PRESS RELEASE

Urgent Deployment of Existing Technology Can Get World Close to Net Zero, BloombergNEF’s New Energy Outlook 2024 Shows

• The study details how the world can still meet the goals of the Paris Agreement, and achieve net zero by mid-century

• BNEF’s updated Net Zero Scenario traces the route to keeping the world on track for well below two degrees of warming and net zero by 2050, but time is running out to pursue this path

• The report shows nine keystone technologies that will make or break the net-zero transition and whose rapid deployment can help stall emissions

• The report’s base case, the Economic Transition Scenario, shows that mature, cost-competitive technologies can halve global emissions by 2050 compared with not taking further action

• The global analysis includes detailed modeling for 12 major economies and nine regions, and shows which countries’ climate commitments are aligned to net zero

• Investments required for BNEF’s Net Zero Scenario are only 19% more than the baseline Economic Transition Scenario

London, May 21, 2024 – Although time is running out, BloombergNEF’s New Energy Outlook 2024 shows how the world could still achieve the major goal of the Paris Agreement – holding global warming to well below two degrees Celsius and avoiding the worst impacts of climate change – and what it would take to get there. The new report indicates that the speed with which clean technologies and decarbonization of the power sector are scaled up is crucial.

The New Energy Outlook 2024, the report published today by research provider BloombergNEF, presents two updated climate scenarios, the Net Zero Scenario (NZS) and a base case Economic Transition Scenario (ETS), designed to inform public policymaking, country climate ambition and low-carbon transition strategies of corporations and financial institutions.

Figure 1: Energy-related emissions and net-zero carbon budget, BNEF’s Economic Transition Scenario and Net Zero Scenario

The report’s NZS, which is consistent with a 67% chance of holding global warming to 1.75 degrees Celsius, sees demand for oil, gas and coal reach an immediate peak and fall into a steep decline starting from the year 2025. The power, transport, industry and buildings sectors transition at different speeds based on the technologies available for them to decarbonize, but all see emissions start to fall immediately. These short-term changes only come to pass thanks to a rapid scale-up of clean energy technologies, in particular a tripling of global renewable-energy capacity by 2030, rapid uptake of electric vehicles (EVs) leading to a full global phase-out of combustion engine vehicle sales by 2034, and a major scale-up of carbon capture technology, alongside energy storage and nuclear power, before 2030.

“The path to staying well below two degrees is narrowing,” said David Hostert, head of economics and modeling at BNEF and the lead author of the report. “In the 18 months since we last updated our global scenarios, the energy transition has certainly accelerated – but not nearly enough. This report should serve as a wake-up call: we need a rapid decline in emissions starting from now – not in five years’ time – if net zero by mid-century is to remain a possibility.”

Figure 2: CO2 emissions reductions from fuel combustion by measures implemented, Net Zero Scenario versus no-transition scenario

Cleaning up the power sector accounts for almost half of emissions avoided between today and 2050, compared with a no-transition scenario where there is no further action on decarbonization. Electrification of end-use sectors, including road transport, buildings and industry, accounts for the next quarter of emissions. The solutions needed to abate the remaining quarter of emissions are among the most challenging to scale: biofuels in shipping and aviation; hydrogen in industry and transport; and carbon capture and storage in industry and power.

