ARTICLE

Ranking the Leaders and Laggards on Circular Plastics: From Pledges to Pullback

By Kirti Vasta, Sustainable Materials, BloombergNEF

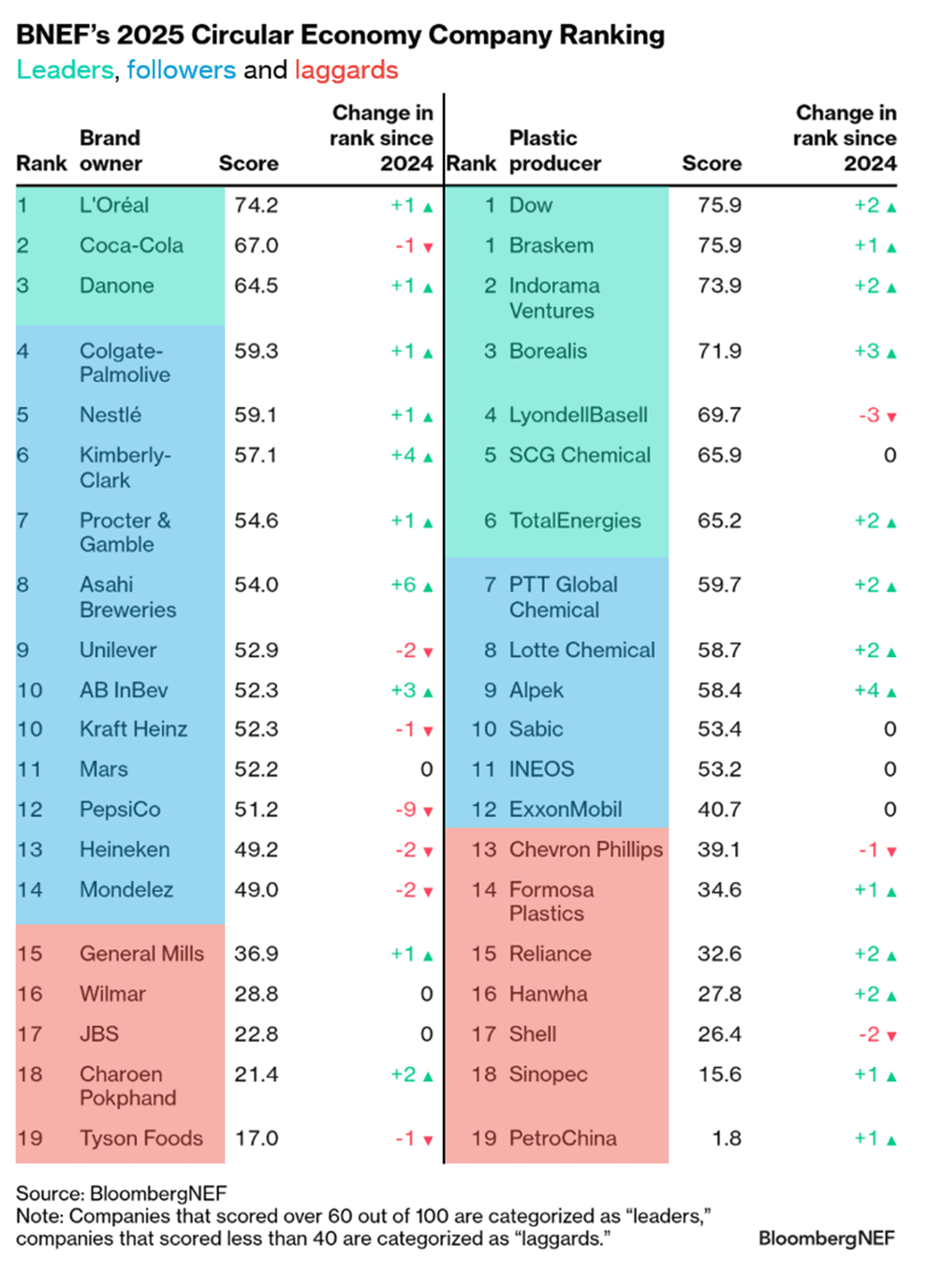

With mounting pressure to tackle plastic pollution, large users and producers of plastic packaging have promised to take action by switching to use or make more sustainable plastics by 2025 and 2030. However, as target deadlines approach fast, not all companies are pulling their weight equally on the journey to achieve a circular economy for packaging.

