This report by BloombergNEF shows how the combination of solar power plants and battery storage can be a clean, economic alternative to an increasingly large share of U.S. gas generation. Its analysis provides valuable insight on a techno-economic trend that lies at the heart of the future of the U.S. power sector and its decarbonization. It comes at a time where President-elect Joe Biden is preparing proposals that aim to put the U.S. on a pathway toward a net-zero power system by 2035.

The combination of ever-cheaper energy storage systems and state and federal policy support has heightened utilities’ interest in hybrid projects combining solar photovoltaics and storage (known as PVS for short). There are now over 19GW of PVS projects in the pipeline in the U.S and expected to come online by 2023, and an additional 80GW of projects in the interconnection queue. Existing projects are designed to facilitate the integration of solar on the grid, by allowing a more stable output during regular generation hours, or by shifting solar energy to deliver peaking capacity. This second application increasingly puts PVS in competition with peaking gas capacity typically delivered by open-cycle gas turbines (OCGTs).

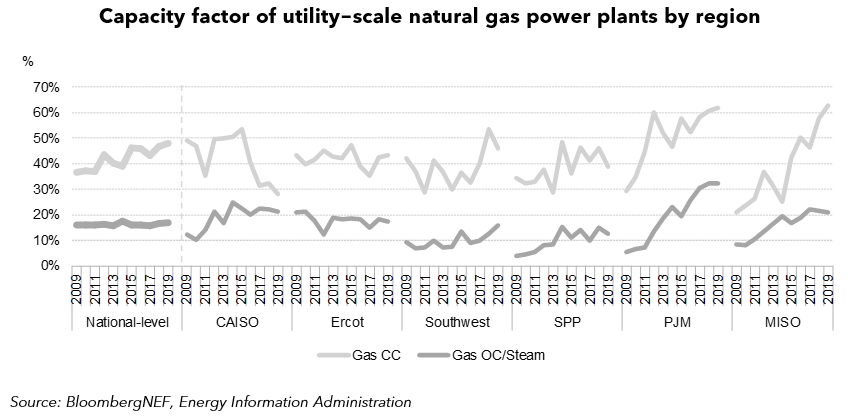

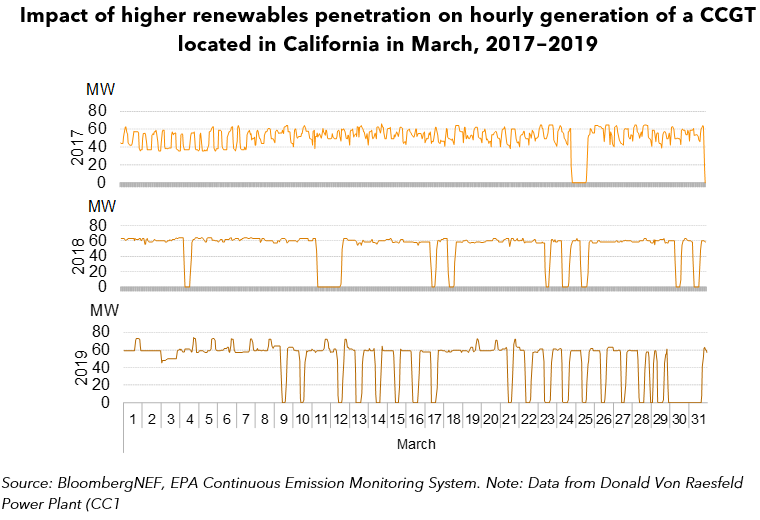

The operating profile of the U.S. gas fleet is diverging from region to region. Gas fleet capacity factors have reached new records in power markets where gas is the cheapest and coal capacity has declined rapidly. But the story is different in markets that have recorded higher shares of renewables penetration. For example, gas generators are struggling in California. In that state, high solar penetration is eating into combined-cycle gas turbine (CCGT) operating hours and forcing these plants to start up and shut down more often, eating into their revenue and adding to operation and maintenance costs. Whilst gas dispatch is more stable in markets with lower penetration of renewables and access to cheaper gas, this is likely to change over time as economics and policy drive more renewables onto the system.

