later increased to $113 million (766 million yuan) for 50,000t LiOH.

BNEF Shorts are research excerpts available only on the BNEF mobile app and the Bloomberg Terminal, highlighting key findings from our reports. If you would like to learn more about our services, please contact us.