BloombergNEF has once again assessed 40 firms – 20 brand owners and 20 plastic producers – to reveal those that are leading the charge to use or develop more sustainable packaging and those that are falling behind. Our analysis reveals patchy progress from both brand owners and plastic producers toward achieving circular economy targets in 2024.

BNEF’s Circular Economy Company Ranking measures selected companies’ circular economy ambition based on publicly announced targets and commitments from their 2024 company reports. Both brand owners and plastic producers are split into three tiers – leaders, followers and laggards – based on BNEF’s ranking methodology.

As sustainable packaging target deadlines draw close, 2025 is a pivotal year reflecting the feasibility of achieving the circular economy goals set by companies a few years back. The shifts in the ranking reflect how companies making steady progress continue to remain on top, while others tapping the brakes on their circular economy ambitions are scoring lower and sliding down.

The companies that moved up the most in the latest ranking are:

- Asahi Breweries moved up six places after announcing a new target to achieve 100% conversion to recycled or bio-based polyethylene terephthalate (PET) bottles by 2030, from 37% in 2024. Asahi also benefits from rigid packaging such as glass and aluminum that are easier to recycle.

- Alpek moved up four places. The company has announced plans to expand PET bottle recycling capacity to 300,000 metric tons annually by 2025. Alpek was also among the few producers that did not announce any new virgin plastic expansion plans.

Companies that moved down in the ranking were:

- PepsiCo lost its leading position in the ranking, sliding down to 12th place this year. Despite being a circular economy pioneer, PepsiCo dropped its goal to reduce virgin resin use by 50% compared to 2020. The company also lowered its target for recycled content from 50% by 2030 to 40% by 2035.

- LyondellBasell lost its top spot this year. It performed well overall, achieving a 65% increase in recycled/renewable polymer production to 200,000 tons in 2024. The company has a target to produce 2 million tons of recycled and renewable polymers by 2030. However, the company lost points after announcing virgin plastics production expansion plans in 2025.

Brands make patchy progress toward recycled content targets

PepsiCo, Unilever and Coca-Cola were among the brand owners that tapped the brakes on their circular economy ambition, setting new, less ambitious targets with deadlines further out in the future. However, these new targets are likely more achievable, given the underdeveloped supply chains for recycling in many markets.

Coca-Cola had previously set a goal to achieve 50% recycled content in all packaging by 2030. However, it reduced this target to 35-40% recycled content by 2035. Coca-Cola achieved 28% recycled content in 2024 and benefits from the fact that majority of its packaging comes from easier to recycle materials like PET bottles and aluminum cans, compared to flexible film packaging. Sourcing rigid packaging with recycled content can be easier in markets with mature waste sorting and recycling in place. For example, water bottle brands like Danone’s Evian and Nestle’s Vittel have achieved 100% recycled content for plastic water bottles in Europe.

In contrast, companies that are dependent on food-contact grade, flexible film-based packaging are falling behind or are stagnant. This is reflected in the ranking with a large set of companies categorized as “followers,” scoring in the range of 50-55%, including Mondelez, Kraft Heinz and PepsiCo. These companies have set circular packaging targets but are failing to source the suitable plastics they require at a reasonable price.

Despite the slowing ambition, some brand owners are making progress. Colgate-Palmolive increased the recycled content in its plastic packaging from 18% in 2023 to 21% in 2024 and is on track to meet its 25% target for 2025.

