PRESS RELEASE

Net-Zero Industry Requires Exponential Growth From Carbon Capture, Hydrogen and Clean Power

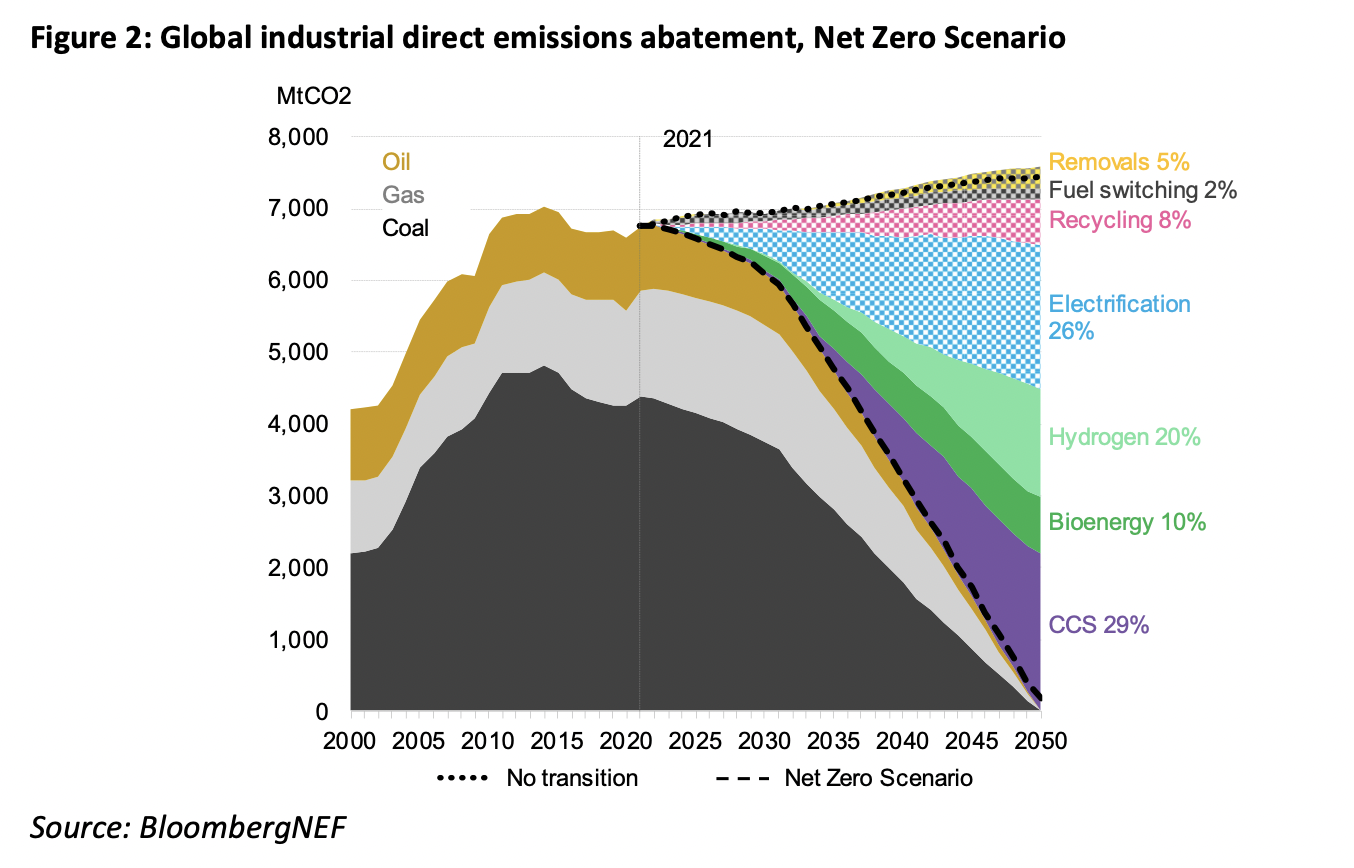

By 2050, industrial sectors will need to be abating more than 7 billion tons of CO2 per year to reach net-zero emissions; building clean capacity needs to start now

New York and London, March 2, 2023 – Without decarbonization intervention, industrial emissions will grow from 6.7 billion tons of CO2 this year to 7.6 billion tons of CO2 per year by 2050, according to the New Energy Outlook: Industry report, published today by research company BloombergNEF (BNEF) as part of its New Energy Outlook (NEO) series. The report finds that there is no ‘silver bullet’ technology to decarbonize industrial emissions; instead significant investments in carbon capture, hydrogen and clean electrification will all be needed.

