As winter approaches, understanding key weather phenomena is critical for managing risk in energy and commodity markets. This winter is set to be shaped by a La Niña, though its weak strength adds uncertainty to long-term temperature forecasts for the US and Europe. Broader atmospheric wind patterns, however, indicate the potential for cold snaps driven by polar vortex breakdown in both regions, which could drive up heating demand during winter storms, according to BloombergNEF’s Weather and Commodities: Winter Outlook 2025/2026.

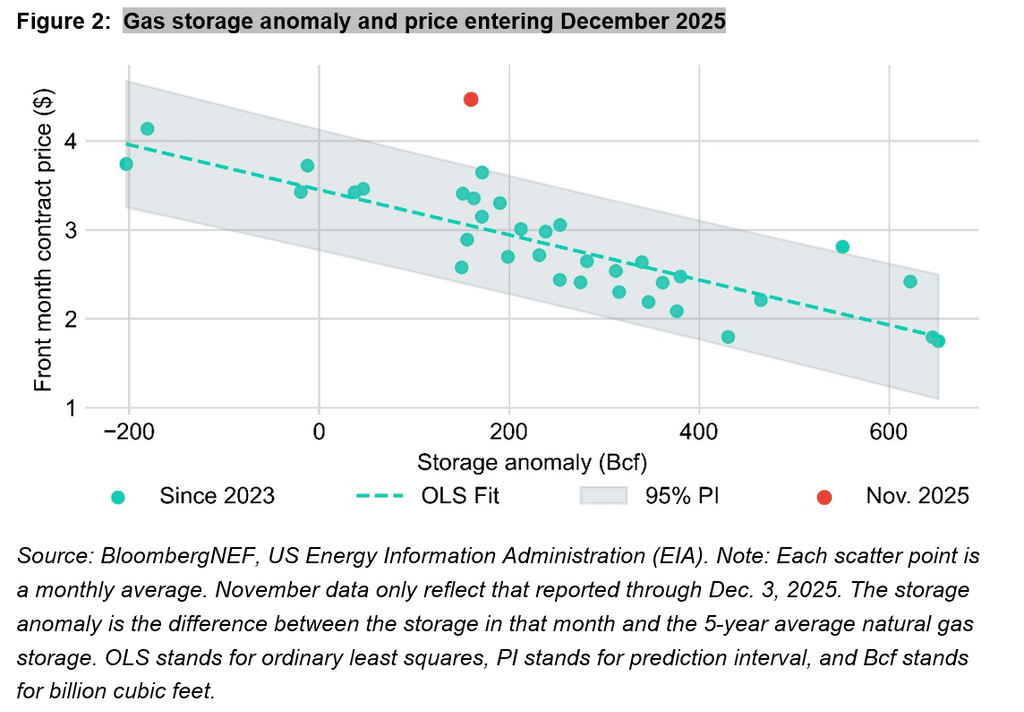

In anticipation of cold weather shaping the withdrawal season in the US, gas futures are unusually expensive at above $5 per million British thermal units at Henry Hub. This in part reflects concerns of cold snaps through December and beyond, which would spike demand and prices for gas. Curiously, price trends in Europe do not mirror those of the US; prices demarked by the Title Transfer Facility (TTF) have fallen below five-year average levels to €28 per megawatt-hour. This behavior reflects the different dynamics that govern pricing and weather risk between the two regions.

