By Colin McKerracher, Head of Advanced Transport, BloombergNEF

In 2008, General Motors unveiled the Chevrolet Volt, a plug-in hybrid with around 40 miles (64 kilometers) of range. Then-CEO Rick Wagoner referred to the Volt during a celebration of GM’s centennial as “a great way to open our second century.”

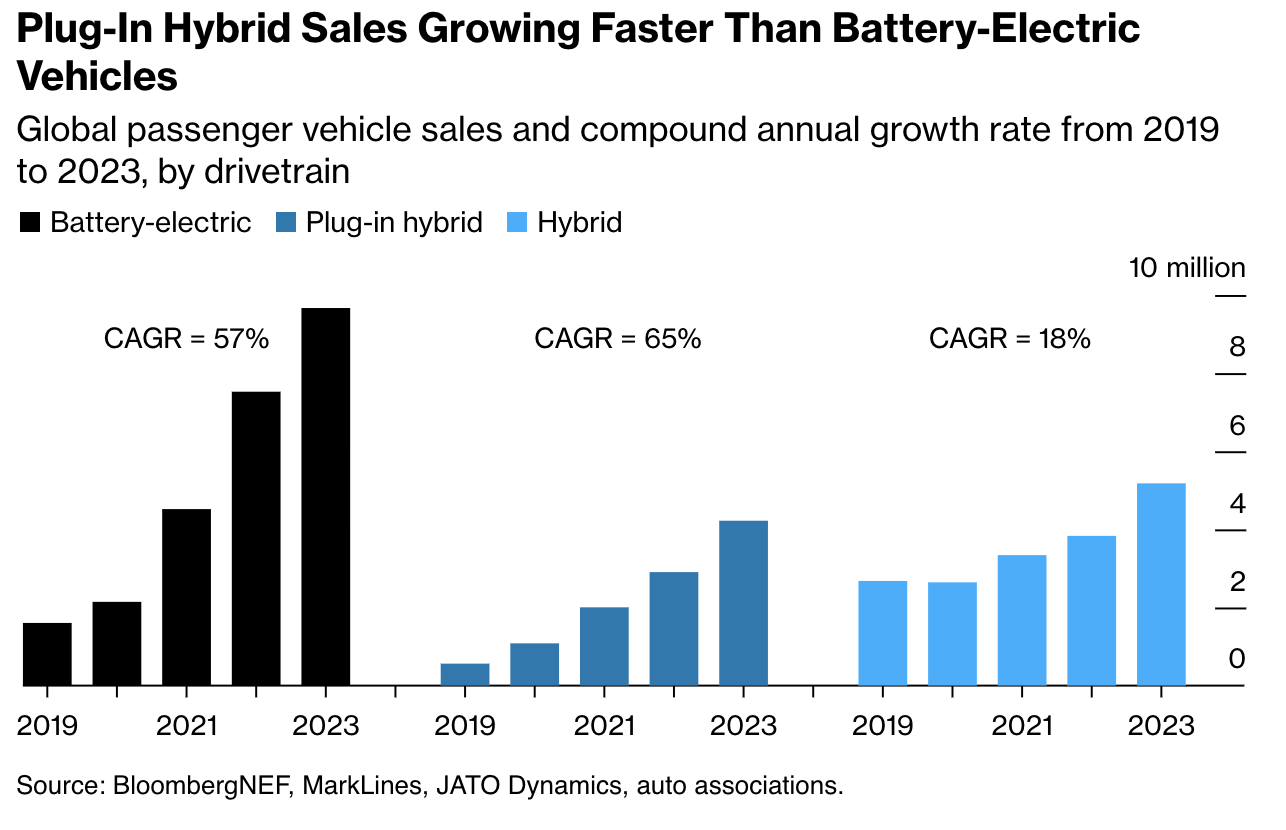

Sixteen years later, the technology is enjoying something of a revival, this time led out of China. Plug-in hybrids, or PHEVs, were the fastest-growing drivetrain segment of the global passenger vehicle market over the last five years in percentage terms, ahead of battery-electrics, traditional hybrids and combustion engines.

Plug-in hybrids have a somewhat storied history, with several automakers jumping on them early as a compliance tool to improve the average emissions of the vehicles they sold without having to go fully electric. Many of the early models had very low ranges, which continues today in markets including the US and Europe.

