Financial institutions have taken different approaches toward disclosing climate transition plans. The world’s largest banks and investment managers remain active in defining complete transition plans and even updating them – while complete disclosure among smaller institutions is lagging.

Transition plans outline companies’ strategies to achieve their climate commitments. According to new BloombergNEF research tracking over 2,000 financial institutions, 44% of the sector by market capitalization has disclosed complete transition plans across all 10 components of a best-practice framework.

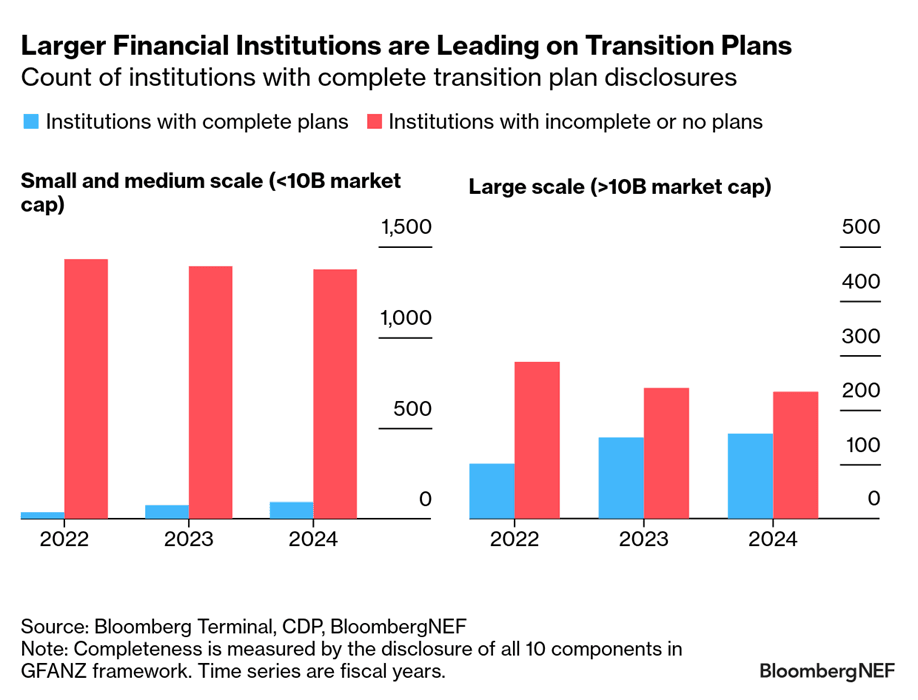

Larger institutions tend to have more complete transition plans. Among the largest financials with market caps above $10 billion, 40% by count disclosed complete plans in the last fiscal year. In contrast, only 6% of smaller institutions (under $10 billion in market capitalization) released information on all 10 components.

The results show regional differences. Close to 55% of large-scale financials domiciled in Europe and North America have complete disclosures, but those in Asia bring the average down. Half of the small-scale universe is also comprised of US domiciled institutions, where climate disclosure policies have lagged.

Institutions that have been part of net-zero alliances are more active in disclosing full transition plans: over 45% of current or past members of net-zero alliances have reported on all components, according to BNEF’s Tracking Financial Institution Climate Transition Plans 2025. Most institutions continue to make climate progress even after exiting net-zero alliances. Since February 2025, at least eight major banks updated transition plans, while six more have kept or updated targets. A comparison of BNEF’s analysis with similar transition plan studies is available in the full report appendix.

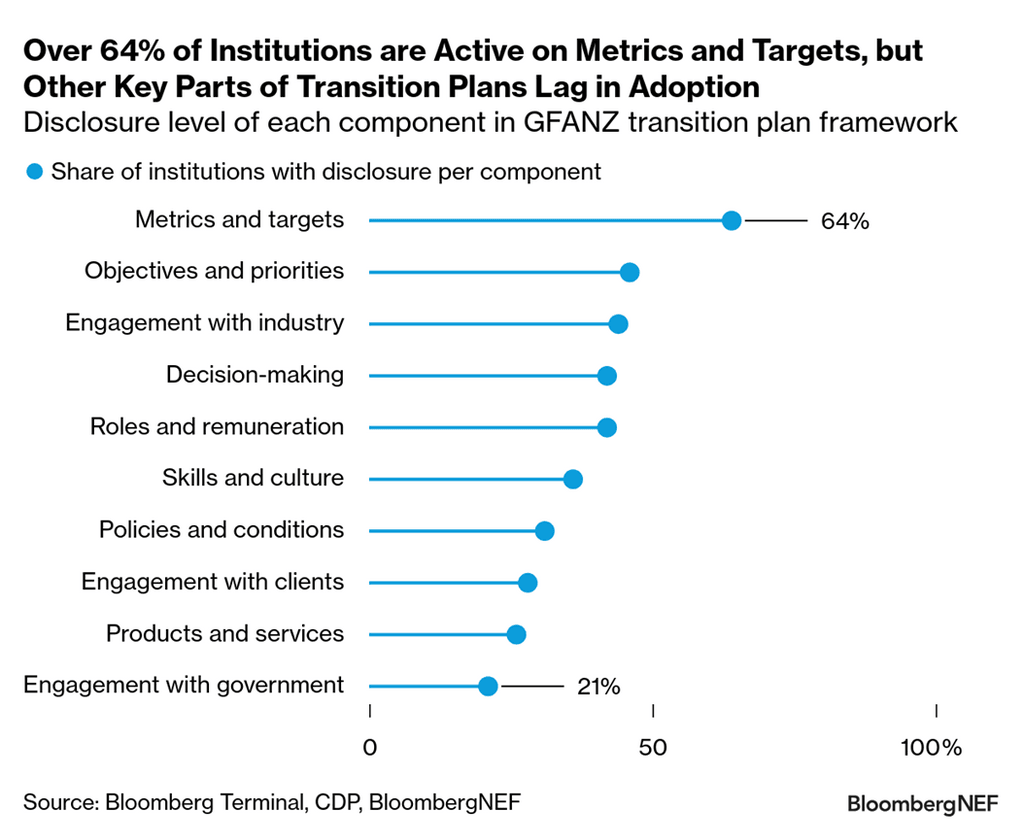

While the number of institutions with complete transition plans is relatively limited, BNEF finds that almost two-thirds (64%) report measures to monitor climate performance under the metrics and targets theme. Adoption of governance disclosures is also rising, driven by more statements on climate governance structure and linking executive compensation with climate.

Many banks and investors show their commitment and activities for net zero by participating in industry climate initiatives. Engagement with industry captures some 44% of institutions becoming members or signatories of initiatives such as the Partnership for Carbon Accounting Financials (PCAF).

Still, most institutions are behind on important aspects of a complete transition plan. Products and services, which captures lending or investing that enables positive climate impact, is the second lowest disclosed component. Though metrics and targets leads, the total drops to an equally low 28% when considering entities with forward-looking targets guiding next steps to transition, besides overall net zero.

As activity on global industry net-zero alliances wanes, progress on transition plan reporting becomes an even more important gauge on whether financials are still advancing their thinking and actions on the path to net zero.

BNEF clients can access the full report here.

Download abridged report

The report will be sent to your email after completing the form.