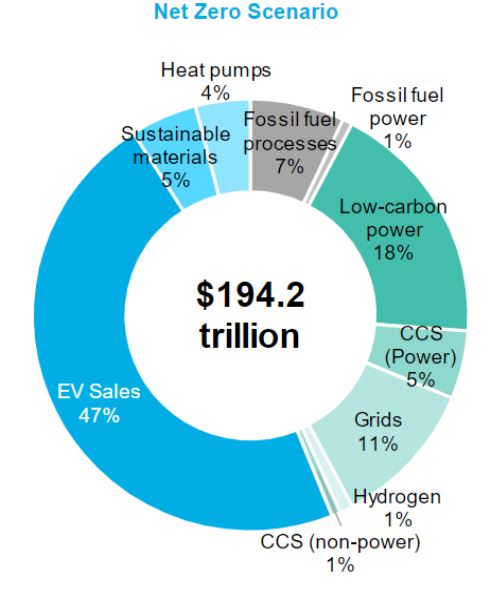

The transition to a net-zero emissions world opens up an investment opportunity that totals almost $200 trillion by 2050 — or nearly $7 trillion a year.

Electric vehicles and low-carbon power will be the biggest markets for investors, followed by power grids, according to the latest outlook from BloombergNEF.

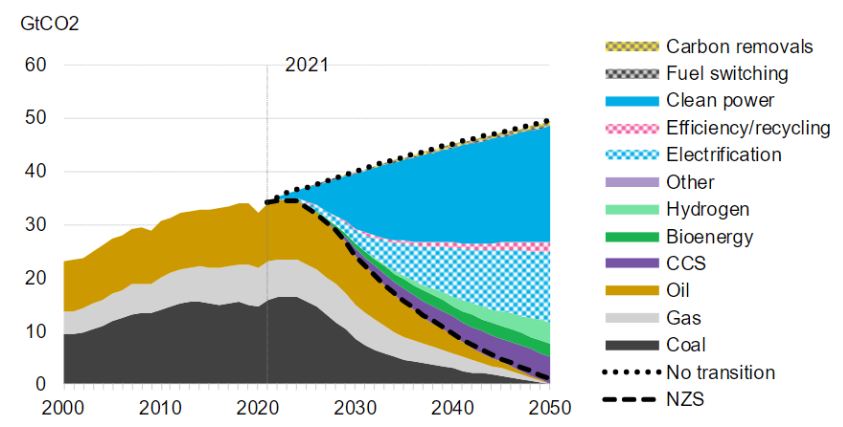

The research and analysis firm modeled a path to global net-zero by 2050 and found the world can limit warming to 1.77C. For that, “clean power deployment needs to quadruple by 2030, in addition to a major investment in carbon capture and storage, advanced nuclear technologies, and hydrogen,” said David Hostert, global head of economics and modeling at BNEF and lead author of the report.

Global investment needed for net-zero goal

Source: BloombergNEF. Note: CCS refers to carbon capture and storage.

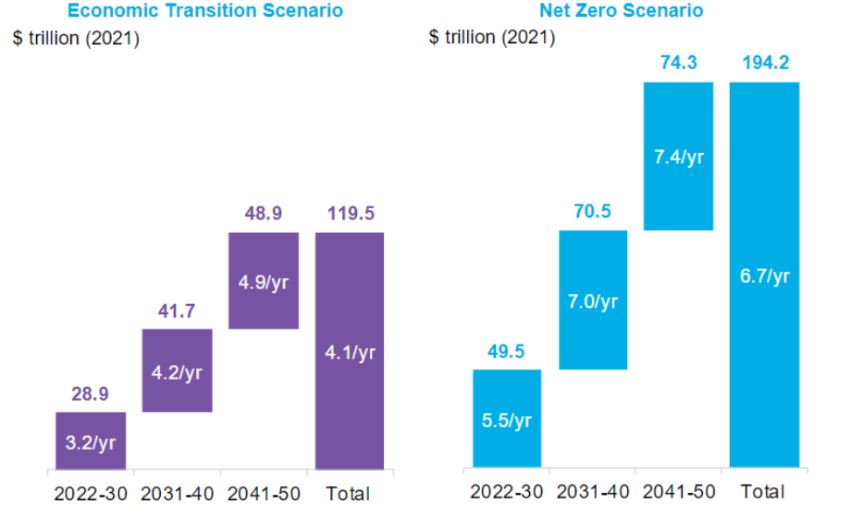

There are two scenarios highlighted in the report:

- Economic Transition Scenario, that assumes no new policy action

- Net Zero Scenario, that assumes global net-zero emissions by 2050

The economic transition scenario requires annual investment to double from the 2021 level of $2 trillion per year to $4 trillion, while the net-zero scenario requires annual investment to more than triple to $6.7 trillion per year.

Global investment needed

Source: BloombergNEF. Note:The numbers inside the bars show the annual investment in each decade. The numbers above the bars show the total investment in each decade. Economic Transition Scenario assumes no new policy action. Net Zero Scenario assumes global net-zero emissions by 2050.

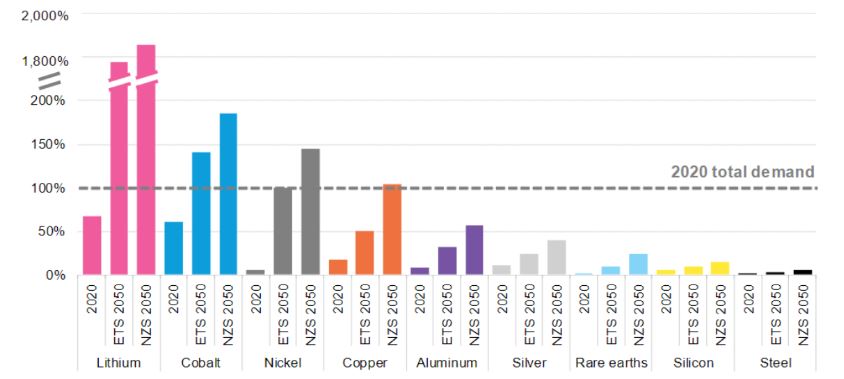

Such a colossal transformation of the global economy would trigger massive demand for related inputs, such as metals. The 2050 lithium demand from the energy transition alone looks to be about 17.5 times total demand in 2020, for instance.

Energy transition and metals demand

Source: BloombergNEF, US Geological Survey 2022. Note: Includes demand from the power sector, grids and batteries (stationary energy storage and electric vehicles). Data in the 2020 columns shows estimated demand from energy transition sectors. The“2020 total demand” line reflects total global demand across all industries, as reported by the US Geological Survey for refined copper and contained silicon, nickel, cobalt and silver. ETS refers to Economic Transition Scenario that assumes no new policy action. NZS refers to Net Zero Scenario that assumes global net-zero emissions by 2050.

This exponential growth in demand for metals will require newer technologies that increase the scale of production, without compromising on sustainable extraction.

“We are at that critical fork in the road where what we do today determines whether the world is 2.6C warmer – under the Economic Transition Scenario – or warming is limited to below 2C under the Net Zero Scenario,” said Hostert.

Source: BloombergNEF. Note: The ‘no transition’ scenario is a hypothetical counterfactual. In the power and transport sector, it keeps the current fuel mix constant at 2021 levels, with emissions growing proportionally to forecast energy demand. For all other sectors, the counterfactual to the Net Zero Scenario (NZS) is the Economic Transition Scenario (ETS). CCS is carbon capture and storage.

What’s next for the global energy economy? Access BNEF’s New Energy Outlook here.