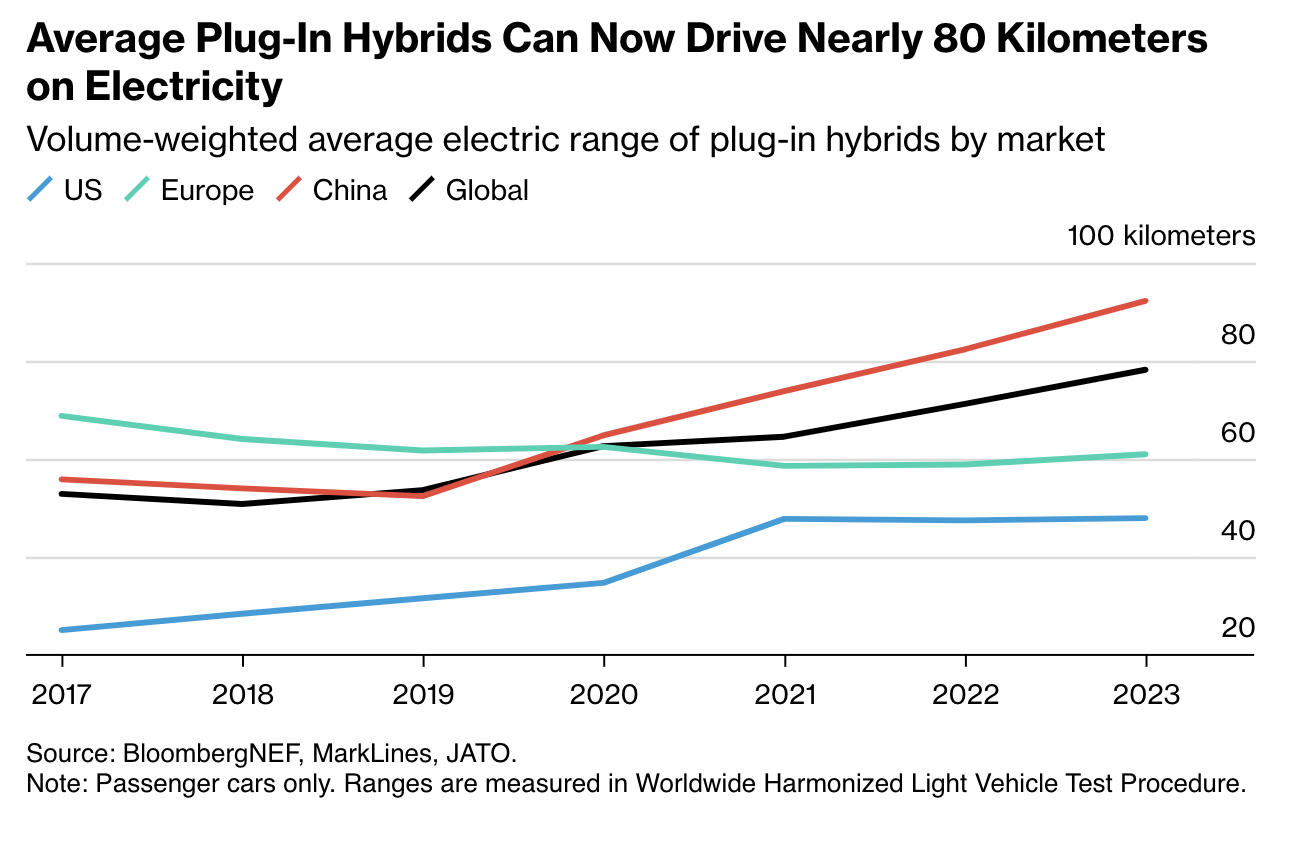

In the last few years, companies including Li Auto and BYD have been launching more capable, longer-range PHEVs that are pulling in new buyers. Recent analysis from my colleagues Corey Cantor and Siyi Mi at BNEF shows that average PHEV range jumped from 50 kilometers in 2019 to almost 80 kilometers in 2023, and this year will be higher again. Most of that increase is down to sales in China, where average PHEV battery pack sizes are rising quickly.

There’s also a technology twist.