Weak demand and challenging economics hamper producers’ progress

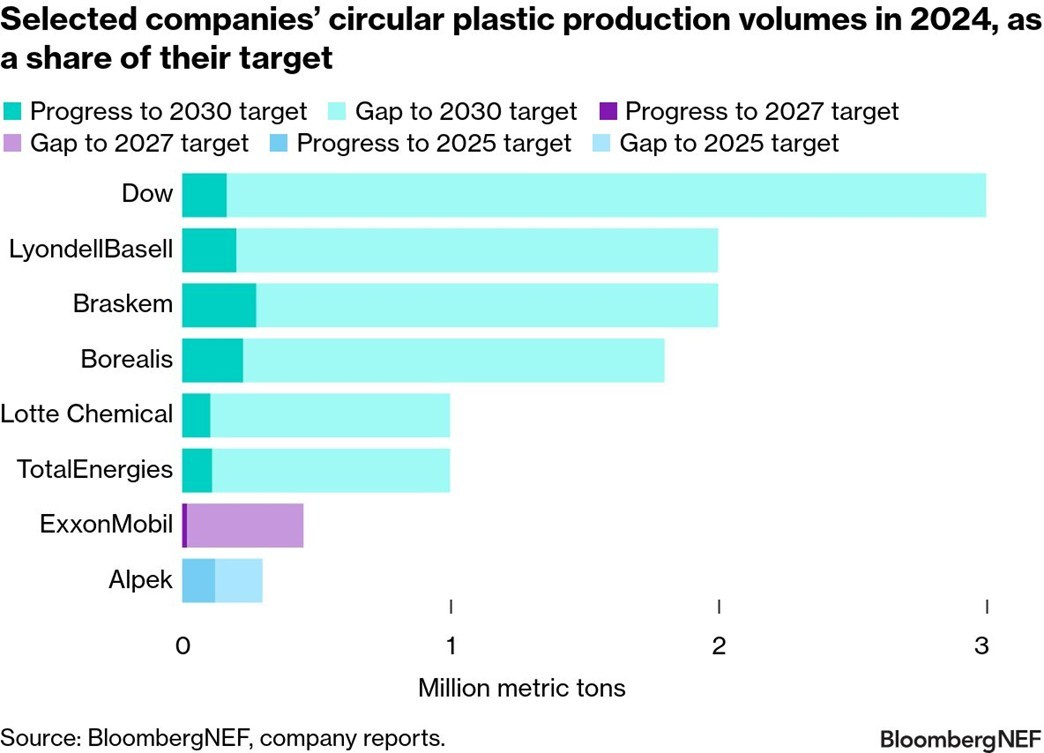

Of the 20 plastic producers, 13 have set clear targets to produce sustainable (recycled or bio-based) materials by 2030 or earlier. If these 13 companies meet their targets, they alone would supply around 13 million tons of sustainable plastics per year by 2030. Production targets hold the greatest weight in BNEF’s ranking methodology, as this reflects the upper limit of how circular a producer’s polymers will be this decade.

Indorama, Alpek and Braskem have made the strongest progress toward their production targets in 2024. However, most plastic producers still have a long way to go. Insufficient demand for recycled products is one of the biggest challenges that producers face.

Nonetheless, plastic producers are seeking out sectors where the demand for high-grade recycled plastics is on the rise and buyers are willing to pay a premium over virgin plastics. For example, Borealis launched a glass-fiber reinforced polypropylene with a 65% post-consumer recycled content for the automotive industry. Sabic introduced a new resin with a 30% post-consumer recycled content used in MSI’s gaming laptops.

Globally, the chemicals market is facing a supply glut, exacerbated by new primary production capacity coming online in Asia. As a result, several plastic recyclers closed operations in recent years. With record low utilization rates and low or even negative margins, companies have halted or delayed investments in sustainable chemicals production.

However, some producers have signed offtake agreements or acquired recycling companies, instead of building their own plants. For example, Dow formed a supply agreement with Freepoint Eco‑Systems for 65,000 tons of pyrolysis oil, which is used as feedstock to make plastics with a recycled content. In 2024, Borealis increased its circular production capacity by 18% compared to the previous year, processing 221,200 metric tons of circular feedstock. The company acquired plastic recycler, Integra Plastics in 2024 and acquired a minority stake in Renasci in 2021.