- BloombergNEF’s Energy Supply Fund-Enabled Capex Ratio (ESFR) is a new metric that measures climate alignment of investment portfolios, analyzing how they enable capital investment into energy supply assets.

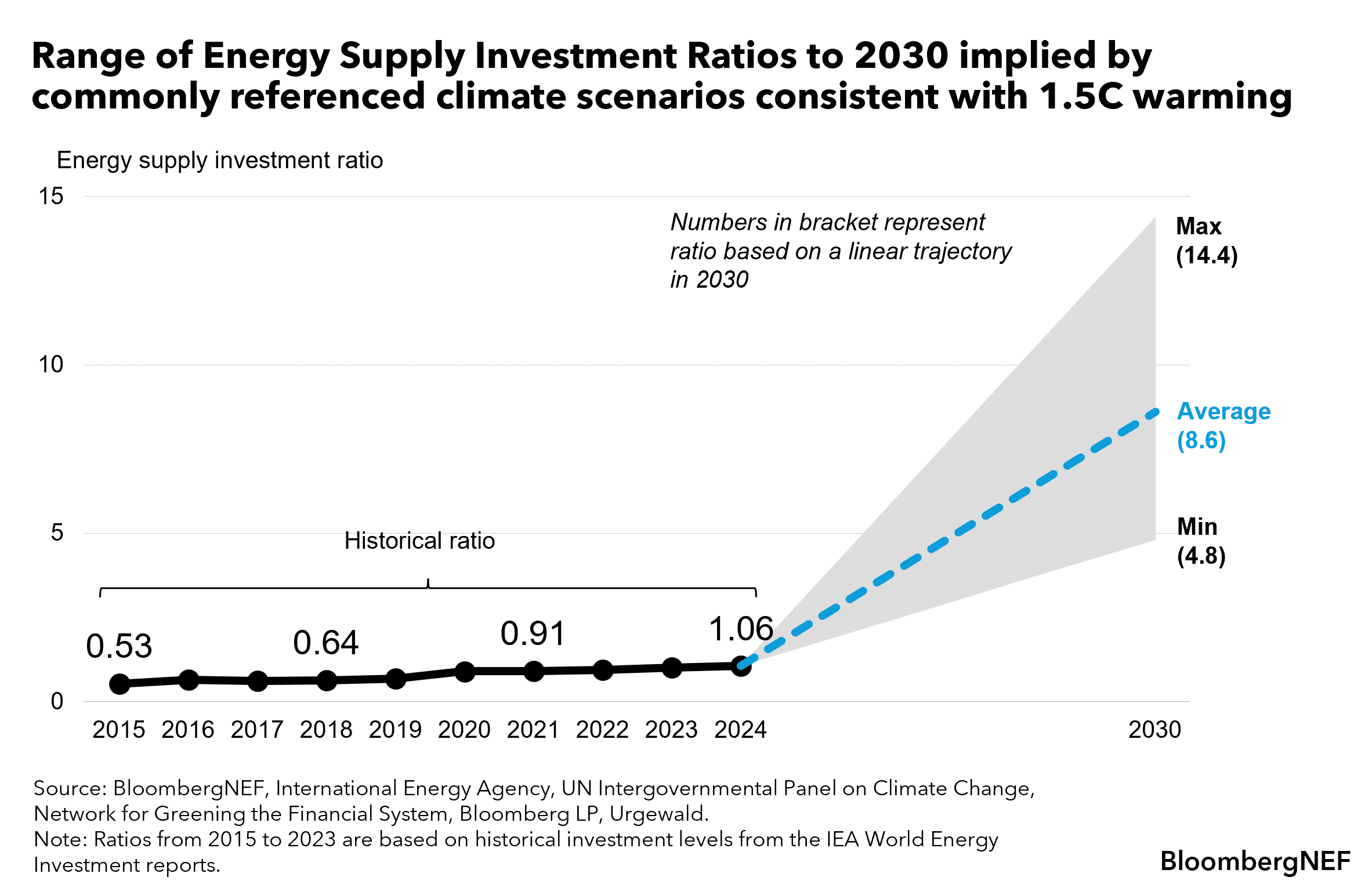

- The consolidated global ratio was 0.48 to 1 as of June 2024, for pooled investment vehicles based on available data, below the current 1.1 to 1 economy-wide investment in energy supply and the 4.8 to 1 ratio required by 2030 under 1.5-degree climate scenarios.