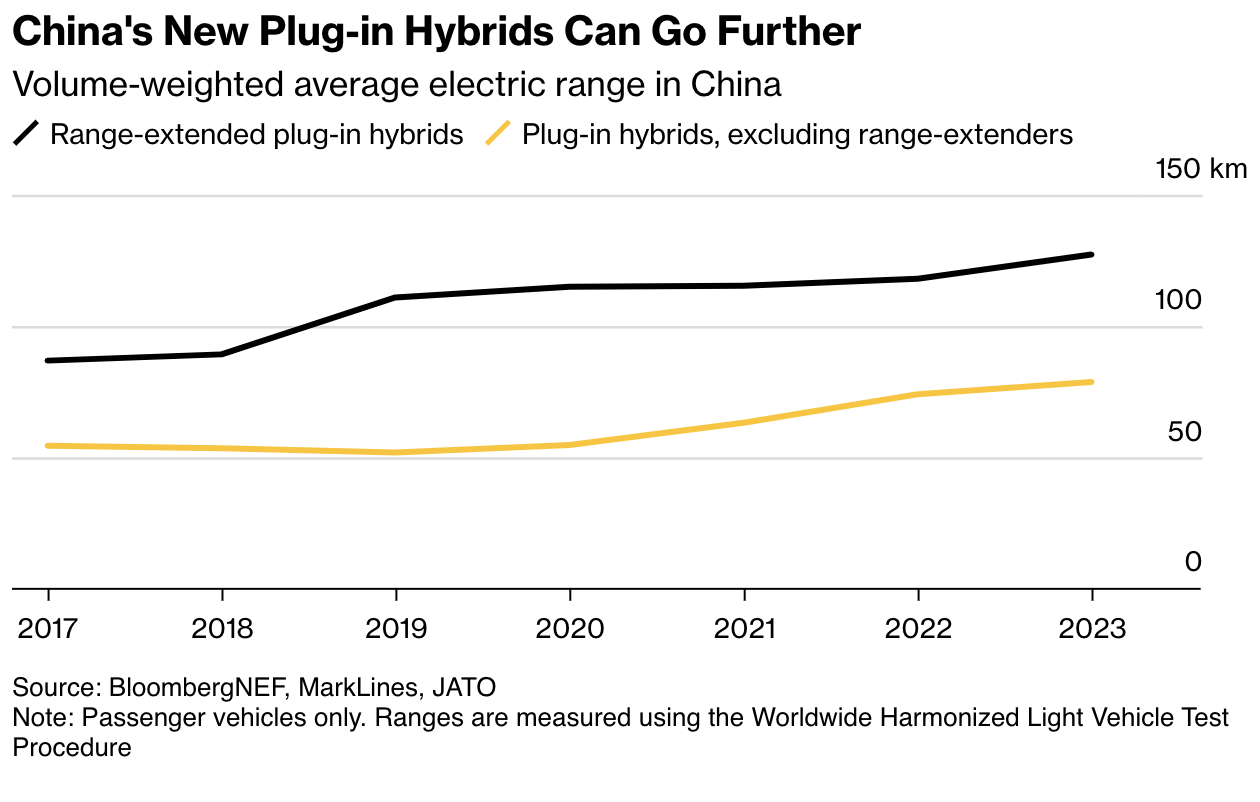

Just under a third of plug-in hybrid sales in China last year were what’s called extended-range electric vehicles, similar to the original Chevy Volt. These had an average range of 127 kilometers last year, and are generally designed using a series powertrain layout, meaning they rely only on the electric motor to drive the wheels. When the battery is depleted, the gasoline engine is switched on to charge the battery or power the electric motor. Standard PHEVs typically have a parallel powertrain architecture, in which both the gasoline engine and electric motor can directly propel the wheels.

Newer PHEV models also are capable of fast charging, which held back some of the early plug-in hybrids. In short, they’re designed for actual consumers, not just for regulatory compliance.