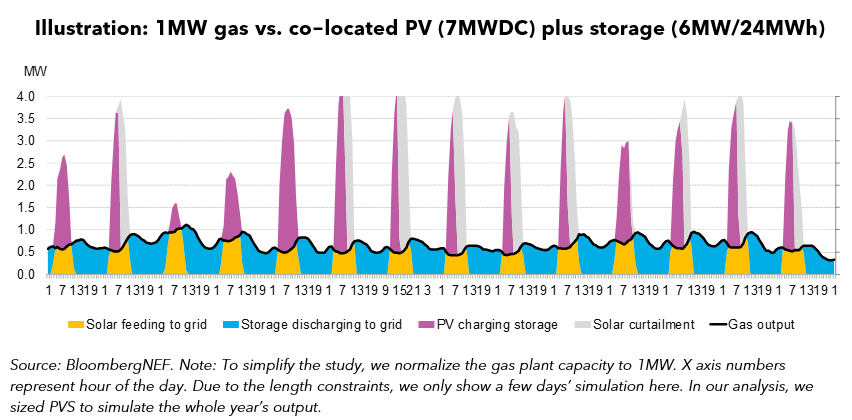

PVS has different characteristics to gas generation, but can deliver comparable services, or offer similar value. For that reason, in this report we compare these plants on an adjusted levelized cost of electricity basis when sized to perform an identical task. This approach differs from the typical integrated resource planning methodology widely adopted by the U.S. utilities. However, it allows a more accurate and direct economic comparison between these two types of technologies.

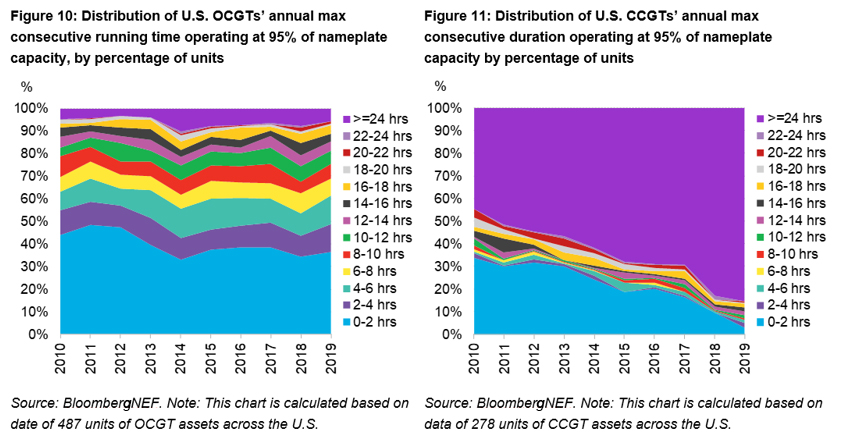

Roughly 80% of U.S. gas peakers had capacity factors below 15% in 2019. This low capacity factor results in a high levelized cost of energy for OCGTs. We sized our PVS system to perform the same job as gas plants, ensuring that they have the same value. Our results show that PVS is already a cost-competitive alternative on a levelized cost of energy basis to the majority of new gas peakers in the U.S., especially in solar-rich regions such as the Southwest. PVS is also more flexible and environmentally friendly than gas peakers.

On the other hand, the number of consecutive hours for which CCGTs operate has increased over the last decade. This is largely a result of coal-to-gas switching. About 82% of units in 2019 operated at maximum capacity for over 24 hours, at least once. As a result, PVS is not yet a cost-competitive alternative to new combined-cycle gas plants, if providing an equivalent service. The need to provide energy and capacity for extended periods of time, even infrequently, makes it challenging for PVS to compete against high capacity-factor CCGTs.

However, there are nuances to this key finding of the report:

- Uptake of PVS and standalone wind and solar will affect the operating profile of CCGTs in many markets. They will likely have to cycle more frequently and will operate for fewer run hours each year, pushing up their costs. This should encourage companies, investors and policy makers to plan for the future rather than current need.