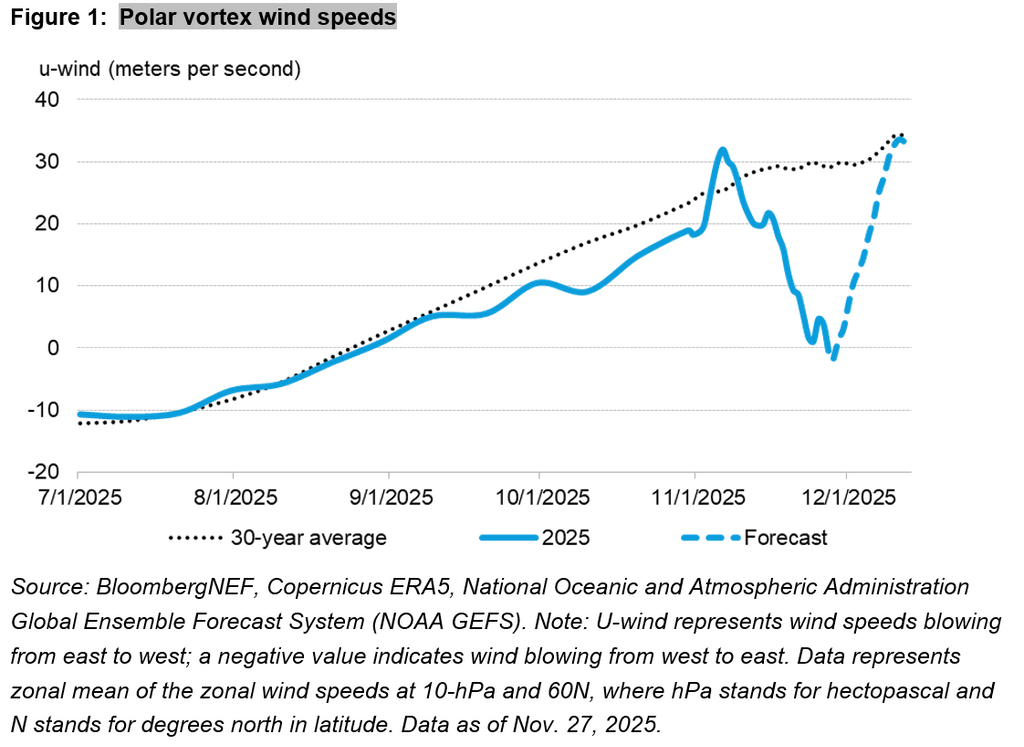

Perhaps the most critical forecast for market participants this winter is the possibility of cold-air outbreaks, which usher cold air from the Arctic deep into the continents, sharply increasing heating demand and triggering spikes in power and gas prices. One of the most prominent indicators of this phenomenon is a sudden stratospheric warming (SSW). Currently, declining stratospheric wind speeds suggest one of the earliest onsets of an SSW ever, which often occur later in the winter.

A number of factors point to the elevated risk of consecutive SSW and cold-air outbreaks. The El Niño-Southern Oscillation (ENSO) is likely to remain in a weak La Niña phase this winter, increasing the odds of an SSW and, in general, implying colder temperatures across the northern US and Europe. The Quasi-Biennial Oscillation (QBO) is in its easterly phase, which also signals a higher probability of an SSW – in this case by almost double – compared to the westerly or neutral phases.

In addition to the phases of ENSO and the QBO, Barents–Kara sea-ice is near record lows, an additional point predictor of a chilly winter. Taken together, these phenomena increase the chance that this early warming could disrupt surface temperatures, flipping both continents’ mild autumns into colder starts to winter.

Gas price fundamentals are closely tied to storage levels. In the US, when storage is above average, prices tend to fall, reflecting an oversupplied market and weaker demand. During winter, this dynamic arises when temperatures are warmer than normal, leading to reduced withdrawals of gas from storage. Since 2023, about 72% of the variance in the monthly average contract price at Henry Hub is explained by this simple heuristic. Currently, prices sit well above the expectation based on storage alone, suggesting other factors are driving prices.

At the time of writing, conditions for an SSW have emerged on top of already cold predictions for December, raising the risk of cold-air outbreaks and polar vortex conditions across the US and Europe in mid- to late-December. While this behavior was not predictable in early October when gas prices began to surge, they now amplify concerns for a chilly December, compounding elevated prices.

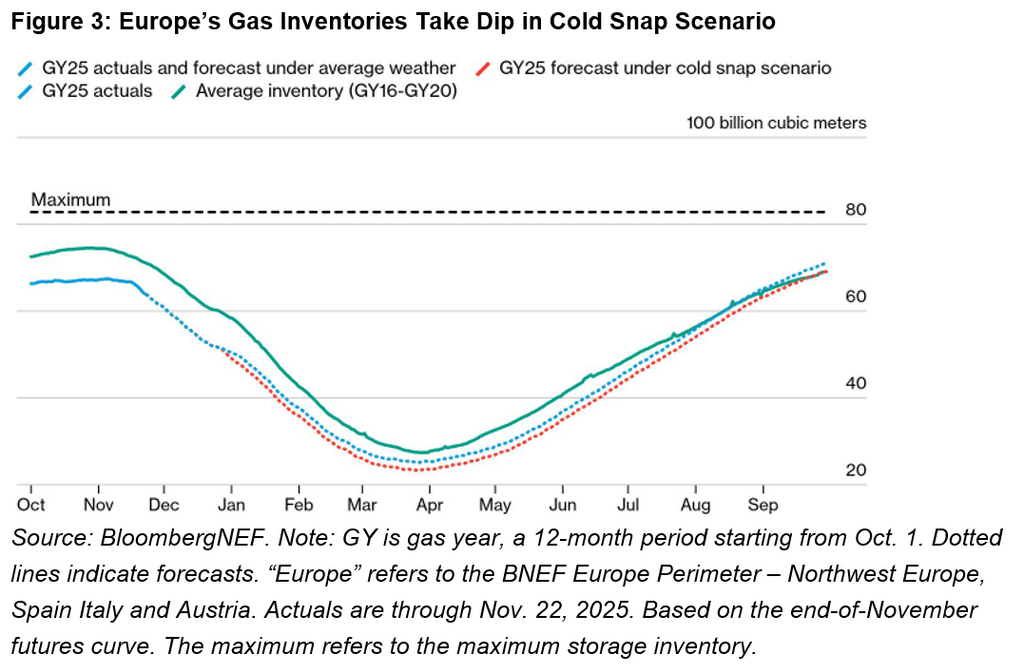

In Europe, the current SSW risk raises the possibility of a scenario akin to 2018’s “Beast from the East,” when an SSW-related cold air outbreak sent average temperatures plunging roughly 10C below the 10-year normal across northwestern Europe. This can significantly dent gas storage in Europe, pushing the market towards spot liquefied natural gas to aid gas demand.

Current TTF prices have not risen to reflect polar vortex breakdown weather risks, demonstrating a different sensitivity to weather in these markets. While cold snaps pose potential risk to European energy markets, geopolitical factors and overall market balance still exert the strongest influence on European gas prices.