- Large US equity tracker funds have an ESFR below 0.5 to 1, credit funds have higher ratios at an average 0.7 to 1, while private markets have ESFRs above 1.2 to 1.

London, June 11, 2025 – Global fund managers are driving twice as much capital investment into fossil fuels as they are into low-carbon energy supply, according to new analysis by BloombergNEF (BNEF). For every $1 of capital expenditure attributed to investment funds around the world that backed oil, natural gas or coal assets, just 48 cents went into low-carbon capex, the BNEF analysis showed. The report analyzes almost 70,000 funds and introduces a new method for investors to quantify and measure climate alignment of their portfolios.

BNEF’s Energy Supply Fund-Enabled Capex Ratio (ESFR) is a new metric to measure the volume of capex enabled by funds in low-carbon assets against the proportion going to fossil fuels. It focuses on specific investment products and institutions, allowing users to gauge the impact of the fund on the energy transition.

The report finds that investment products are far from being aligned to the capital deployment needs of a net-zero economy. Of the $204 billion of corporate energy supply capex that BNEF could attribute to named investors through their pooled investment products, the global ESFR average across funds is 0.48 to 1. That is well below the 1.1 to 1 of economy-wide energy supply investment tracked by BNEF and the IEA. It is even further behind the 4.8 to 1 required by 2030 according to commonly referenced 1.5-degree climate scenarios.

Several factors contribute to the gap between the ESFR of 0.48 to 1 and the 1.1 to 1 of economy-wide energy supply investment. Oil and gas majors continue to invest heavily in fossil fuel supply and are among the most prevalent in pooled funds. In contrast, firms allocating significant capex to low-carbon energy tend to be smaller, less represented in major indices, and thus less prevalent in portfolios. Additionally, a significant share of low-carbon capex is sourced via infrastructure vehicles not captured in securities-focused funds.

The ratio works by showing how much the underlying companies in a portfolio are investing in a given year toward clean and fossil energy respectively, and then attributing those sums to funds based on the proportion of debt and equity capital the institution holds.

BNEF finds that large US funds tracking the likes of the S&P 500 have an ESFR below 0.5 to 1. Indices tracking conventional energy like the Bloomberg World Energy Index have an even lower ESFR of 0.06 to 1, owing to high percentage of constituent companies that invest heavily in fossil fuels. Credit funds, however, had higher ratios (0.7 to 1) than equity funds (0.4 to 1), and the difference is widening.

This can be explained by an increase in fossil fuel weights in equities indices as a result of oil and gas price spikes after Russia’s invasion of Ukraine and falling clean energy valuations due to higher interest rates, fund outflows and fierce industry competition. By contrast, oil majors offloading debt and low carbon firms adding leverage meant credit funds increased ratios.

Private markets, especially infrastructure funds, already play an important role in capital deployment into low-carbon energy assets. Brookfield and BlackRock (mainly through the 2024 acquisition of Global Infrastructure Partners) have ESFRs above 1.2 to 1.

“Investing in low-carbon solutions is the most important role investors can play in the energy transition. The ESFR provides a holistic, forward-looking alternative to backward-looking, one-sided metrics like financed emissions — one that incentivises capital allocation, not divestment,” said Ryan Loughead, research associate at BloombergNEF and lead author of the report. “By focusing on what portfolios enable in the real economy, the ESFR helps refocus the asset management industry on doing what it does best: investing in the infrastructure and technologies the transition urgently needs.”

An abridged version of the report is available at this link. BNEF subscribers can find the full report with institution and fund-level analysis on the client website and on the Bloomberg Terminal.

Full results of BNEF’s ESFR analysis at the fund and manager level are available on a data visualization tool on the client website here.

Media Contact(s)

For further information, please contact our media team.

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.