The production of steel, aluminum, petrochemicals and cement (the four sectors covered in the report) is due to increase in developing economies and stay flat or only slightly decline in most developed countries. While low-carbon options for industrial sectors remain expensive, to reach net zero by 2050 it is crucial that all future capacity is built with clean technologies, or the option to easily make the transition in the future. If current production routes are maintained, billions of dollars’ worth of polluting assets could be stranded by net-zero deadlines in 2050 and 2060.

Industrial decarbonization requires policy intervention

In the report’s Net Zero Scenario (NZS), a combination of technologies deliver more than seven billion tons of carbon dioxide abatement by 2050, with a contribution of 29% from carbon capture and storage, 26% from electrification, 20% from hydrogen, 10% from bioenergy and 8% from recycling. However, the report’s Economic Transition Scenario (ETS) shows that there will be virtually no emissions abatement in industry based on economics alone. A small amount of fuel switching and hydrogen use occurs in the steel industry, but only in the 2040s, far too late to prevent catastrophic warming. Projects today are being driven by consumer demand and generous subsidies, such as the Inflation Reduction Act in the US.

“Zero-carbon materials are not yet economic, but many companies have committed to lowering their emissions. According to our research, 73% of aluminum production capacity, 62% of petrochemicals, 47% of cement and 38% of steel is covered by a net-zero commitment. These commitments will drive investment and innovation, and ultimately bring down the costs of decarbonization.” said Claire Curry, Head of Technology & Industry at BNEF.

The timing of the decarbonization determines the technology mix. Electrification and hydrogen pathways have the best chance of competing with existing production routes on cost, but will only become widely available around 2035. Recycling, fuel switching, bioenergy and carbon capture can deliver emissions reductions today, and are deployed earlier in BNEF’s least-cost modelling, helping to keep global warming below two degrees. Hydrogen arrives later but ultimately plays a crucial role in steel and petrochemicals as both a feedstock and a source of heat.

There is no consensus technology for industrial net-zero

The variety of process requirements and sources of emissions in industry means that no technology will ‘win’. A clean fuel will be chosen based on local supply chains and cost, and hydrogen used where it is needed for its chemical properties, in steel and petrochemicals. A large portion of cement’s emissions come from a chemical process where limestone is converted to lime. For this reason, carbon capture will play a major role in decarbonizing cement.

“To avoid stranded assets, it is crucial that all new industrial capacity is built clean, today,” said Julia Attwood, Head of Sustainable Materials at BNEF and lead author of the report. “Low-carbon technologies can increase costs in the near-term, but locking a new industrial plant that would run for 50 to 100 years into coal, gas or oil will eventually lead to high carbon payments and uneconomic production.”

Industrial powerhouses lead the way

China, as the producer of half of the world’s steel, aluminum and cement, is the most important actor today. After a period of exponential growth in materials production, output cuts and a focus on quality rather than quantity will give the country a start on its net-zero pathway, reducing emissions through declining production. While China has not yet published a definitive technology roadmap, its scaling power could change the economics of hydrogen or carbon capture for the rest of the world.

The US is well positioned for decarbonization. Its steel sector is mostly electrified, and its petrochemical sector already has expertise in both hydrogen and carbon capture. The recently passed Inflation Reduction Act will make these technologies viable for industry through generous tax credits. The global role for the US and Europe will be as a laboratory for net-zero production routes. Most of the early pilot projects for low-carbon production are located in these regions, and will be used as a model globally.

In the future, India will be the focus for net zero, as its industrial emissions are due to more than double by 2050. India has the largest hill to climb, as it will be one of the fastest growing materials producers over the next 30 years, building plants that could run until 2100. Ensuring that those plants can run on clean fuels or eventually be retrofitted with carbon capture is the only way to provide both economic growth and net-zero emissions.

This research forms part of a series of reports diving deeper into country and sector results from BloombergNEF’s New Energy Outlook. As part of this series, BloombergNEF today also published a separate report New Energy Outlook: Grids, exploring the future of the global electricity network to 2050. A link to the press release can be found here.

BloombergNEF will publish New Energy Outlook reports for the US, Europe, China, Japan, India, and Australia over the coming months.

Contact

Oktavia Catsaros

BloombergNEF

+1-212-617-9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.