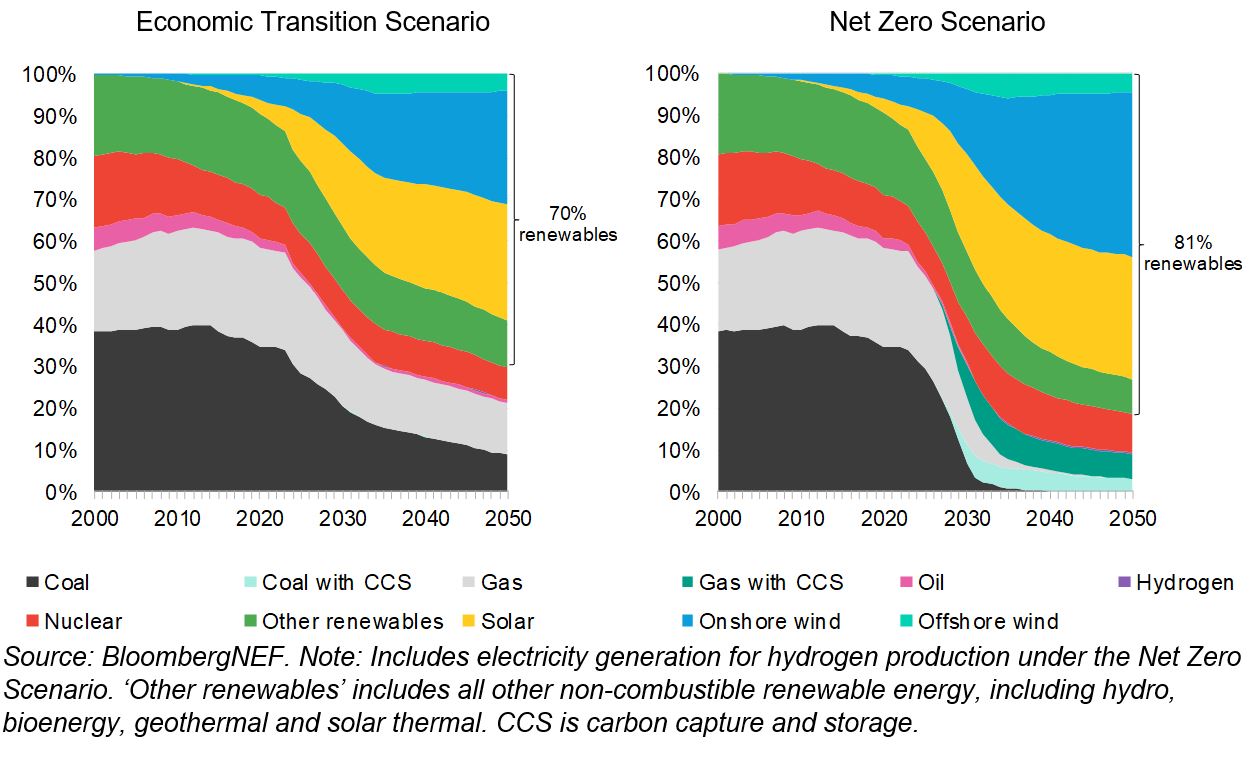

The New Energy Outlook also details a base case ETS, in which clean-energy technologies are only deployed where they are economically cost-competitive or adopted by consumer choice, with no further policy support for clean technologies. The affordability of renewable energy, especially solar and wind, means that they grow rapidly in this scenario, to 51% of global power generation by 2030, and 70% by 2050. The global power system is transformed and becomes much more flexible in order to accommodate high penetrations of wind and solar.

Figure 3: Electricity generation by technology/fuel, Economic Transition Scenario and Net Zero Scenario

“Our hourly modeling shows that power systems can accommodate very high penetrations of wind and solar without incurring higher costs,” said Ian Berryman, lead energy systems modeler at BNEF. “With the aid of smart electric vehicle charging, battery storage and flexible generators, the most affordable power system of the future will be one based on a foundation of inexpensive renewables.”

The ETS also sees significant EV uptake, thanks to their increasing cost-competitiveness compared to conventional vehicles. Thanks to the combined impacts of clean power, EVs and energy efficiency, emissions in 2050 in the ETS are half what they would otherwise be without these technologies, or down 27% from current levels. This is far from achieving net zero – and breaches the Paris Agreement with a global warming result of 2.6 degrees Celsius – but demonstrates how far the energy transition can already go based on economical and commercially ready technologies. In this scenario, fossil fuels still play an important role in power, industry, transport and buildings sectors, but gas demand grows modestly while oil and coal demand are set to enter a period of structural decline.

Matthias Kimmel, head of energy economics at BNEF, said, “Renewable energy, electric vehicles and energy storage are already being deployed at scale and will only grow further in the next few years. These three technologies are no-regrets choices that can help countries reduce emissions, improve energy security and even reduce energy system costs today.”

BNEF has enhanced its modeling for the 2024 edition of the New Energy Outlook. The analysis now includes detailed modeling results for 12 countries and nine regions for both scenarios, and shows that:

• The current climate plans (Nationally Determined Contributions or NDCs) of Brazil, France, the UK, the US and Australia are the most aligned to BNEF’s Net Zero Scenario.

• Germany, South Korea, Japan and India have existing NDCs that are in line with or better than the Economic Transition Scenario – indicating they have scope to raise their ambition to align with the NZS.

• China, Indonesia and Vietnam have the most scope to raise ambition in their next Nationally Determined Contributions. Their current NDCs even fall short of the Economic Transition Scenario.

The report also sheds light on other important topics relating to the global low-carbon transition, including:

• The need to scale up nine key technologies in order to get on track for net zero. These are: renewable power, electric vehicles, battery energy storage, nuclear energy, carbon capture and storage, hydrogen, sustainable aviation fuels, heat pumps and power networks.

• A more nuanced picture of where low-carbon hydrogen can be most impactful in the energy transition, and where electrification plainly makes more sense.

• How the technologies above combine and interact to solve for decarbonization across power, transport, industry, and buildings.

• The investment volumes needed to achieve the ETS ($181 trillion globally to 2050) and the NZS ($215 trillion to 2050), and why these estimates are surprisingly similar (only 19% higher in the NZS).

• The importance of land-use considerations, given that low-carbon technologies typically require a larger land footprint than fossil-based sources, and the rising land demands for energy transition, food production and biodiversity preservation will need to be weighed up and co-optimized.

Figure 4: Global energy investment and spending across 2024-2050, Economic Transition Scenario and Net Zero Scenario

An executive summary of the New Energy Outlook 2024 is publicly available via the following link. For the first time, BNEF is also making available a limited data set of findings here.

BloombergNEF clients can find the full report and full data viewer on bnef.com and the Bloomberg terminal.

Contact

Oktavia Catsaros

BloombergNEF

+1 212 617 9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.