PRESS RELEASE

Electric Vehicle Sales Headed for Record Year but Growth Slowdown Puts Climate Targets at Risk, According to BloombergNEF Report

• BloombergNEF’s Long-Term Electric Vehicle Outlook shows that as technology for electrification continues to improve, and battery prices fall, adoption moves from being policy-driven to being driven by consumer demand across all markets

• Passenger EV sales are expected to exceed 30 million in 2027 in BNEF’s base case scenario and grow to 73 million per year in 2040

• Strong and carefully structured policy support is still needed, however, on all vehicle segments but one to get on track for net-zero trajectory

• According to BNEF’s Net Zero scenario, for the world to achieve a totally zero-emission vehicle fleet by 2050, sales of combustion vehicles will need to stop around 2038. In the Economic Transition Scenario, only the Nordic countries reach a full phase-out of combustion vehicles before 2038.

• Currently, only one segment of road transport – three-wheeled vehicles – is fully on track to reach net zero by mid-century.

London and New York, June 12, 2024 – BloombergNEF’s Long-Term Electric Vehicle Outlook (EVO) shows that EV adoption is still growing, despite the mixed near-term outlook. The new report indicates that rapidly falling battery prices, advancements in next-generation battery technology and improving relative economics of electric vehicles with internal-combustion engine counterparts continue to underpin long-term EV growth globally. However, the report indicates that the window to reach global net-zero transport ambitions is now narrower than ever.

The report presents two updated road transport scenarios: the base case Economic Transition Scenario (ETS) – in which EV adoption is shaped by current techno-economic trends and with no new policy intervention – and the Net Zero Scenario (NZS) – consistent with reaching a global zero-emission fleet by 2050.

In the base case ETS, electric-vehicle sales continue to rise globally, even though growth has slowed in the US and Europe as a result of regulatory and political changes, and some automakers pushing back their EV targets. In the US, a lack of lower-cost models and EV market jitters inflamed by the upcoming presidential elections helped slow down adoption this year, while block-wide fuel-economy targets in Europe do not become more stringent until 2025, releasing automakers active in the region from the pressure to substantially increase sales of EVs.

The report also shows that electric vehicles are no longer only a wealthy country phenomenon, and countries like Thailand, India and Brazil are all experiencing record sales as more low-cost electric models are launched targeting local buyers. China, the world leader on EVs, is not looking back, and despite early signs of saturation of some EV segments and a tougher economic outlook, the country is projected to maintain its lead as the biggest EV market globally.

The underlying technology for electrification continues to improve, battery prices continue to fall, and EV adoption moves from being policy-driven to being driven by consumer demand across all markets. Passenger EV sales are expected to exceed 30 million in 2027 in the ETS and grow to 73 million per year in 2040, contributing 33% and 73% to global car sales in those years, respectively.

BNEF also finds that electrification is now spreading quickly to all sectors of road transport, from rickshaws to heavy trucks. Two- and three-wheeled vehicle sales continue to rise in emerging economies and electric sales are expected to exceed 90% globally by 2040. The decarbonization of the commercial vehicle sector – including vans, trucks and buses – has already started and is set to accelerate. The rapid adoption of EVs across all vehicle segments creates an unprecedented market opportunity. The cumulative value of EV sales across all segments could hit $9 trillion dollars by 2030 and $63 trillion by 2050 in BNEF’s ETS. At least $35 billion needs to be invested in battery-cell and component plants by the end of the decade, though this is easily exceeded by the $155 billion already planned by companies.

Despite the progress, global road transport is still not on course for a net-zero trajectory. While BNEF’s NZS calls for 100% of the road-going car fleet to be electrified by 2050, the base case ETS only achieves 69% in the same year. This shows that current techno-economic trends alone are not enough to get the transport sector on track for global climate goals, and that continued strong regulatory support is still very much needed.

Currently, only one segment of road transport – three-wheeled vehicles – is fully on track to reach net zero by mid-century. Heavy- and medium-duty vehicles are the furthest off course for this goal: electric and hydrogen fuel-cell powertrains account for only 18% of global truck sales by 2030 and 43% by 2040 – and even this represents significant change for the industry.

“Truck manufacturers are about to undergo a rapid technological transformation on the back of strict environmental targets in Europe and the US. The speed of that change will be unprecedented for the industry, but meeting a Paris-aligned scenario requires even faster production of zero-emission vehicles,” said Nikolas Soulopoulos, head of commercial transport at BNEF.

According to the Net Zero scenario, for the world to achieve a zero-emission vehicle fleet by 2050, sales of combustion vehicles will need to stop around 2038, with leading markets needing to phase out combustion vehicles even sooner, in the early 2030s. In the Economic Transition Scenario, only the Nordic countries reach a full phase-out of combustion vehicles before 2038. As more countries implement industrial strategies to capture value from the transition, there is a risk that climate goals fall further out of reach. Governments will need to carefully weigh up competing priorities and avoid policies that reduce competition or access to affordable EVs.

“Governments trying to champion domestic manufacturing at the cost of faster decarbonization should consider very carefully what they are prioritizing, as reaching net-zero road transport emissions by 2050 is still possible, but much faster progress is needed,” said Aleksandra O’Donovan, head of electric vehicles at BNEF.

Other findings of the Long-Term Electric Vehicle Outlook include:

•

Global passenger EV sales continue to grow, but the growth rate in the next few years is visibly slower than before.

