By Ryan Loughead, Senior Associate, Finance and Investment Research, BloombergNEF

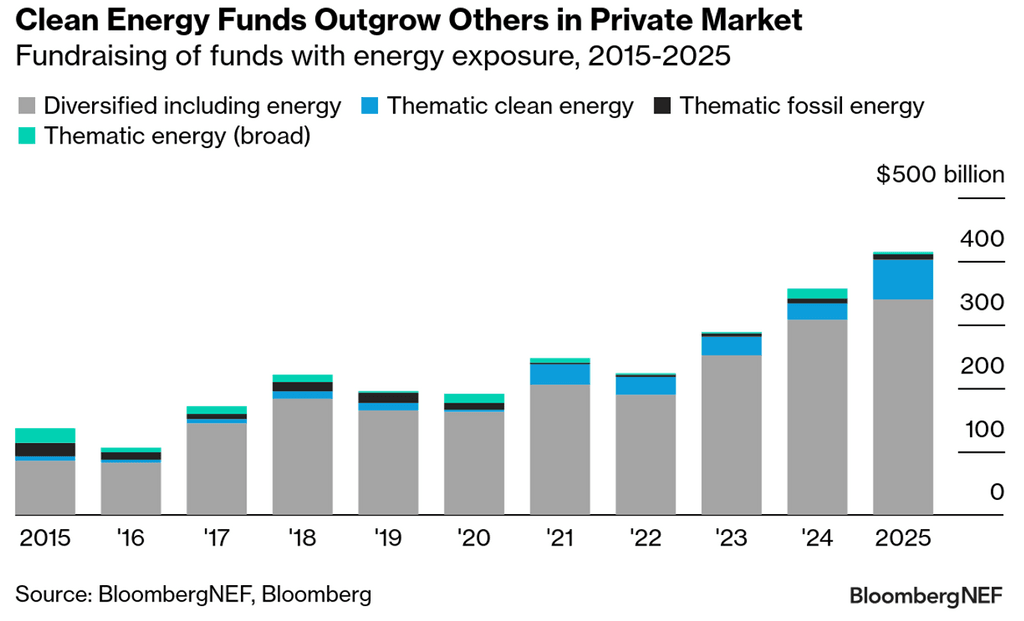

Private markets have raised $2.7 trillion for funds investing in energy over the past decade, according to BloombergNEF. Those dedicated to the transition away from fossil fuels have taken off more recently, with funds managing more than $10 billion leading the charge. These vehicles are emerging as a significant source of capital for the transition, delivering competitive returns and higher, stable cash payouts.

Energy-exposed private market funds have boomed due to interest rates changes, portfolio diversification strategies and investor interest in the energy transition. Among strategies with varied exposure to energy, clean energy focused funds drew in about $178 billion since 2021 – triple the sum of thematic fossil and broad energy funds combined.

With aggressive fundraising, these clean energy strategies now sit on about $92 billion of dry powder – the amount of capital committed to a fund but not yet called from investors.

Real assets – including infrastructure and natural resources – are the dominant asset class for private market energy investing, across fund strategies from credit to venture capital. Contracted cash flows and the capital-intensive nature of renewable energy assets align with the strategy.

Highly concentrated

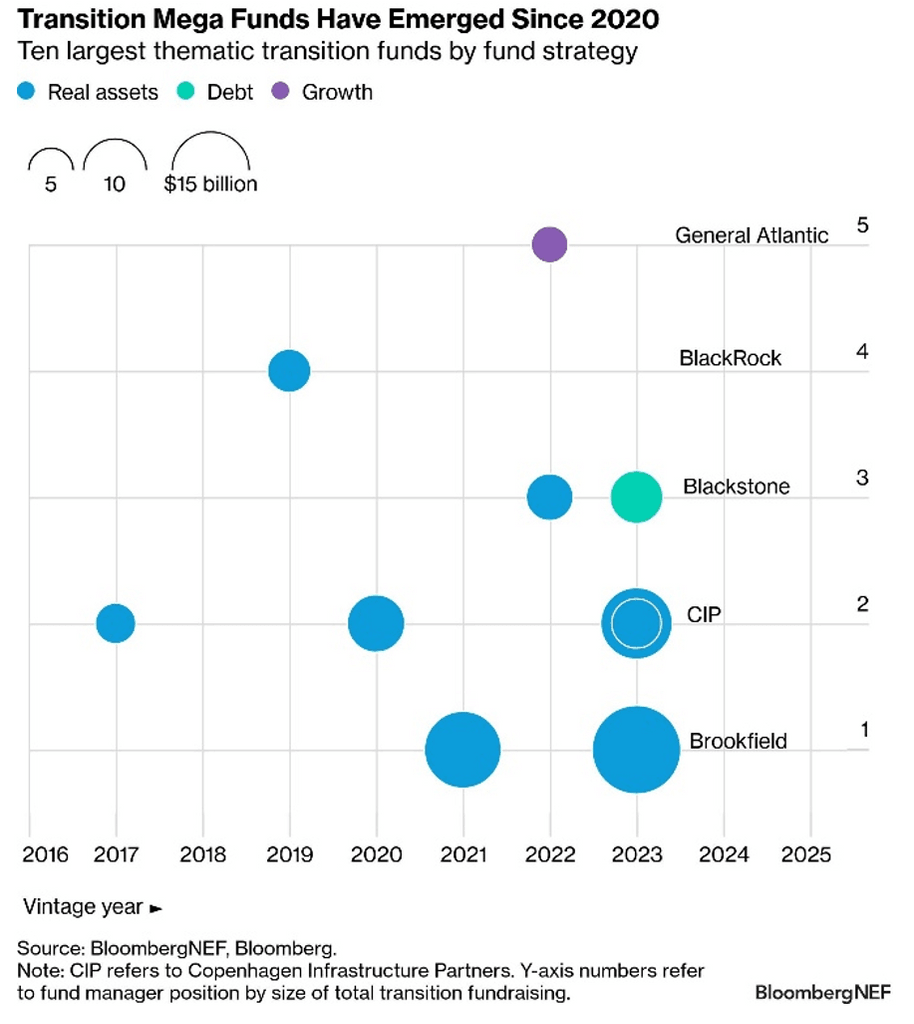

Four fund managers account for about half of current private thematic energy transition funds. They are: Brookfield, Copenhagen Infrastructure Partners (CIP), Blackstone and BlackRock. Brookfield runs the two largest of these strategies. CIP led the third to raise more than $10 billion for a single strategy.

Diversified fund managers are also major players. Dedicated transition funds accounted for only 3% of Blackstone’s total private market fundraising, but they still make it the third largest manager by thematic clean energy fundraising. Traditional infrastructure investors – like KKR, EQT and Macquarie – also have material energy exposure, but are more likely to attain it through diversified, core infrastructure products.

Among the asset owners giving capital to asset managers, pension funds provide the most capital. Corporate and public pensions made about 85% of commitments to private market funds with energy exposure, according to available data. Sovereign wealth funds made up a further 10%.

Competitive returns

Dedicated transition funds can compete with broader infrastructure mandates on performance, but manager selection and timing influence outcomes. Their median return ranged from 7% to over 20% for funds established between 2015 and 2022. The payback period varies significantly.

Private clean energy infrastructure funds also can deliver the cash flow profile investors require at a higher rate than public markets. Cash returns paid back to investors were more than 60% of total returns for private clean energy funds set up in 2015, whereas cash flows represented under 40% of total return of listed stocks.

BloombergNEF clients can access the full report here.