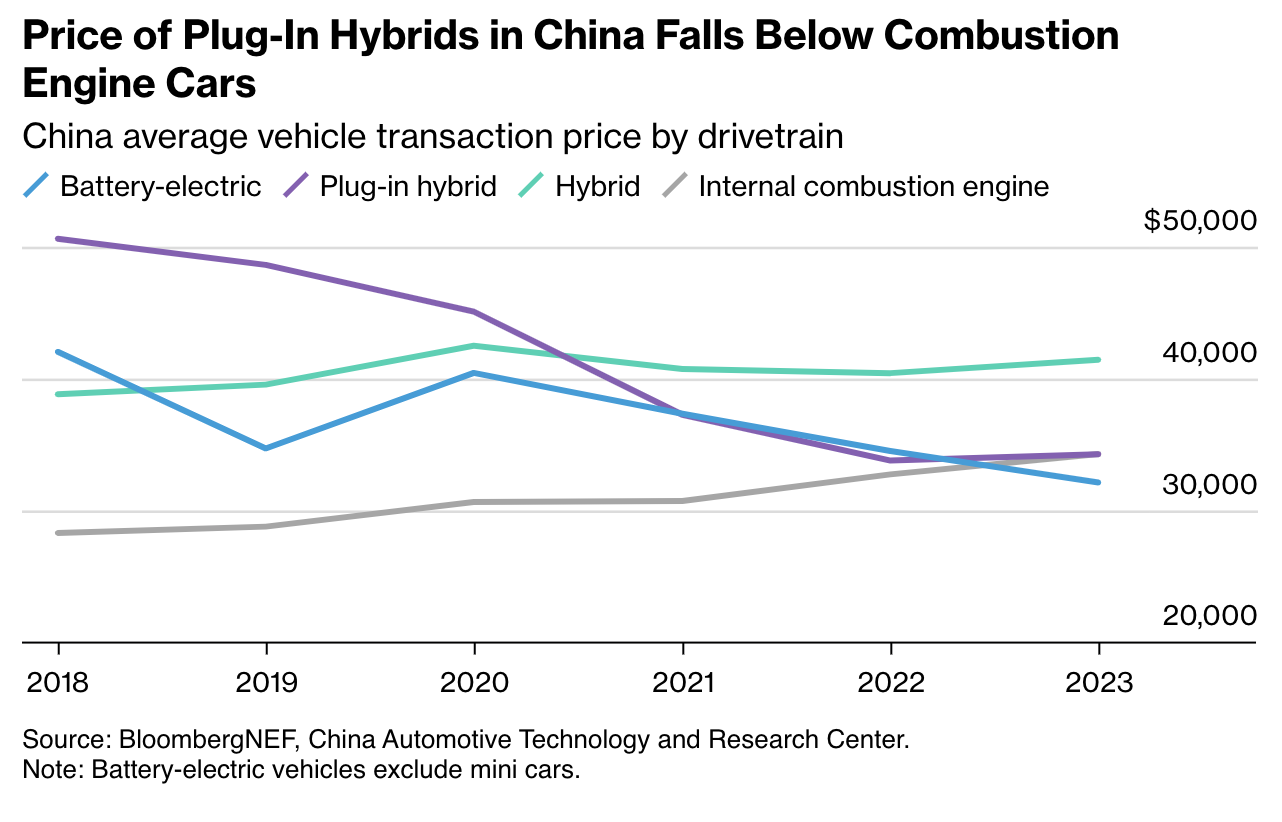

Price tells a lot of the revival story for this drivetrain. Average prices of PHEVs in China have fallen steady in the last five years, taking them from the most expensive option to now being fully cost competitive with gasoline and battery-electric models. In the US, by comparison, they’re now the most expensive drivetrain, costing around $20,000 more than the models available in China, on average.