- Even though PVS may not be a suitable like-for-like replacement for a high capacity-factor CCGT, the combination of clean energy resources such as wind, solar, storage and demand-side flexibility can provide the equivalent service in some cases.

Power system implications

- PVS systems are already replacing gas peakers, and should continue to do so in the near term as a growing share of the existing OCGT fleet reaches the end of its economic lifetime. They are cost-competitive, they have better operational characteristics, and they align with longer-term decarbonization goals.

- Utilities can use PVS to provide many of the services currently offered by CCGTs, but like-for-like replacement of CCGTs will be more challenging. New Energy Outlook 2020 economic modelling suggests that cheap renewables and batteries appear to reach an economic limit between 70% and 80% penetration in most markets. This is the result of two related dynamics. First, as new renewables eat into the run-hours of existing coal and gas plants, the most expensive mid-merit generators are displaced first, making the next MW of renewables marginally less competitive. Second, since renewables all generate together when the conditions are right, at high penetration each additional plant tends to increase fleet-wide curtailment, which lowers capacity factors and weakens the economic case for the next plant.

- In some but not all cases, a combination of clean energy resources such as wind, solar, storage, demand-side flexibility and power imports can displace a CCGT. Even if clean energy does not remove the need for some form of firm capacity, it will significantly alter the use case. Gas peakers and combined-cycle gas stay in the system, not for the hours of highest demand, but for those of lowest renewable generation.

- A future low-carbon system will be made up of renewables, storage and some firm capacity. The firm capacity is likely to include gas generators, and these might in future even burn clean gases such as hydrogen, or utilize carbon capture. At first glance, our findings may seem to imply that gas peakers have little future in the U.S. power market and that CCGTs are here to stay. However, as renewable penetration rises and CCGT run-hours are displaced, the gas fleet will increasingly be asked to operate at lower capacity factors, while still being able to meet the longer multi-hour periods when renewables are producing less. This might actually shift the balance towards gas peakers again, as they tend to be more economical at lower capacity factors. Ultimately, whether a CCGT or OCGT is best placed to provide this service will depend on the expected capacity factor, operational requirements of the plant, gas price and location.

Policy implications

- Switching from coal to gas, with increasing renewable energy penetration, has proven an effective way of reducing power sector emissions over the last decade. Reducing the role of gas in power markets is the next step.

- We expect gas to remain economically attractive in many parts of the country over the next decade due to low natural gas prices and massive coal retirement. In the Economic Transition Scenario of NEO 2020, new gas build holds strong in the parts of the U.S. with relatively poor economics for renewables, particularly PJM, and gas accounts for 23% of all capacity additions to 2050.

- This puts the impetus on regulators and utilities who must consider the future role of renewables-plus-storage when approving investments today. Investments in new-build gas assets will make it significantly harder to decarbonize power markets. The use case for these assets is changing. A failure to recognize this will result in costly, under-used or stranded assets.

- Market reform remains necessary in order to better enable the participation of standalone batteries and hybrid assets. Integrated resource planning processes are also in need of reform to ensure that the capabilities and economics of non-traditional resources are adequately assessed.

- BNEF hourly modelling suggests there is still a need for some firm capacity in future power systems. Recognizing this, and supporting the development of zero- or low-emissions alternatives to fossil gas, is necessary to deliver a transition to a net-zero power system in the U.S..

About the New Energy Outlook

The New Energy Outlook (NEO) is BloombergNEF’s annual long-term analysis on the future of the energy economy.

Now covering transport, industry and buildings in addition to its traditional focus on the power sector, NEO leverages the combined expertise of more than 65 BNEF analysts across 12 countries to offer a unique assessment of the economic drivers and tipping points that will shape these industries to mid-century, and paint a picture of the energy economy in 2050.

This study is considered an invaluable input to CEOs, investors, strategists, and policy thinkers to support long-term planning. Read the press release here.