In the next four years, electric car sales grow at an average of 21% per year in the Economic Transition Scenario, compared to the average of 61% between 2020 and 2023. The EV share of global new passenger vehicle sales jumps to 33% in 2027, from 17.8% in 2023. Only China (60%) and Europe (41%) are above that global average by then. EV sales in Brazil quintuple by 2027 and triple in India.

•

The Net Zero Scenario requires a much faster transition.

By 2035, there are 476 million EVs on the road, rising to 722 million by 2040, accounting for 45% of the fleet. In the Net Zero Scenario this is 679 million and 1.1 billion, respectively.

•

Internal combustion vehicle sales have peaked.

Sales of internal combustion vehicles peaked in 2017 and by 2027 are 29% lower than their peak in our outlook. Our economic analysis indicates that electric vehicles are the primary method of decarbonizing road transport. Still, hybrids can play a meaningful role in the near-term, in particular in markets with increasingly stringent fuel-efficiency rules. Hybrid adoption reaches between 5% and 45% of sales by 2030 in our outlook, depending on the market.

•

Plug-in hybrids are making a comeback, but their full role in the transition is still unclear

. Average PHEV range is rising quickly, hitting 80km in 2023 and making these vehicles more attractive, particularly in China, where sales are growing quickly. Still, there are big open questions on how often they are used in electric mode. If PHEVs displace BEV sales and are not utilizing their full electric potential, they can add to both oil consumption and emissions.

•

EVs are driven more than their combustion counterparts.

Meta-analysis of EV driving patterns in different countries shows that fully electric vehicles are doing more annual kilometers than comparable gasoline powered vehicles. There is significant variation by country and the US is a notable outlier with fewer kilometers driven by EVs.

•

Electric heavy trucks become economically viable for most use cases by 2030.

In heavier segments, battery electric trucks are mostly used in urban duty cycles initially. But their economics improve even for long-haul routes and around 2030 approach those of diesel powertrains. Fuel-cell trucks remain a viable option for some duty cycles and in some countries, but their outlook is far less certain.

•

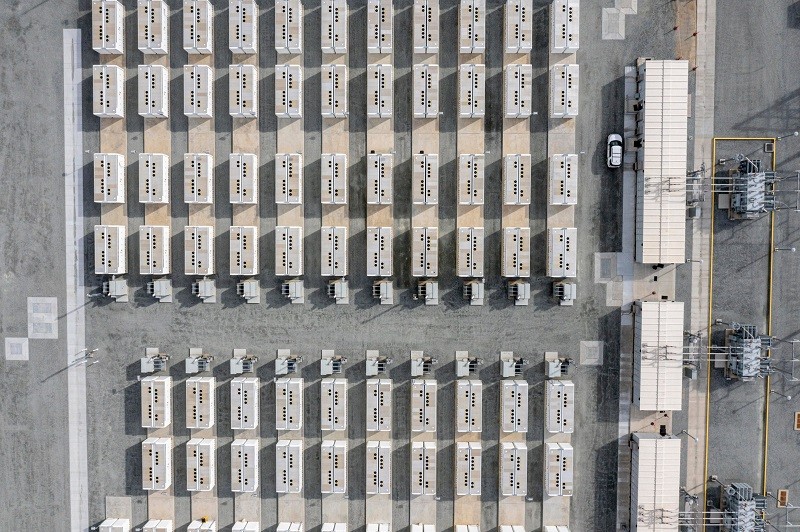

Overcapacity is a big issue for battery makers.

Planned lithium-ion cell manufacturing capacity by the end of 2025 is over five times the 1.5TWh global battery demand expected that year. Annual lithium-battery demand grows rapidly in our Economic Transition Scenario, approaching 5.9 terawatt-hours annually by 2035.

•

Lithium-iron-phosphate batteries (LFP) are taking over the EV market.

Improvements in lithium-iron-phosphate (LFP) technology are increasing its market share, particularly in China, where cell prices have fallen rapidly to $53/kWh so far this year. LFP crosses 50% share of the global passenger EV market within the next two years in this outlook. Nickel and manganese are set to feel the most pressure as a result. Due to the shift toward lower-cost chemistries, nickel, and manganese consumption by 2025 is 25% and 38% lower, respectively, this year than in the previous outlook.

•

Oil demand displacement from EVs starts to ramp up.

With 83 million electric cars, trucks, and buses on the road next year, and over 340 million electric two-and three-wheelers, in the next three years oil demand displaced by electric and fuel-cell vehicles of all types more than doubles from today, to almost 4 million barrels per day by 2027. This is slightly more than the volume Japan consumed in 2022.

•

A fully electric global fleet could consume twice the amount of electricity as the US did in 2023.

By 2050, in the Net Zero Scenario, some 8,313TWh of electricity is needed to power an all-electric vehicle fleet, double the amount of electricity consumed in the US in 2023. Despite the large growth in electricity demand, electric vehicles can aid the electrification of the energy system through smart charging, as grid operators apply variable pricing and other mechanisms to incentivize flexibility.

•

To meet the growing EV electricity demand, the charging industry will need to mature rapidly over the next decade.

Between $1.6 trillion and $2.5 trillion in cumulative investment is required in charging infrastructure, installation, and maintenance by 2050, depending on the scenario.

A comprehensive executive summary with key findings and more information on the Long-Term Electric Vehicle Outlook can be found at this link.

Contact

Oktavia Catsaros

BloombergNEF

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Terminal. Bloomberg’s enterprise solutions build on the company’s core strength: leveraging technology to allow customers to access, integrate, distribute and manage data and information across organizations more efficiently and effectively. For more information, visit Bloomberg.com/company or request a demo.