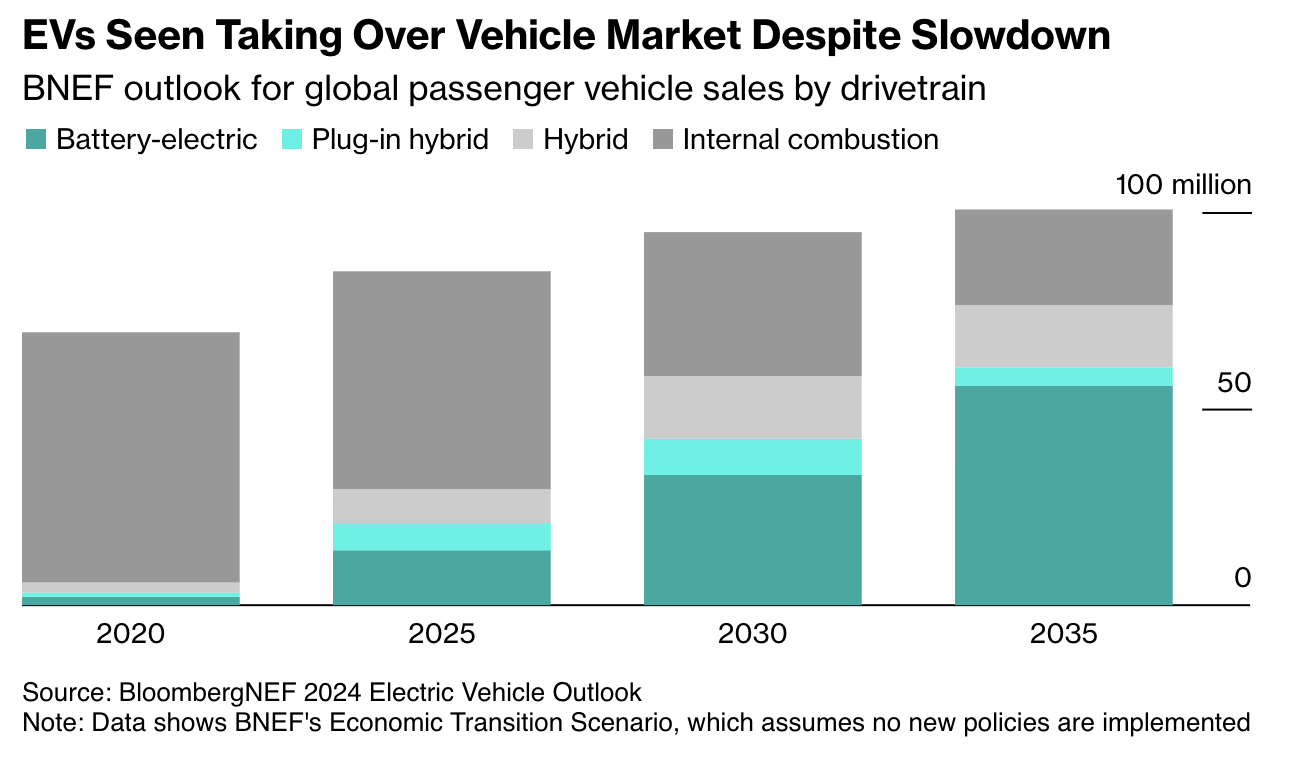

In BNEF’s latest long-term outlook, battery-electrics still account for the bulk of global plug-in vehicle sales, but the PHEV share is higher than in last year’s outlook, and they stay around for longer, peaking at 10% of the global vehicle market in 2030 before falling back as battery prices drop further.

There are still two big unknowns with plug-in hybrids.

The first and most obvious one is around how much they’re driven in electric mode. BNEF analyzed all the research available on this topic over the last decade, and the results are mixed. For private car buyers, studies found a range of 26% to 54% of all kilometers driven in PHEVs were done in electric mode. Some of the largest studies, involving millions of cars in China, were toward the higher end of that range. So, not terrible, but certainly not great either.

For company cars, the story is much worse, with the electric drivetrain accounting for just 11% to 24% of total mileage. That’s mostly a European phenomenon, and is likely because many of the drivers of company cars are not paying the fuel costs for their vehicles. As a result, they have little incentive to charge.

The incentive structures that fueled sales in that segment have since changed, which is why most of the PHEV sales growth has shifted from Europe to China. That, combined with the increased capabilities of newer models, means the electric share of driving should increase in the years ahead.

The second unknown is more abstract, and it revolves around consumer behavior. It’s not clear what the buyer of a plug-in hybrid would have bought if they hadn’t purchased that vehicle. The EV-purist view is that every plug-in hybrid buyer should have bought a battery-electric vehicle instead. If indeed that buyer could have been talked into a full electric, then each PHEV sold is a missed opportunity from an emissions and oil demand-reduction point of view.

But if that buyer was never going to purchase a full electric, and the PHEV is in place of buying another gasoline vehicle, then the conclusion changes completely — the PHEV is a net positive, from an emissions point of view. Teasing out the counterfactual of what would have happened here is difficult, if not impossible, since each consumer has their own specific circumstances. Still, the latest trends show that the technology continues to evolve, and consumers are taking notice.

GM is well into its second century now, but it’s other companies that are taking the technology and running with it.